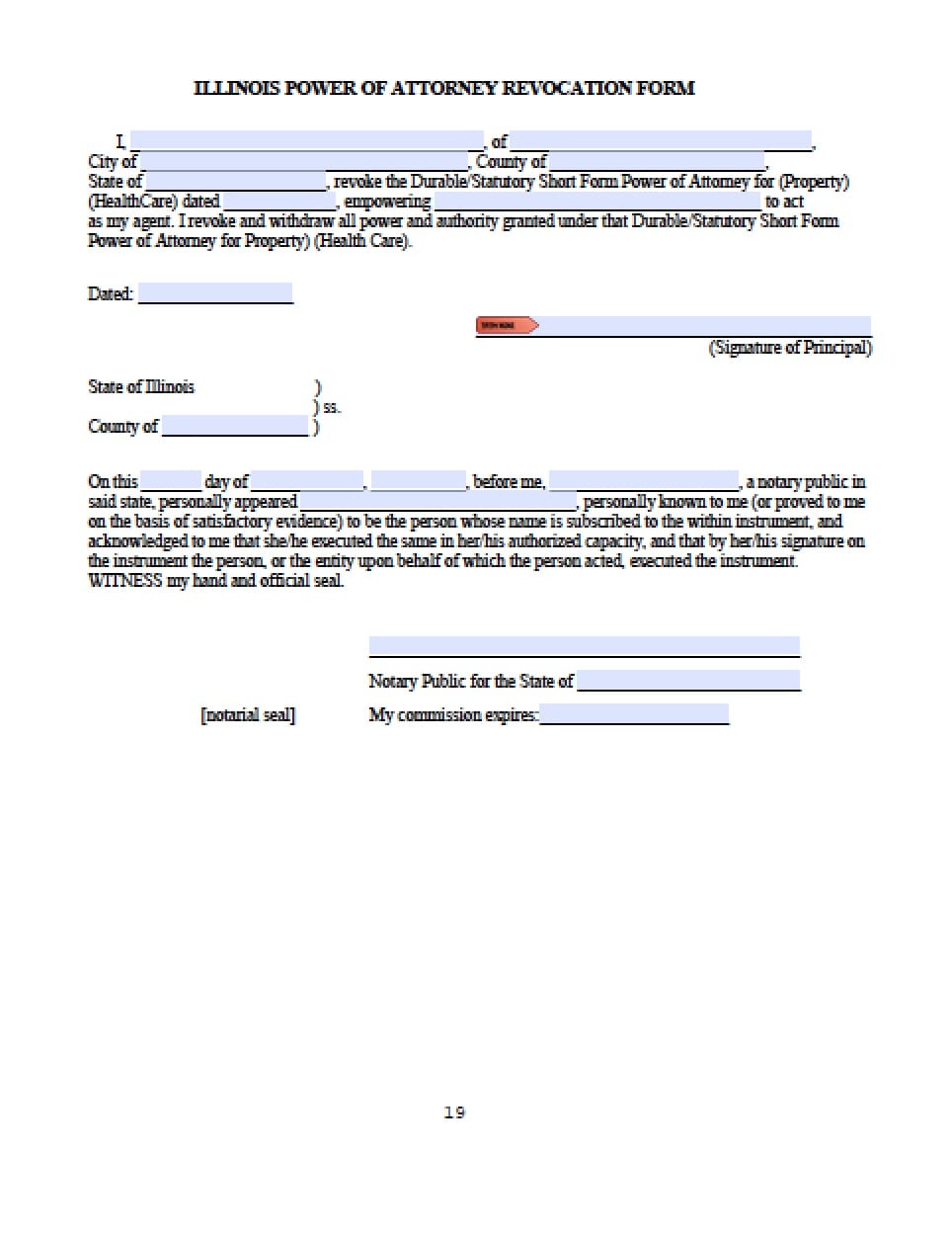

| Illinois Durable Financial Power of Attorney Form |

The Illinois durable financial power of attorney form is a document that is designed to allow a Principal to grant powers to an Agent/Attorney In Fact, to handle their financial affairs. This document could have serious financial implications if, in fact, the Agent doesn’t have the Principal’s best interest in mind. The Principal must read the document.

