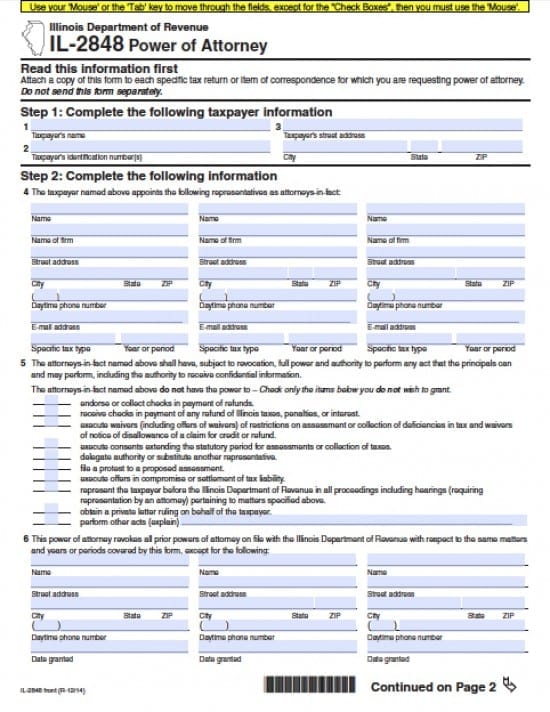

| Illinois Tax Power of Attorney Form |

The Illinois tax power of attorney form is a document that provides the Principal an avenue in which they may provide permission for a delegated Agent that will allow the Agent all of the powers needed to complete tax documents. In order to accomplish completion of tax forms, the Agent must also claim the right to confidential financial information.

There are powers that this document will not allow to be done in the name of the Principal and this document. A copy of this document must be attached to each tax form. The document must not be sent separately. The form may be revoked when the Principal is prepared to do so, if needed.

How to Write

Step 1 – Taxpayer Information –

- Taxpayer’s Name

- Taxpayer’s Identification Numbers, (Social Security Number or Employee Identification Number)

- Taxpayer’s Address

- City, State, Zip Code

Step 2 – Agent’s Information – The Principal must provide the following information on all Agent’s

- Name’

- Name of Firm

- Street Address

- City, State, Zip Code

- Daytime phone number

- Email Address

- Specific Tax Type

- Year or Period

Step 2 – The Principal must initial all powers that they do not wish to grant to their Agent(s) –

- endorse or collect checks in payment of refunds

- Receive checks in payment of any refund of Illinois taxes, penalties, or interest

- Execute waivers (including offers of waivers) of restrictions on assessment or collection of deficiencies in tax and waivers of notice of disallowance of a claim for credit or refund

- Execute consents extending the statutory period for assessments or collection of taxes

- Delegate authority or substitute another representative

- File a protest to a proposed assessment

- Execute offers in compromise or settlement of tax liability

- Represent the taxpayer before the Illinois Department of Revenue in all proceedings including hearings (requiring representation by an attorney) pertaining to matters specified above

- Obtain a private letter ruling on behalf of the taxpayer

- Perform other acts (explain)

