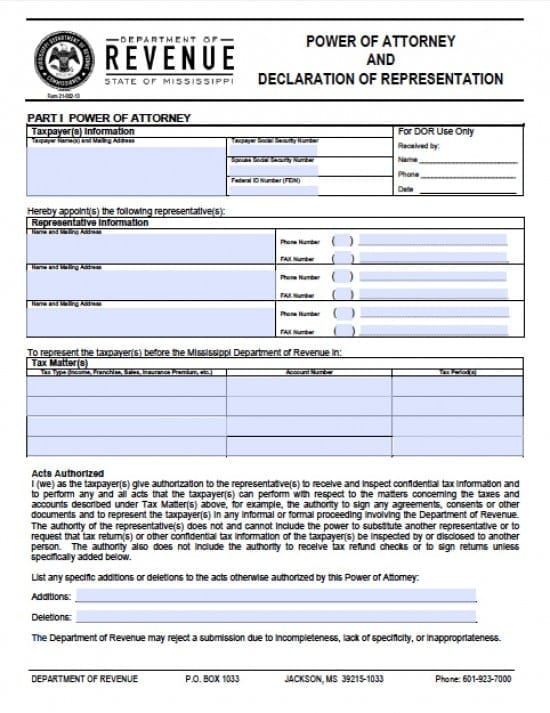

| Mississippi Tax Power of Attorney Form |

The Mississippi tax power of attorney form is a document that will permit a taxpayer to transfer powers to an individual or one or more Agents who would better have the ability to accurately complete tax forms and, if needed, represent the taxpayer before any tax agency. By using this document it must be understood by the taxpayer that the Agent(s) will need access to confidential financial information. It’s also the job of the Agent(s) to ensure that your information remains confidential.

This document may be revoked by the taxpayer at any time by placing notice in writing and having it delivered to the Agent(s)

How to Write

Step 1 – Taxpayer’s Information – Enter the following information:

- Taxpayer Name(s) and Mailing Address

- Taxpayer Social Security Number

- Spouse’s Social Security Number

- Federal Identification Number (FEIN)

Step 2 – Representative (Agents) Information -If more that three Agents are required, enter all of the same information to an additional sheet for any additional Agents and attach to this document:

- Enter all names and mailing addresses of all Agents who shall represent the taxpayer(s)

- Phone number

- Fax number

Step 3 – Tax Matters – Submit the following information:

- Tax Type (Income, Franchise, Sales, Insurance Premium, etc.)

- Account Number

- Tax Period(s)/Tax Year(s)

- The taxpayer(s) must read the paragraph provided

- If needed, enter any additions and/or deletions with regard to allowable powers

Step 4 – Retention/Revocation of Prior Power(s) of Attorney – Read the paragraph in this section

- If the taxpayer(s) understand that other powers documents will be revoke with this document being a replacement, check the box to indicate their understanding

- Should the taxpayer(s) wish to revoke all other documents, then copies of the document(s) must be attached to the form

- Read the following:

- Who Must Sign and What Documentation of Authority

- AND

- Signing is Certification Under Oath Subject to Penalty of Perjury

Step 5 – Taxpayer’s Signature(s) -This document must have all required signatures or it will be returned – Taxpayer(s) must enter the following:

- Signature(s)

- Date(s) of Signature(s)

- Title(s) (if applicable)

- Printed Name(s)

- Phone Number(s)

- Fax Number(s)

Step 6 – Declaration of Representative(s) – All Agents must read the entire section including A through G. If there are other powers enter them into the “Other” line – If the Agent(s) are in agreement with the document and their own selections, enter the following in the fields provided in the table on the form (be advised that if all signatures are not provided, the document will be returned)

- Designation – Insert Above letter (a-g)

- State Issuing License

- State License Number

- Signature(s) of Agent(s)

- Date the signature(s) in mm/dd/yyyy format