| South Dakota General Financial Power of Attorney Form |

The South Dakota general financial power of attorney form is a legal document that will permit a Principal to delegate powers to an Agent who would oversee the finances, personal property and real property, if the Principal must be absent for an extended period or becomes ill.

The powers will commence on the same date of the execution of the document and shall continue to remain in effect regardless if the Principal becomes disabled or incapacitated. However, the Principal may revoke the document prior to such time they may become incapacitated in which case the Agent will no longer have access to any of the previous powers. This document must be reviewed by the Principal, before completion and applying signatures. If the Principal is unclear with regard to any of any portion of this document, they may wish to consider consultation with an attorney for competent legal advice.

This document must be signed before a Notary Public. This document may be revoked at the discretion of the Principal, by written notice and by delivery or service provided to the Agent.

How to Write

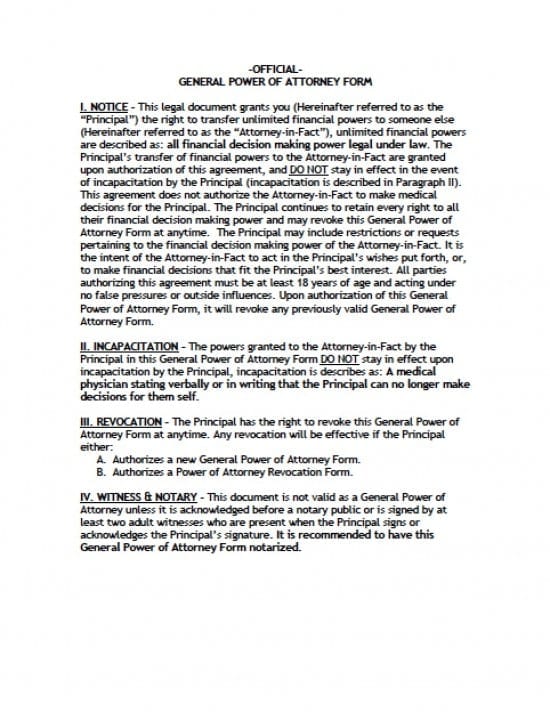

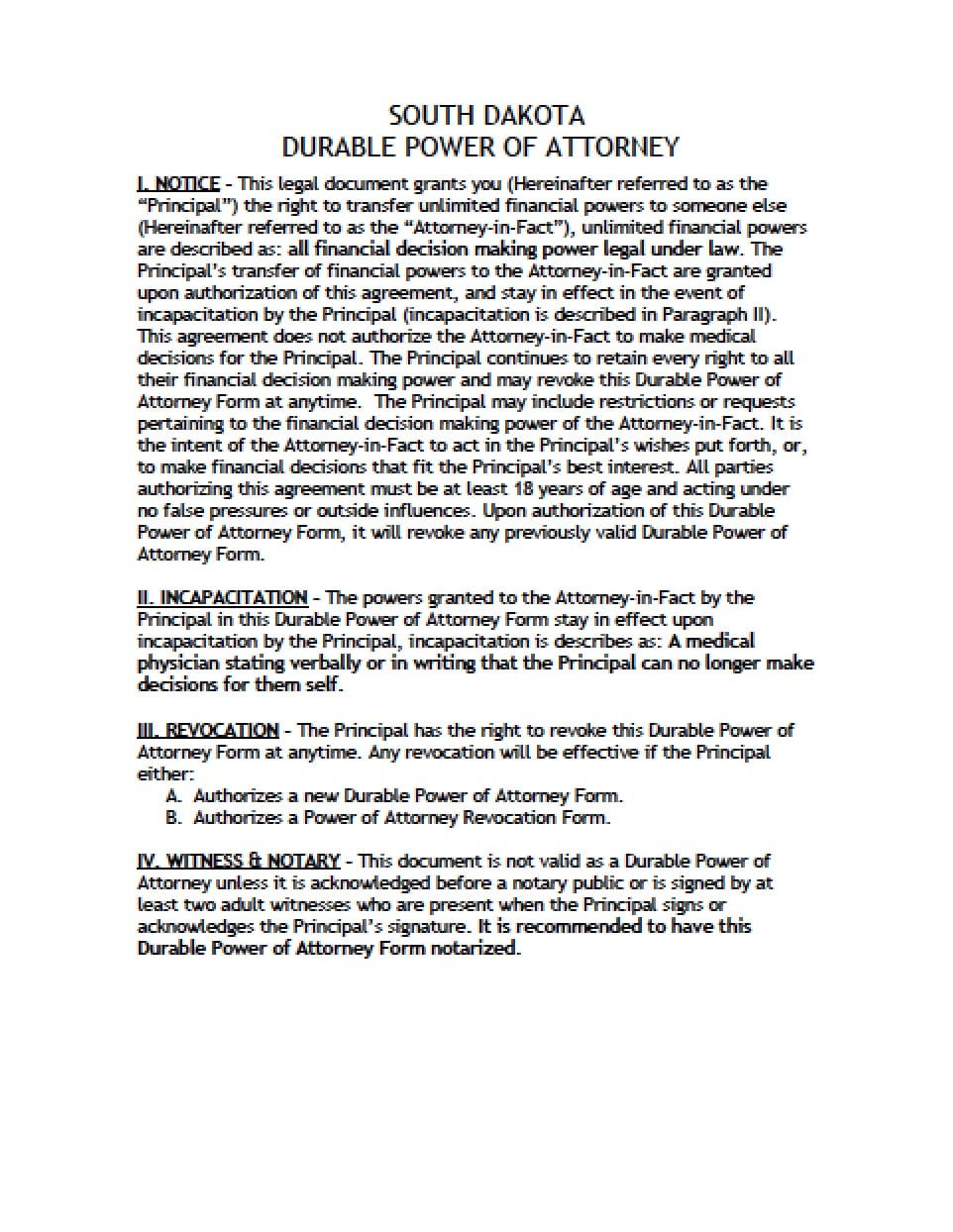

Step 1 – Titled Sections – Review the following titles:

- Notice

- Incapacitation

- Revocation

- Witness and Notary

Step 2 – The Parties – Submit the following information:

- Enter the name of the Principal

- Street Address

- City

- State

- AND

- Enter the name of the Agent

- Street Address

- City

- State

- Provide the state where the powers that the document shall be served by the Agent

- AND

- Select and enter the name of the Successor Agent

- Street Address

- City

- State

- Submit the state where the powers document shall be utilized by the Successor

- Review the Terms and Conditions prior to proceeding with this document

