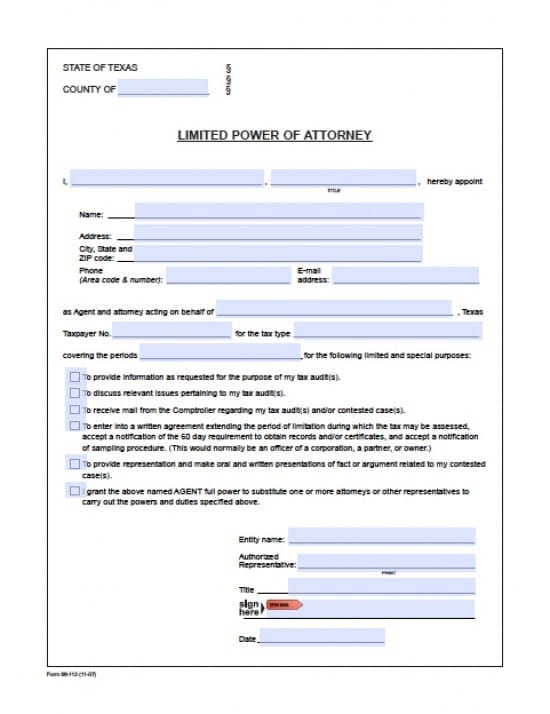

| Texas Tax Power of Attorney(for Audits Only) |

The Texas tax power of attorney(for audits only) is a legal document that would authorize powers to an Agent to represent the taxpayer in the event of a tax audit. This document will allow the taxpayer to request confidential, financial information so that the Agent’s may competently represent the taxpayer at the time of their scheduled audit. This document will revoke all other tax powers documents unless stated in writing by the taxpayer. This document may also be revoked should the taxpayer decide it’s necessary.

How to Write

Step 1 – Location –

- Enter the County in the state of Texas where the document shall be executed

Step 2 – The Parties – Submit the following:

- Taxpayer’s name

- Title (if any)

- AND

- The name of the Agent’s

- Address

- City, State, Zip Code

- Complete phone number

- E-mail address

- AND

- Taxpayer’s name

- Taxpayer’s Number

- Tax type

- Periods covered for the audit

Step 3 – Authorized Powers –

- The taxpayer must check each box preceding the power they would wish to authorize

- Enter the name of the entity serving as Agent(s)

- Printed name of authorized Agent

- Title

- Signature of authorized Agent

- Date the signature in mm/dd/yyyy format