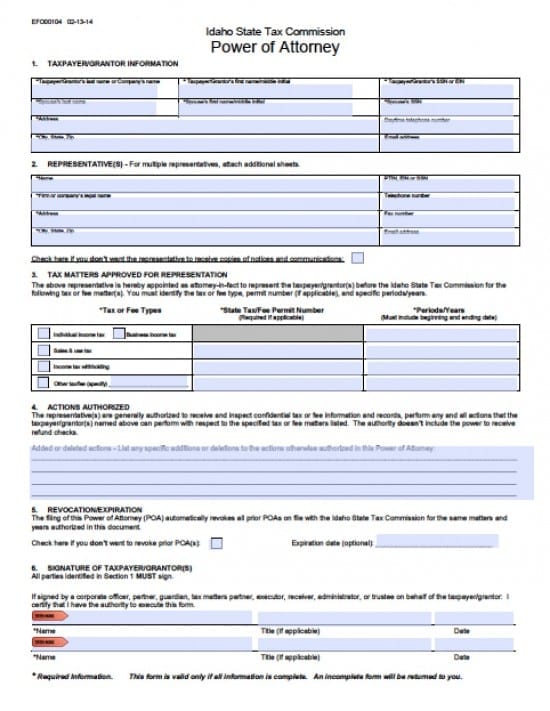

| Idaho Tax Power of Attorney Form |

The Idaho tax power of attorney form is a document that is legal and binding, that allows a taxpayer to grant powers for another person or business entity to prepare and/or represent the Principal with before the Tax Commission. The document will remain effective until it reaches the date provided or until the Principal revokes the document.

How to Write

Step 1 – Taxpayer Information – All fields must be completed:

- Taxpayer/Grantor’s last name or Company’s name

- Taxpayer/Grantor’s first name/middle initial

- Taxpayer/Grantor’s Social Security Number or Emplyee Identification Number

- AND

- Spouse’s last name

- Spouse’s first name/middle initial

- Spouse’s Social Security Number

- Address

- Daytime telephone number

- City, State, Zip

- Email address

Step 2 – Representatives/Agents – (If more than one Agent, list the others on a separate sheet)

- Name

- Preparer Tax Identification Number (PTIN), Employee Identification Number (EIN) or Social Security Number (SSN)

- Firm or company’s legal name

- Telephone number

- Address

- Fax number

- City, State, Zip

Step 3 – Tax Matters Approved for Representation – Complete all of the fields as follows:

- Tax or Fee Types -Check the applicable boxes

- Enter the Tax/Fee Number

- Enter the Periods/Years – Include beginning and Ending Dates

- Check the box if the Principal would like to receive notices and communications

Step 4 – Actions Required – (Authority will not include receiving the Principal’s Refund Check)

- Enter any other authorized actions in the lines provided on the form

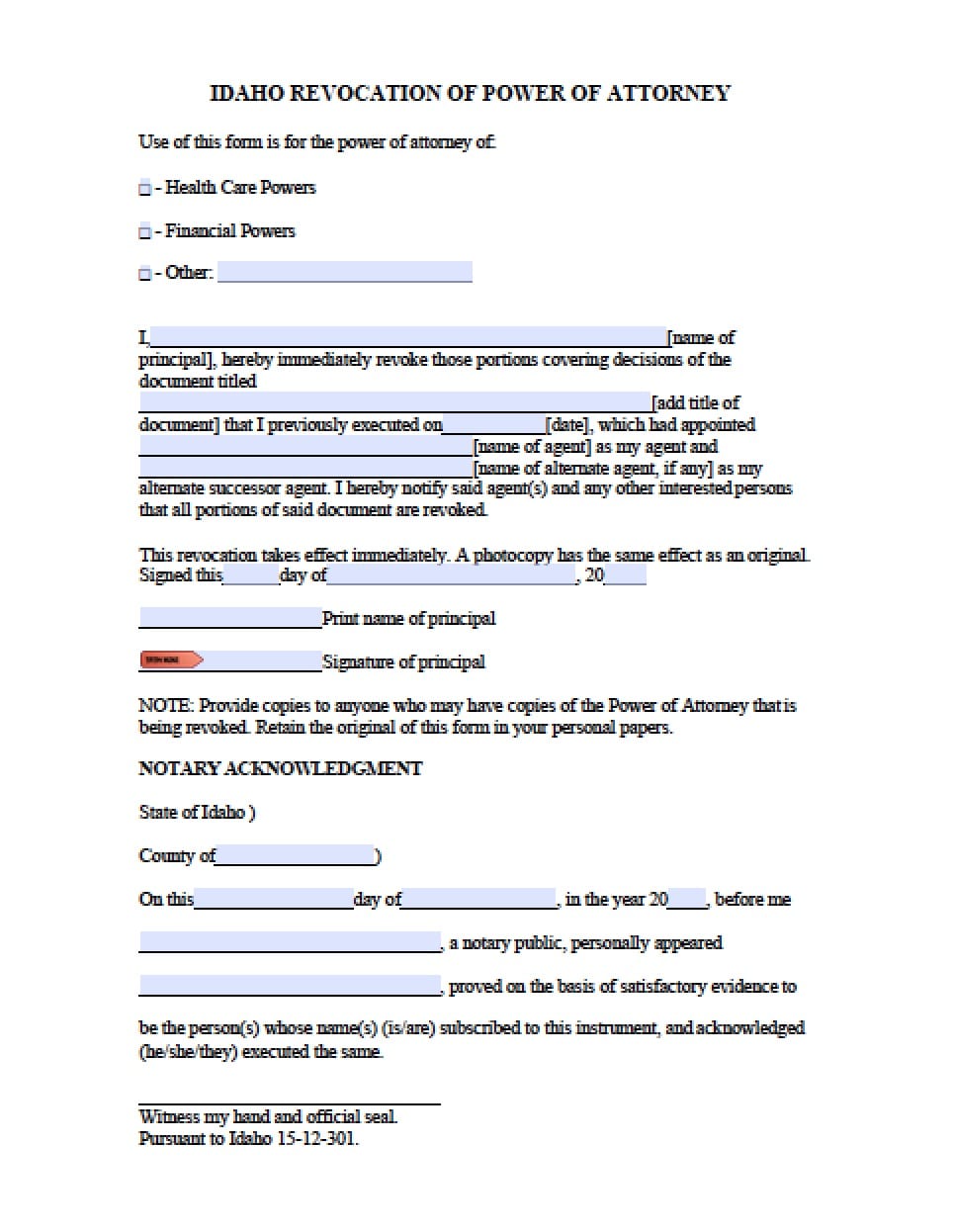

Step 5 – Revocation/Expiration –

- Check the box if you do not wish to revoke any other POA’s you may have in place

- Enter the expiration date of this document

Step 6 – Signature of Taxpayer(s) – All parties listed in the first section must provide signature as follows:

- Taxpayer’s full name(s)

- Title (if any)

- Date of respective signature(s)

Step 7 – General Information – The Principal’s must take the time to review the following Titles Sections as follows:

- Purpose of Form

- Submitting POA

- Revoking or Withdrawal

- Expiration

- Who Must Sign

- Filing This Form

- Taxpayer Services