Step 3 – Granting of Powers – The Principal must read all of the powers provided in the document. If the Principal should choose to grant any specific power, they must enter their initials, if they choose to reject any of the powers, place an “X” in the preceding line:

- (A) Real property transactions

- (B) Tangible personal property transactions

- (C) Stock and bond transactions

- (D) Commodity and option transactions

- (E) Banking and other financial institution transactions

- (F) Business operating transactions

- (G) Insurance and annuity transactions

- (H) Estate, trust, and other beneficiary transactions

- (I) Claims and litigation

- (J) Personal and family maintenance

- (K) Benefits from Social Security, Medicare, Medicaid, or other governmental programs, or military service

- (L) Retirement plan transactions

- (M) Tax matters

Step 4 – Additional Titles – Review the following:

- Third Parties

- Compensation

- Disclosure

Step 5 – Signatures – To only be signed before a Notary Public:

- The Printed name of the Principal

- Enter the Date the signature in dd/mm format

- Provide the Principal’s Signature

- AND

- The printed name of the Agent

- Agent’s Signature

- Date the signature in mm/dd/yyyy format

- AND

- Provide the printed name of the Successor Agent (this is optional)

- Enter the Successor Agent’s signature

- Date Successor’s signature in mm/dd/yyyy format

Step 6 – Notary Acknowledgement –

When the notary has witnessed all signatures, they shall acknowledge the document by entering all of the information required to acknowledge the document and it’s validity

Step 7 – Acknowledgement and Acceptance Appointment as Agent and Successor Agent – Enter the following:

- Each Agent must review the acceptance information:

- Enter the name of each Agent in their respective paragraphs

- Provide the Agent’s signatures

- Date signatures in mm/dd/yyyy format

Step 8 – Witness Attestation – The witnesses must review the attestation and enter:

- Each witness must enter their printed names

- Both witnesses must provide their signatures