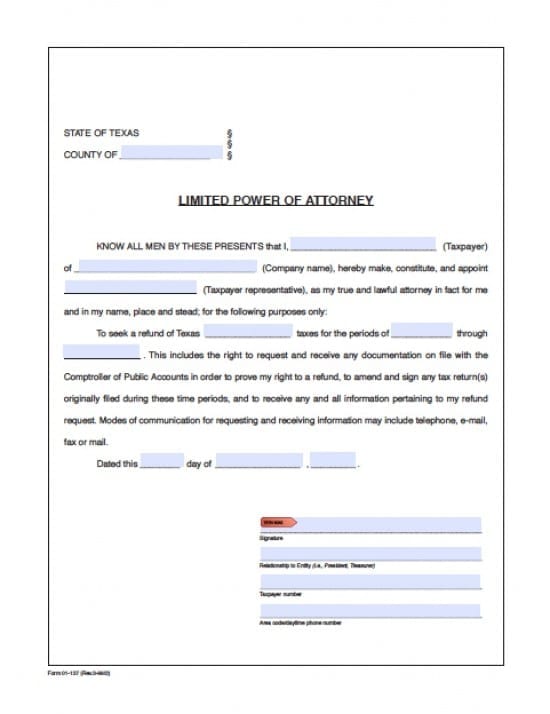

| Texas Tax Power of Attorney Form |

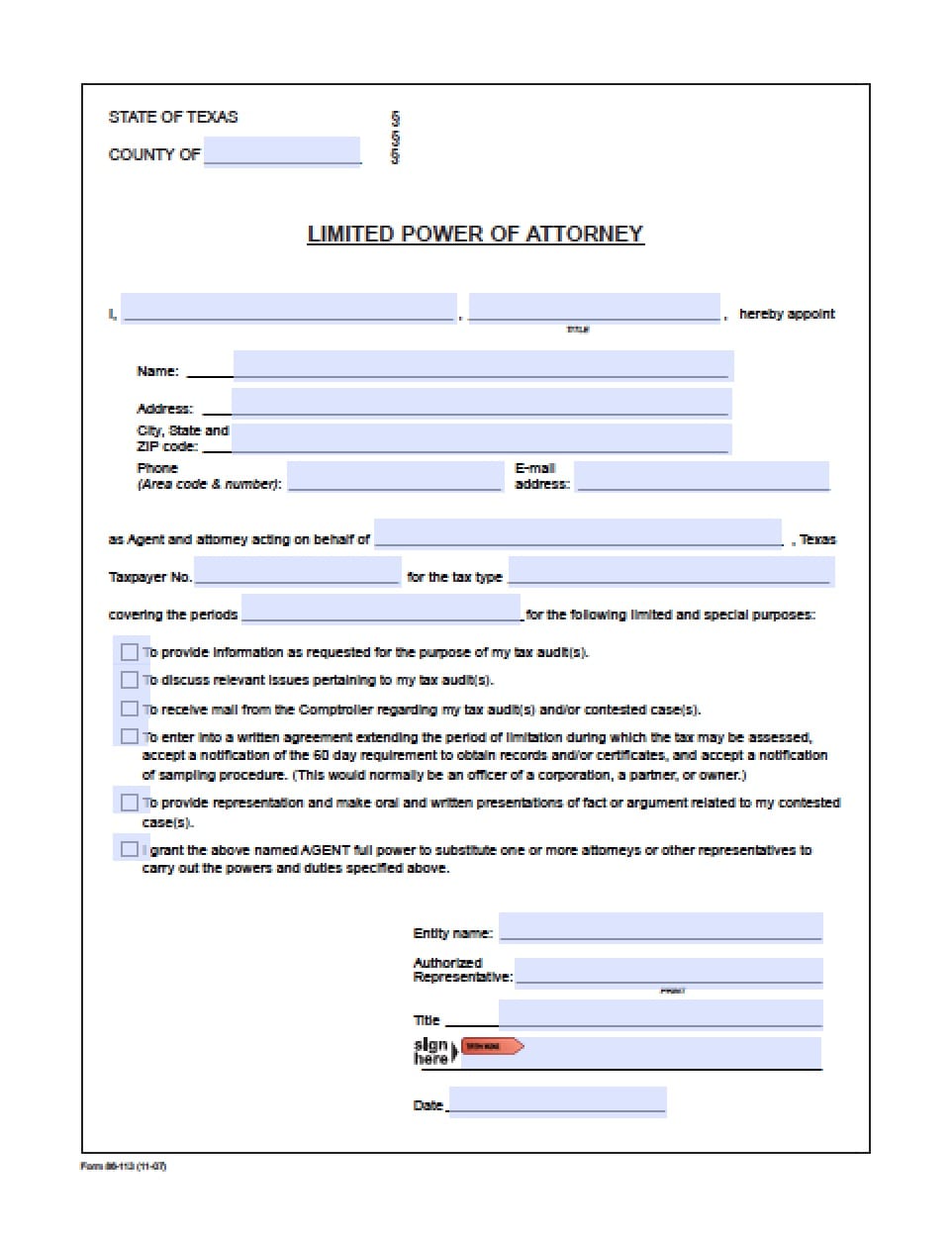

The Texas tax power of attorney form is a legal document that allows taxpayers to appoint a business, employing tax professionals or an individual, as their Agent so that their appointee(s) may have the permitted ability, to legally acquire and review the taxpayer’s confidential financial information. This information may be provided by the taxpayer(s) or be requested, with the permission that this document provides. This document will allow the Agent(s) to properly complete tax documents on behalf of the taxpayer(s).

