| Nebraska General Financial Power of Attorney Form |

The Nebraska general financial power of attorney form is a document that is designed to designate another person to whom the Principal shall entrust powers over their financial accounts, and real property by designating them, in writing into this document.

This document may become immediately effective and available to the Agent, meaning that as of the date of the document, the Agent will begin to control the accounts and properties that the Principal will grant powers over, or, they may choose to make the document available, contingent upon when the Principal is no longer able to conduct their own business as a result of incapacity or incompetency.

This document should be entered into cautiously, inasmuch as the document will essentially allow the Agent to take complete control over the Estate of the Principal. If the Principal is unsure of what the document truly, legally entails, they may wish to speak with an attorney, prior to completion and signature to ensure that they are in complete understanding of what they are signing.

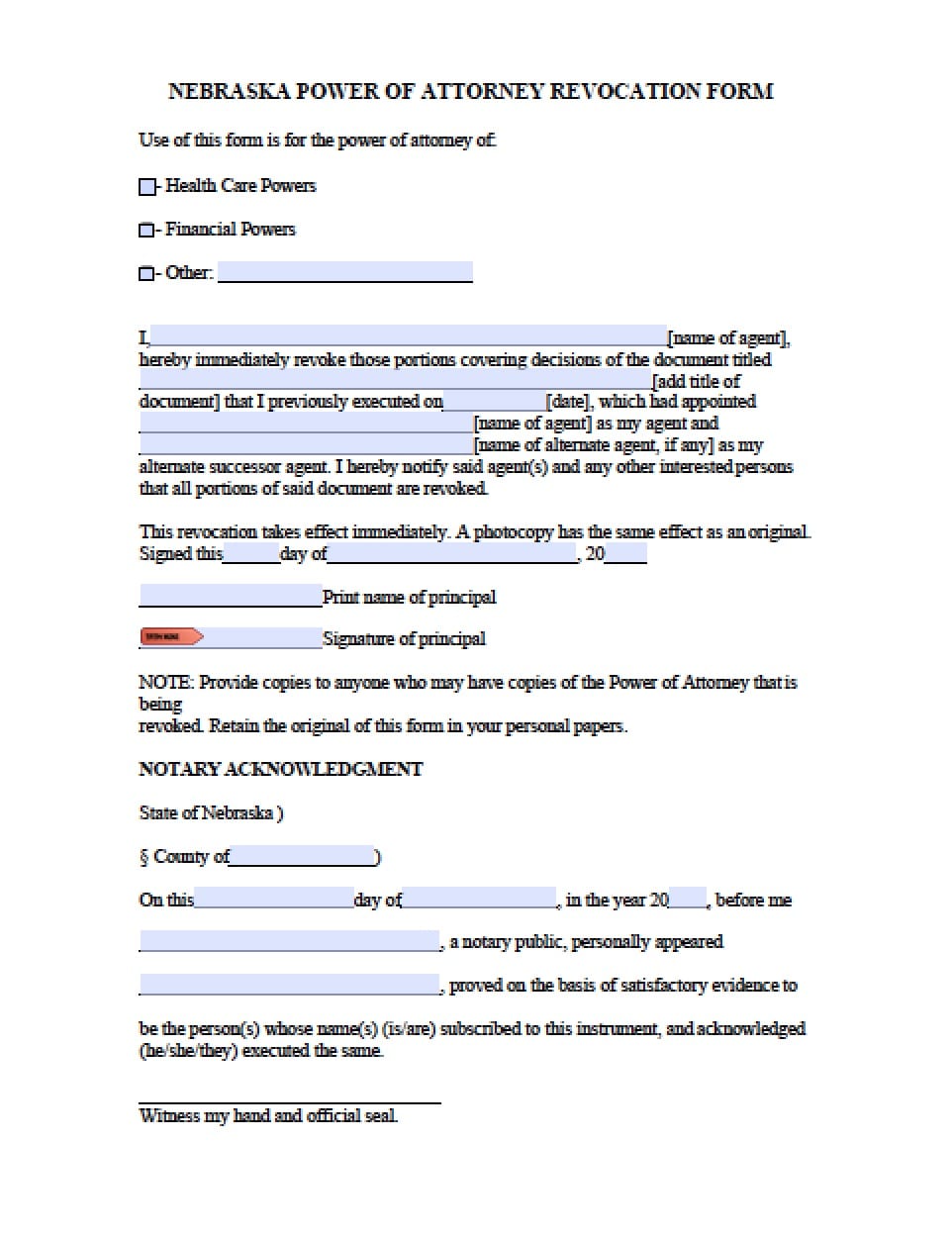

This form must be notarized to ever be effective. The Principal must be aware that they will retain the right, as long as they are of sound mind, to revoke this document at any time they choose, by providing written notice to the Agent, removing all powers on the date specified. Completion of this document will revoke any previous powers documents.