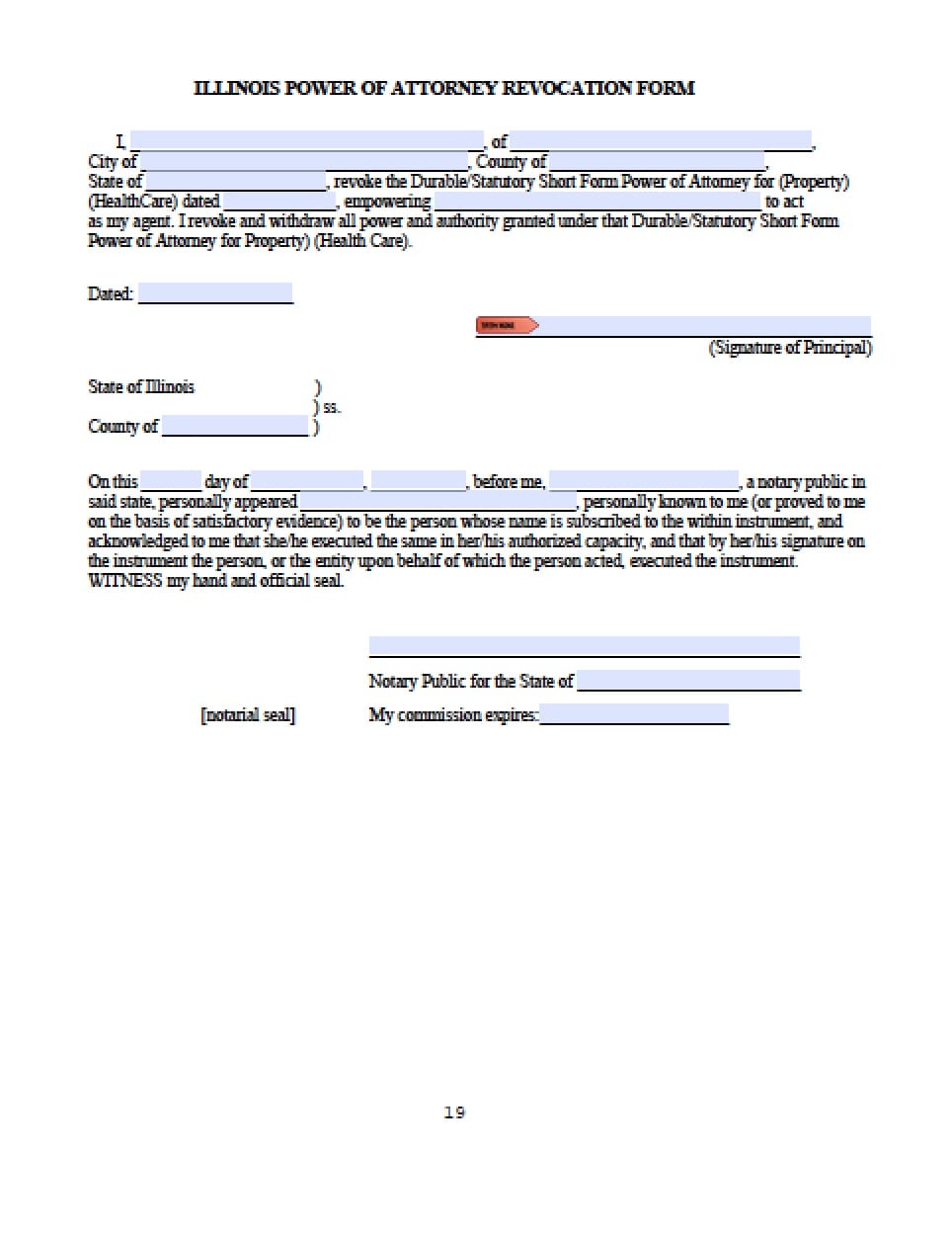

Step 3 – To Date a Revocation to All Agents in Advance – Enter:

- Name(s)

- Street Address(es)

- City, State, Zip Code

- Daytime Phone Number(s)

- Date of Granted Revocation

Step 4 – Agents Information Where the Principal May Send Notices – Provide the following for each respective Agent –

- Name

- Street Address

- City, State, Zip Code

- Daytime Phone Number (with area code)

Step 5 – Taxpayer(s) Signature(s) –

- Taxpayer’s Signature

- Title (if any)

- Date of Signature

- AND

- Spouse’s Signature

- Title (if any)

- Date of Signature

- AND

- If corporation or partnership, signature of officer or partner

- Title

- Date of Signature

Step 6 – Complete the following if the powers are granted to attorneys, CPAs, or an Enrolled Agent enter the following information for all agents:

- Designation (attorney, C.P.A., enrolled agent)

- Jurisdiction (state(s), etc.)

- Signature

- Date

Step 7 – Complete the following if the powers are granted to someone other than an attorney, CPA or an Enrolled Agent –

- Enter the Signatures of two disinterested witnesses

- Date the signatures in mm/dd/yyyy format

Once the Notary has witnessed all signatures, the notary must sign the document and provide a Notary Seal in acknowledgement.