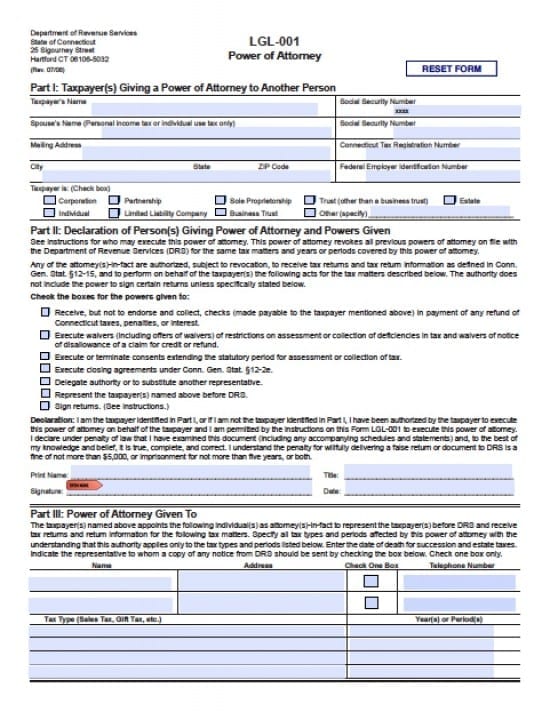

| Connecticut Tax Power of Attorney Form |

The Connecticut tax power of attorney form is a document that authorizes one or more individuals to represent the Principal before the Department of Revenue Services. This authorization allows your representative(s) to receive and inspect confidential tax information and to act on your behalf with regard to tax matters before DRS. Be certain to review all tax information preparation when someone else represents you, as, the taxpayer will always be responsible if there are miscalculations. Check with the representative(s) and/or firm, to be certain that they are willing to represent the taxpayer with the DRS, in the event there are mistakes made on the returns by your Attorney in Fact/Agent or members of any firm. (See §12-15)

How To Write

Step 1 – Begin by downloading the form. In preparation of providing power of attorney to someone else, provide the following information in the appropriate boxes provided:

- Taxpayer’s Name

- Social Security Number

- Spouse’s Name (Personal income tax or individual use tax only)

- Social Security Number

- Mailing Address

- Connecticut Tax Registration Number

- City

- State

- Zip Code

- Federal Employer Identification Number

Step 2 – Type of Taxpayer – Check the box pertaining to what type of tax category you fall into from the following: (Check the appropriate box on the form):

- Corporation

- Partnership

- Sole Proprietorship

- Trust (other than a business trust)

- Estate

- Individual

- Limited Liability

- Company

- Business Trust

- Other (specify on the line provided on the form)

Step 3 – Declaration of Appointment of power of attorney – In this section, check all boxes that apply to the powers you’re willing to allow the person of service. If any box is left unchecked, the Attorney in Fact will not be able to exercise those particular powers – select from the following and check them on the form:

- Receive, but not to endorse and collect, checks (made payable to the taxpayer mentioned above) in payment of any refund of Connecticut taxes, penalties, or interest

- Execute waivers (including offers of waivers) of restrictions on assessment or collection of deficiencies in tax and waivers of notice of dis-allowance of a claim for credit or refund

- Execute or terminate consents extending the statutory period for assessment or collection of tax

- Execute closing agreements under Conn. Gen. Stat. §12-2e

- Delegate authority or to substitute another representative

- Represent the taxpayer(s) named above before DRS

- Sign returns (If your agent is not allowed to sign the returns, you will have to meet with them and sign them on your own)

Step 4 – Declaration – This section will ask that you name the person you would like to use as your Attorney in Fact/Agent. Read the information and Provide the following information:

- Print Name of Taxpayer

- Title

- Taxpayer’s Signature

- Date Taxpayer signed the form

Step 5 – Appointment of Agent(s) – Provide the following information with regard to your appointed Attorney(s) in Fact/Agent(s)

- Name

- Physical Address

- Telephone Number

- Tax Type (Sales Tax, Gift Tax, etc.)

- Year(s) or Period(s)

- Once completed, all information with regard to tax returns will be returned to the taxpayer as a matter of state law.