How to Write

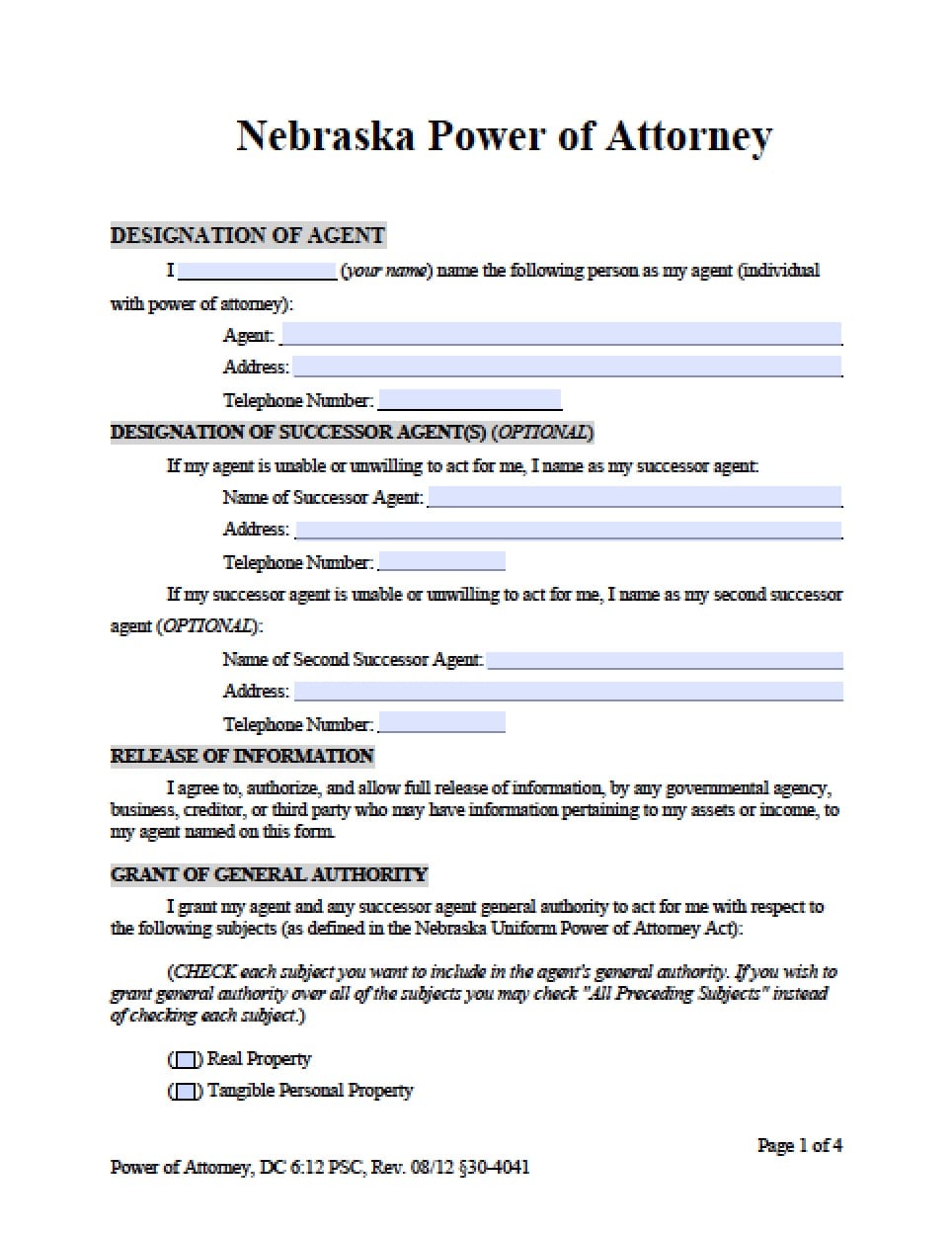

Step 1 – The Principal must download the document and enter the following:

- The Principal’s full name

- The county in which the Principal resides

- AND

- Enter the name of the selected Agent

- The name of the county in which the Agent resides

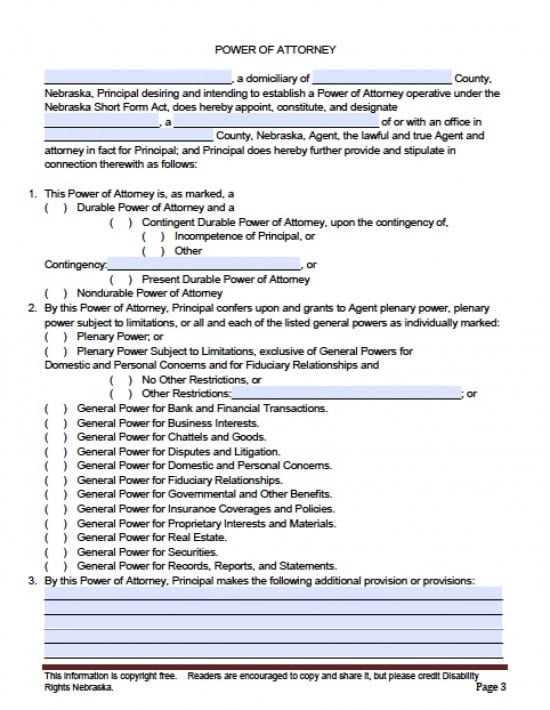

Step 2 – Selection of the Effective Date of the Document –

- Review the following selections and check those that are applicable:

- The Principal may mark the document as a Durable Power of Attorney

- OR

- A Contingent Durable Power of Attorney to become effective upon the contingency of:

- Incompetence of Principal

- OR

- Other (enter the Principal’s specific contingency

Step 3 – Non-durable Powers – The Principal must consider each of the following powers. Check only those powers they wish to grant to their selected Agent:

- Plenary Power

- OR

- Plenary Power Subject to Limitations, exclusive of General Powers for Domestic and Personal Concerns and for Fiduciary Relationships

- No Other Restrictions

- OR

- Other Restrictions (enter the restriction and limitations into the line provided

- Check any or all of the following, remaining selections. If there are selections that the Principal would not choose to grant powers for, do not check:

- General Power for Bank and Financial Transactions

- General Power for Business Interests

- General Power for Chattels and Goods

- General Power for Disputes and Litigation

- General Power for Domestic and Personal Concerns

- General Power for Fiduciary Relationships

- General Power for Governmental and Other Benefits

- General Power for Insurance Coverages and Policies

- General Power for Proprietary Interests and Materials

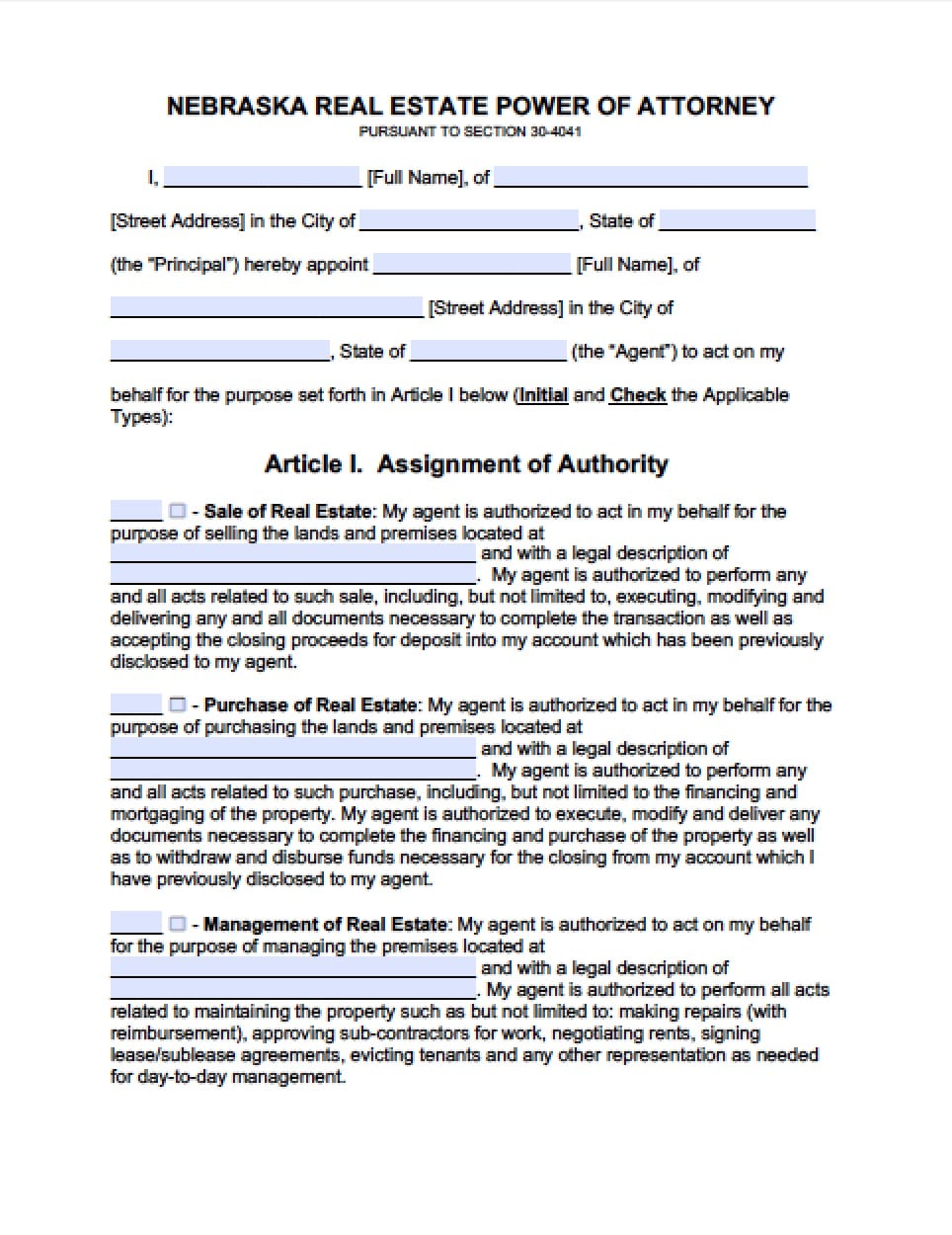

- General Power for Real Estate

- General Power for Securities

- General Power for Records, Reports, and Statements

- By this Power of Attorney, Principal makes the following additional provision or provisions (enter the additional provisions in the lines provided on the form

