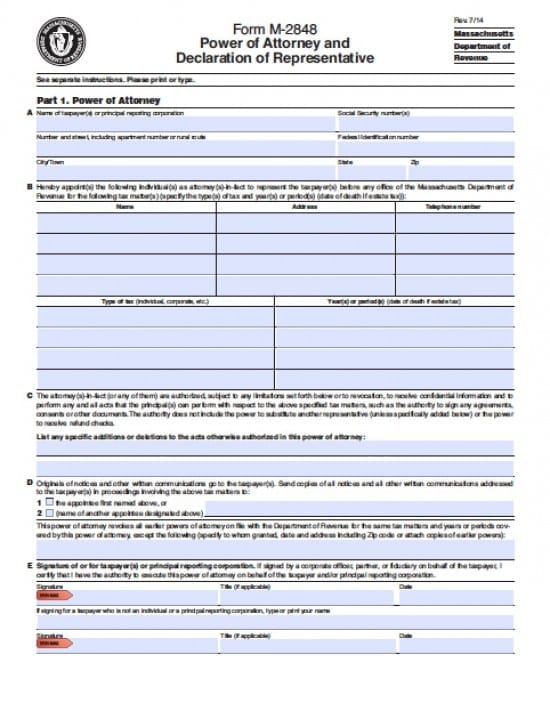

| Massachusetts Tax Power of Attorney Form |

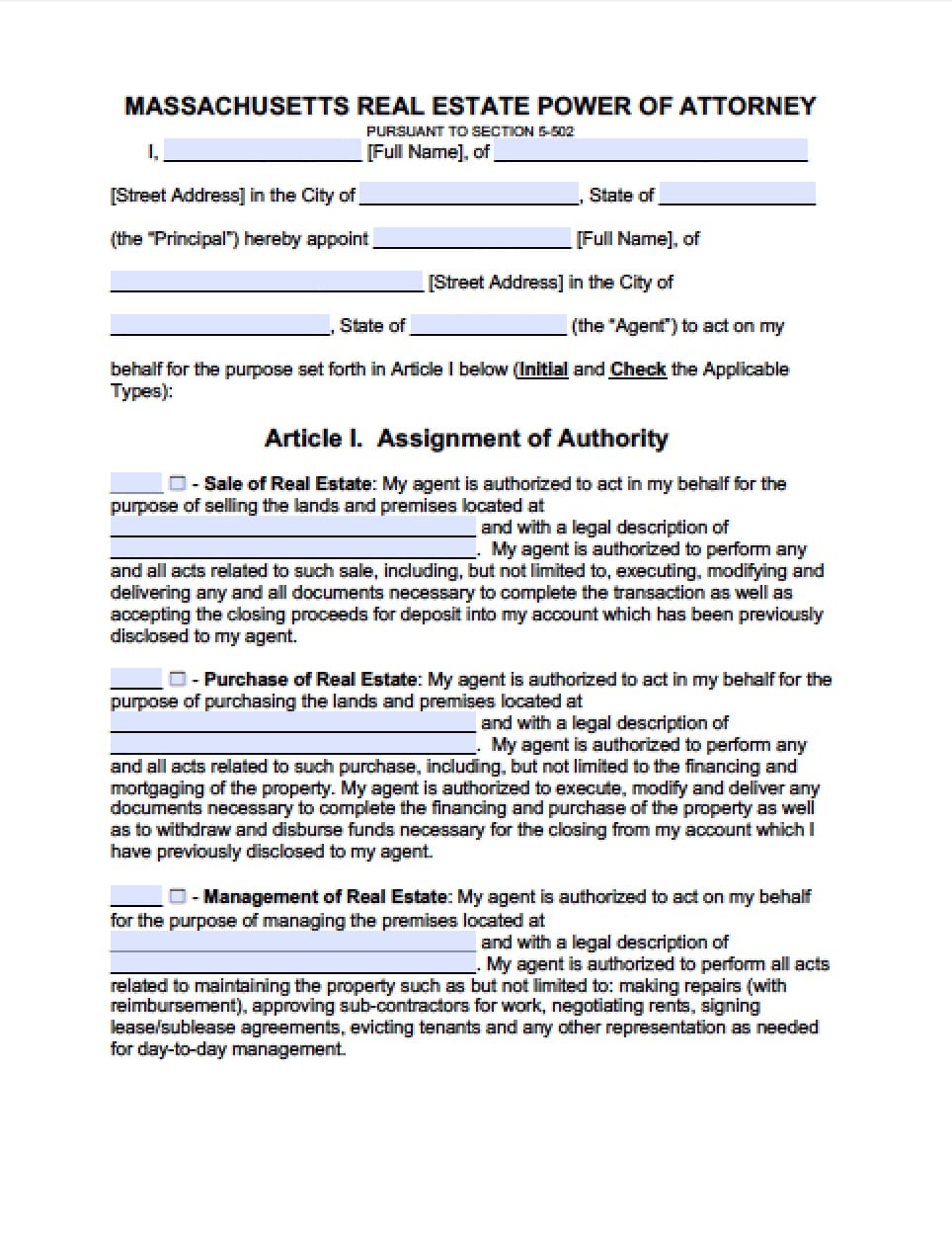

The Massachusetts tax power of attorney form is a document that will allow a taxpayer(s) to appoint an Agent or Agent(s) to complete tax forms and/or represent the taxpayer(s) before tax agencies. Agent(s) and tax payers must sign the document or it will be returned for signatures. This document must be completed before confidential financial information with regard to the taxpayers can be released. Since it’s likely that the Agent(s) will need to request information, this form will require completion.