How to Write

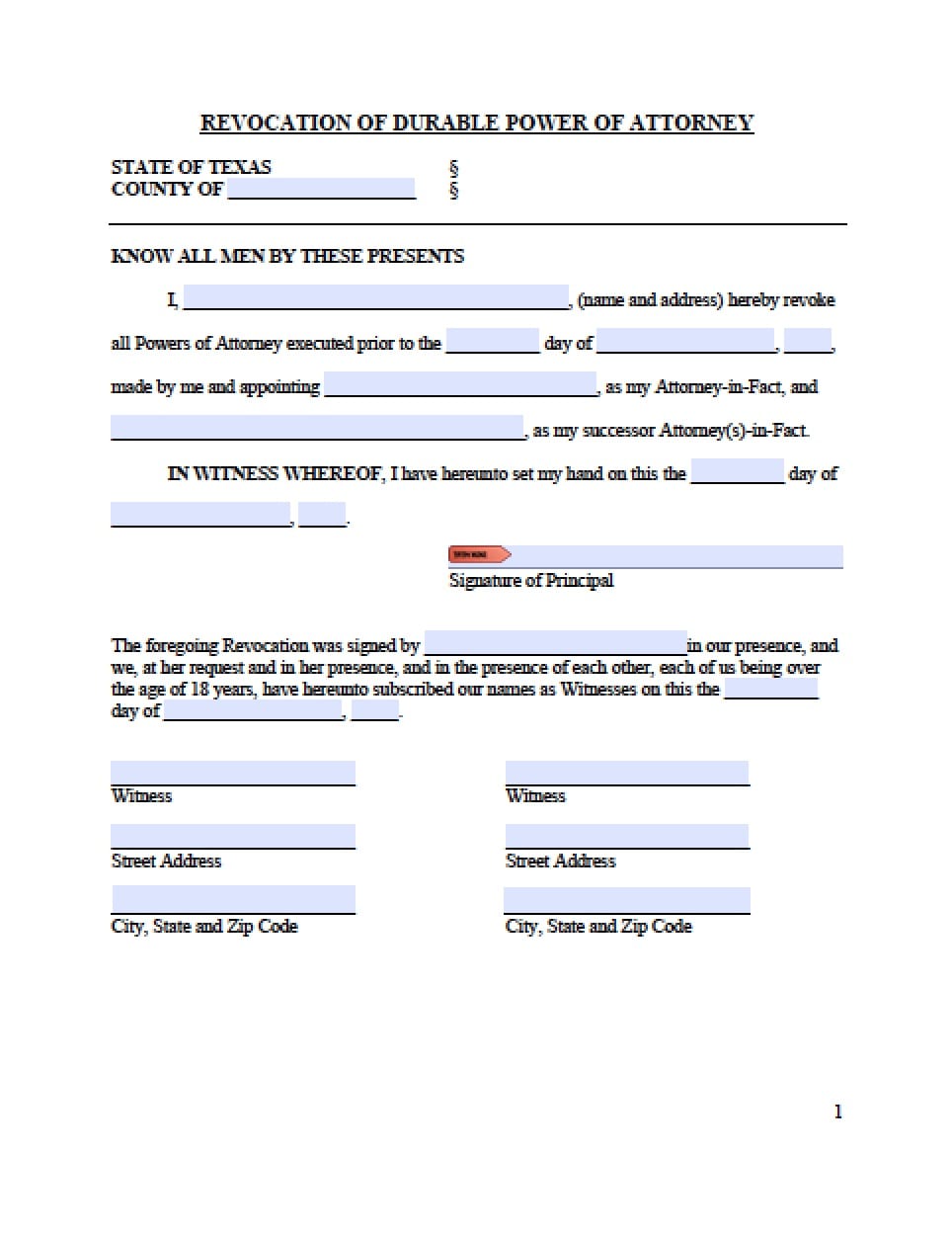

Step 1 – Location of Execution of Revocation –

- Begin by entering the name of the County where the document will be used, at the top left side of the page

- Enter the Taxpayer’s name

- Enter the Company name (if any)

- Enter the Agent(s) name(s)

- Enter the type of taxes for which the Taxpayer is seeking refund

- Submit the beginning of the periods

- Submit the ending of the periods

- Read the remainder of the section

Step 2 – Signatures –

- Provide the date in which the powers document is being executed and signed in dd/m./yyyy format

- Enter the Agent’s signature

- Provide the relationship of the entity to the Agent

- Provide the Taxpayer’s SSN or EIN

- Enter the area code and day time telephone number