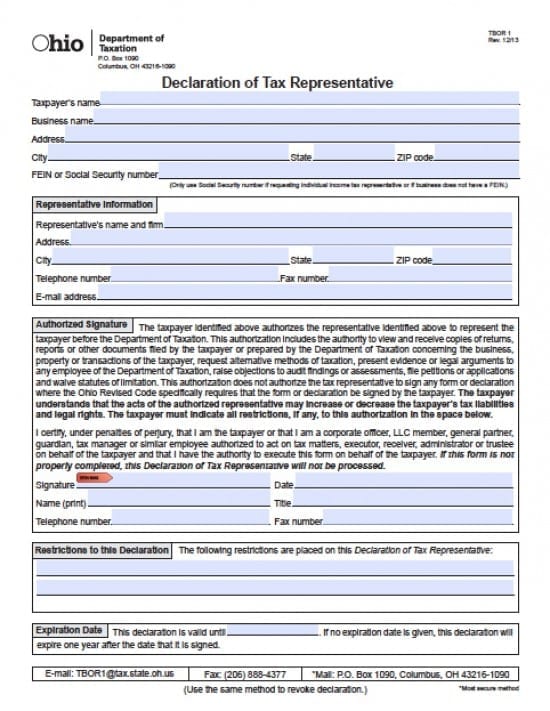

| Ohio Tax Power of Attorney Form |

The Ohio tax power of attorney form is a document that is provided by a taxpayer to assign an individual or business of tax professionals as Agent(s) who would have the ability to legally complete more detailed forms on behalf of the taxpayer(s). The Agent(s) will also have the ability to represent the taxpayers before any Department of Revenue if needed or required. Completion of this document will revoke all previous powers documents, unless it’s stated otherwise by the taxpayers.

This document may also be revoked in writing and by delivery or service, to any/all Agents. Be certain that all signatures are entered or the document will be returned for reprocessing.

How to Write

Step 1 – Taxpayer’s Information – Enter the following:

- Taxpayer’s name

- Business name

- Address

- City, State, Zip Code

- Federal Employer Identification Number (FEIN)

- or

- Social Security number

Step 2 – Representative’s/Agent(s) Information – Submit:

- Representative’s/Agent(s) name and firm

- Address

- City, State, Zip Code

- Telephone number

- Fax number

- E-mail address

Step 3 – Authorized Signature – Enter the taxpayer’s information or the signature and information of the authorized Agent:

- Signature

- Date

- Printed Name

- Title (if any)

- Telephone number

- Fax number

Step 4 – Restrictions to This Declaration –

- The taxpayer(s) must enter any limitations or restrictions in the lines provided

Step 5 – Expiration Date – Enter:

- The taxpayer(s) may enter an expiration date of the powers document in this section in mm/dd/yyyy format

If no termination date is entered, the document will automatically expire in one year from the date of the document