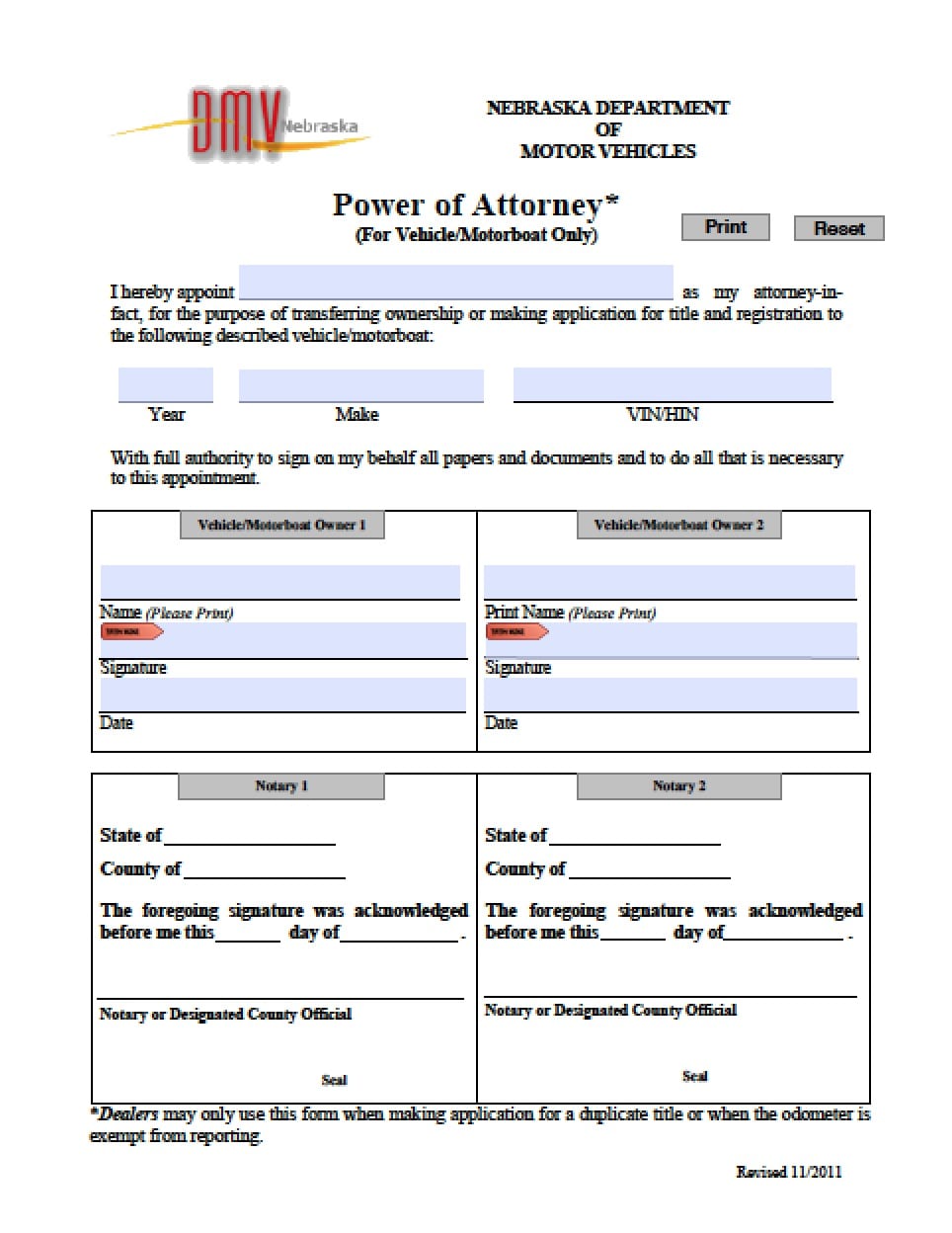

Step 4 – Signature and Notarization – The Signature must be signed before a Notary Public – Enter the following:

- The specific location of execution of the document

- The name of the county

- Enter the date of the execution of the document in mm/dd/yyyy format

- The Principal must then submit their signature

When the Notary has witnessed the Principal’s signature, they shall complete the notary section of the document, affixing their official seal/stamp in acknowledgement