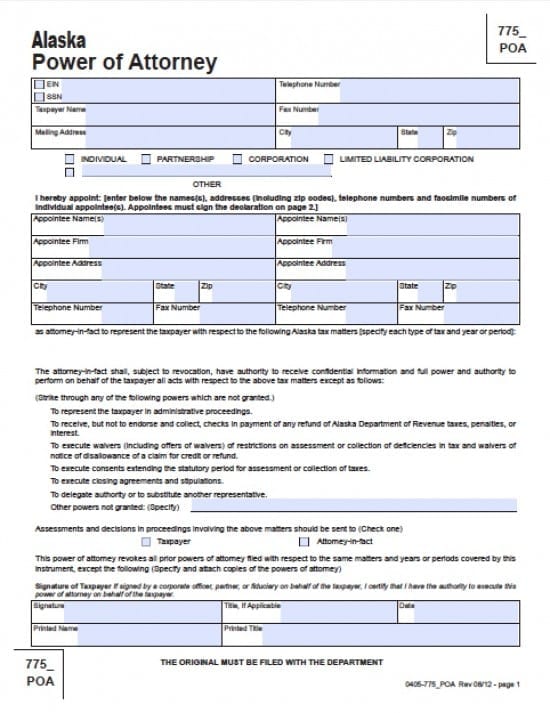

| Alaska Tax Power of Attorney Form |

The Alaska Tax power of attorney form is a document signed by the taxpayer by which another individual, also known as an attorney in fact is given the authority to appear before the department and act for the taxpayer. The acts of the attorney-in-fact are binding on the taxpayer. A power of attorney may be general or it may be limited. The department form conveys a general power of attorney; a taxpayer must designate on the form if the powers being granted to the representative are to be limited in any way. This form may grant power to an individual or a firm. (Contained within Alaska Stat. § 13.26.344. : Alaska Statutes – Section 13.26.344).

How To Write

Step 1 – Principal’s Information – Enter the following information into the first section of fields provided:

- Select EIN or SSN – Enter the selected number

- Telephone Number

- Taxpayer Name

- Fax Number

- Mailing Address

- City

- State

- Zip Code

Step 2 – Select from one of the following and check the box:

- Individual

- Partnership

- Corporation

- Limited Liability/Corporation

- Other

Step 3 – Appointment of Attorney(s) In Fact – Read the single sentence statement and then provide the required information into the fields provided, for one or more Attorney(S) In Fact/Agent(s). Two boxes are provided on the form, however, if you need more room for information with regard to more appointees add them on a separate sheet to be attached to this document:

- Appointee Name(s)

- Appointee Firm

- Appointee Address

- City

- State

- Zip Code

- Telephone Number

- Fax Number

Step 3 – Regarding powers excluded by the principal – Read the paragraph granted powers. Strike through ANY of the powers you do not wish to grant to your Attorney In Fact. If you would like to exclude other powers not mentioned on the form, add them into the line provided. If you need more room, add them on a separate sheet and attach the sheet to this document.

- Select whether you would like any decisions made in any proceeding sent to you or the Attorney In Fact -check the box in front of your selection.

Step 4 – Signature – Read the brief information above the signature and information fields. The fields provided are available in the event a Corporate officer or partner is signing this information. If this is the case the officer of the firm must provide the following information:

- Signature

- Title, If Applicable

- Date

- Printed Name

- Printed Title

Step 5 – The final signature lines are for the paragraph review and signature(s) of the representative(s) – Representative(s), after reviewing the paragraph must provide:

- Their respective signature(s)

- The date in which they are signing the document

- Principal should request copies of the document for their records

- If this document shall revoke other powers of attorney, copies of the past documents must be attached to this form