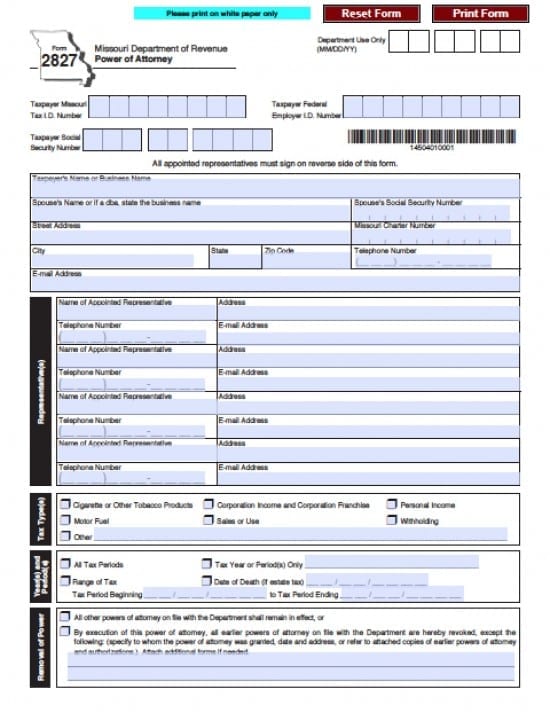

| Missouri Tax Power of Attorney Form |

The Missouri tax power of attorney form is a document that permits an Agent to complete tax forms for and/or represent the Principal before a tax agency. The document will provide all of the information that an individual or business entity will require in order to properly and accurately complete the tax information also required to present to a tax agency.

All necessary taxpayer’s signatures, as well, all Agent’s signatures must be entered. If the signatures are not present once the agency received the documents, they will be returned to the taxpayers or their representative (who must sign on the reverse side of the form) before they will review the documents.

How to Write

Step 1 – Download the document – Once downloaded, begin by providing the following:

- Taxpayer(s) Missouri Tax I.D. Number

- Taxpayer(s) Social Security Number

- Taxpayer(s) Federal Employer I.D. Number

Step 2 – Taxpayer(s) Information –

- Taxpayer’s Name or Business Name

- Spouse’s Name or if a dba, state the business name

- Spouse’s Social Security Number

- Missouri Charter Number

- City

- State

- Zip Code

- Telephone Number

- E-mail Address

Step 3 – Attorneys In Fact/Agents – All Agent’s who will participate in processing the taxpayer’s information must provide the following (per agent):

- Name of Appointed Agent

- Address

- Telephone Number

- E-mail Address

Step 4 – Tax Type(s) – Check the following applicable types of taxes:

- Cigarette or Other Tobacco Products

- Corporation Income and Corporation Franchise

- Personal Income

- Motor Fuel

- Sales or Use

- Withholding

- Other (if there are other tax types enter them on the line provided)

Step 5 – Year(s) and/or Period(s) – Check all boxes that apply:

- All Tax Periods

- Tax Year or Period(s) Only

- Range of Tax

- Date of Death (if estate tax) in mm/dd/yyyy format

- Tax Period Beginning through the Tax Period Ending dates in mm/dd/yyyy format

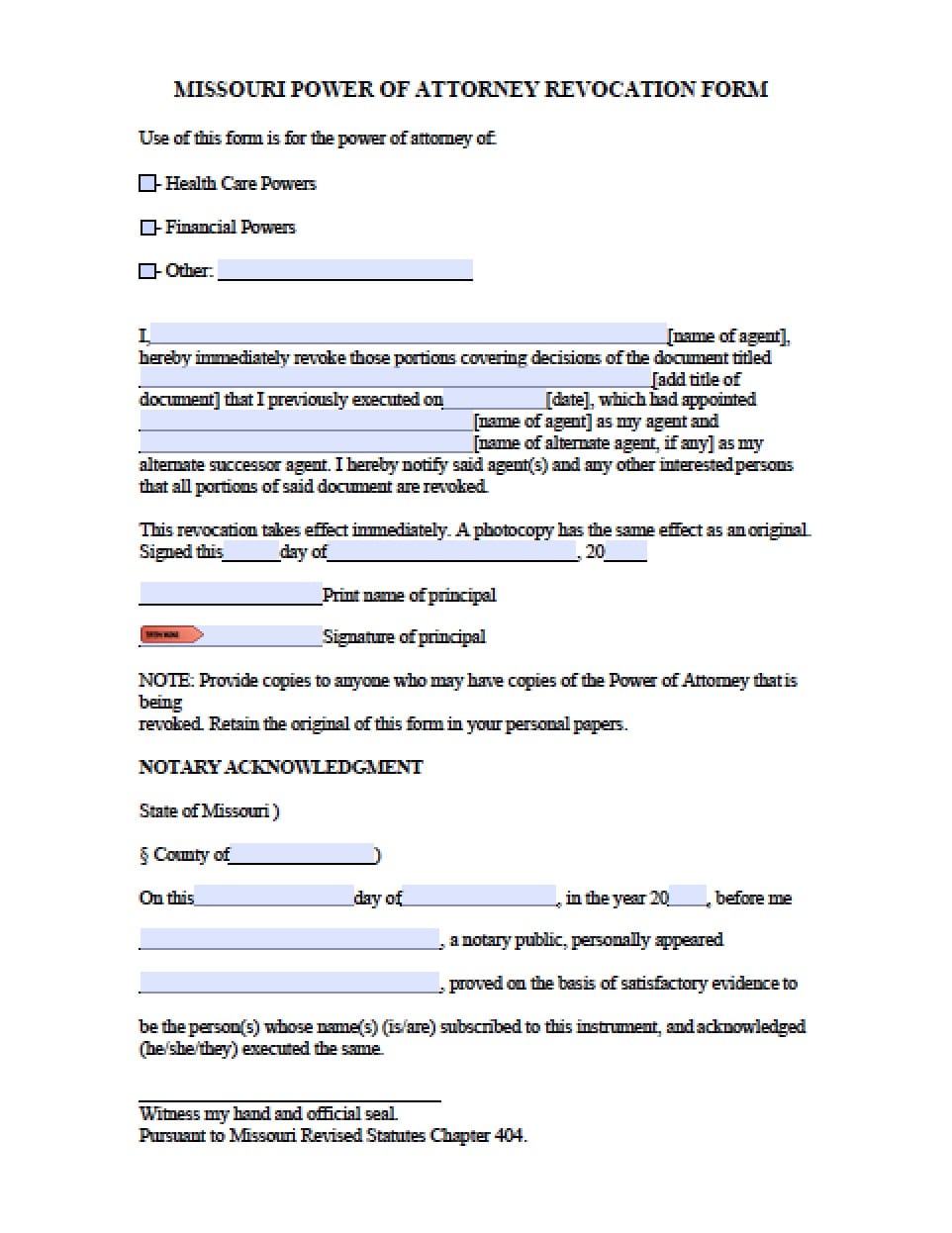

Step 6 – Revocation (removal of power) – Check one box that applies:

- All other powers of attorney on file with the Department shall remain in effect

- OR

- By execution of this power of attorney, all earlier powers of attorney on file with the Department are hereby revoked

Step 7 – Taxpayer(s) Statement and Signatures – Taxpayers must read the statement. If in agreement, taxpayer and spouse (if any) must enter (individually) the following:

- Taxpayer’s Name

- Title (if applicable)

- Signature

- Date in mm/dd/yyyy format

- Taxpayer”s Telephone Number

Step 8 – The Attorney’s In Fact/Agent’s Declaration – The Agent(s) must read the information and the selections. If in agreement, enter the following (per Agent):

- Printed Name of Agent

- Signature of Agent

- Date of signature in mm/dd/yyyy format

- Designation (Select a number from list)

- Title (if applicable)