If the Principal is unsure with regard to the meaning of the document, they should consider a consultation with an attorney to clarify the language for them prior to completion and signature(s). This document will require the signatures of one (1) witness and must be notarized. The Principal must know that they may revoke this document at their discretion, by placing the revocation in writing and delivering it to the Agent.

How to Write

Step 1 – Notice –

- The Principal must read the paragraphs in the beginning section of the document to be certain that they understand the document clearly.

- The “Note” paragraphs throughout the form are instructions, do not ignore these sections but instead, review them carefully

- Once the Principal has completed the review of the first section of the form, they must enter their initials at the bottom right side of the page

Step 2 – Illinois Short Form for Property – The Principal must be advised that no Co-Agents may be listed on this document, therefore, be certain that the initial Agent chosen is someone that the Principal trusts completely.

- Section 1 – The Principal must enter their full name and complete address into the lines provided

- Should the Principal choose to revoke other outstanding documents when creating this document, insert the name and address of the Agent to be notified

- Read the “Note” paragraphs before proceeding

- The Principal must be cautious to strike through any of the categories that they choose not to grant to their Agent. Failure to do so will grant the Agent powers that the Principal may not feel comfortable entrusting to the Agent

- Review and strike through any of the following section that will not be granted to the Agent as follows:

- Real estate transactions

- Financial institution transactions

- Stock and bond transactions

- Tangible personal property transactions

- Safe deposit box transactions

- Insurance and annuity transactions

- Retirement plan transactions

- Social Security, employment and military service benefits

- Tax matters

- Claims and litigation

- Commodity and option transactions

- Business operations

- Borrowing transactions

- Estate transactions

- All other property transactions

Step 3 – Limitations –

- The Principal must read all the “Notes”

- If the Principal wishes to grant but limit some of the powers, enter that information on the lines provided on the document

- The next section would ask that the Principal to add other powers they would wish to delegate without limitations into the lines

- The Principal must then enter the effective date in which the Principal wishes to make the document available for use by the Agent

- If the Principal would like to add Agent’s that may take over these duties in the event the initial Agent should pass away, or become unwilling or unable to serve, enter the names of those potential Agents to serve one at a time, into the lines – Include their name, address and telephone number

Step 4 – Signatures – Must be signed before a Notary Public – After completion by the Principal, signatures of all parties will be required before the document will be allowed to go into effect – Provide the following:

- Date the Signature in mm/dd/yyyy format

- Enter the Principal’s Signature

- Principal – Read the “Notes”

- AND

- The Witness must carefully review the information in this section

- Enter the name of the first Witness

- Date the Signature in mm/dd/yyyy format

- Enter the Signature of the first Witness

- AND

- The Witness must carefully review the information in this section

- Enter the name of the second Witness

- Date the Signature in mm/dd/yyyy format

- Enter the Signature of the second Witness

- AND

- Once the notary has identified all parties and witnessed all signatures, the notary will complete all of the state-required information in acknowledgment

Step 5 – Specimen Signatures of Agent(s) – The Principal has the opportunity to request specimen signatures from their respective Agent(s)

- Agent(s) may provide Signatures in the appropriate lines

- Agent

- Principal

- Two Successor Agent(s)

Step 6 – Document Preparer Information –

- Name

- Address

- Telephone Number

Step 7 – Notice to Agent –

- Any Agent(s) listed, original and successor Agent’s must receive a copy of this notice.

- They must carefully review the notice and adhere to the statements, as the Principal is protected by state law and therefore if any of the requirements are violated and reported, the Agent will be responsible for whatever actions are ignored, by law.