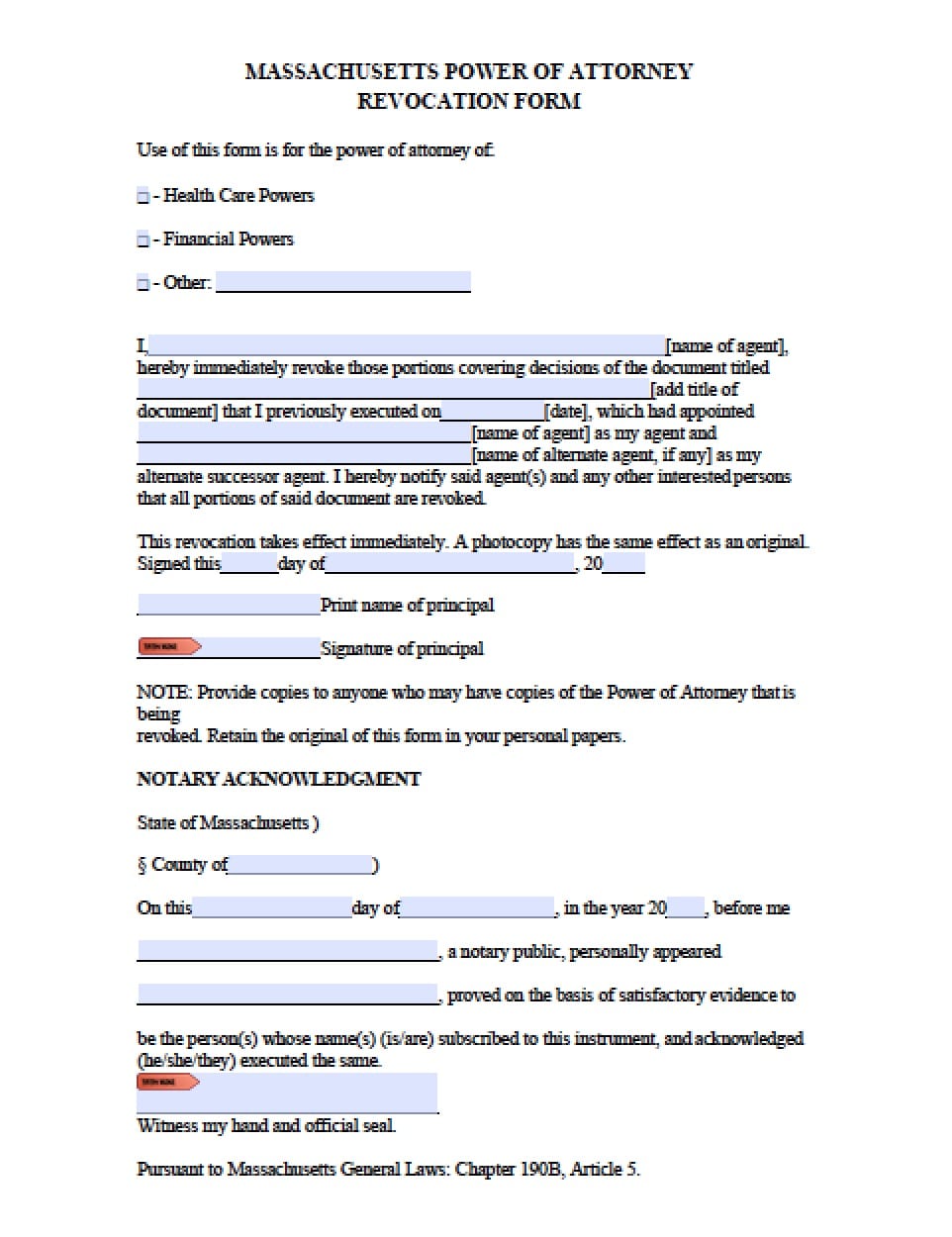

This document may be revoked at any time by the taxpayer(s) by provision of written notice that is delivered to the Agent(s) or at least the first Agent on the list if there is more than one Agent.

How to Write

Step 1 – Taxpayers Information – Enter:

- Taxpayer(s) Name(s)

- Social Security Number(s)

- Street Address (include any apartment number or rural route

- Federal Identification Number

- City

- State

- Zip Code

Step 2 – Agent’s Information – Enter the following:

- Agent(s) Name(s)

- Agent(s) Addresses

- Agent(s) Telephone Number(s)

- Type of Tax

- Year(s) or Period(s) (or death if this is estate tax)

Step 3 – Additions/Deletions –

- Taxpayer must list any additions/deletions to the acts that are already stated if needed

Step 4 – Copies of Notices –

- By checking one of the boxes, specify if the taxpayer would like to have communications sent to them or the Agent who is first on the list of Agent(s)

Step 5 – Powers Documents –

- This document will revoke all other powers documents. If the taxpayers would like any of their documents that they would like to remain in power specify:

- To whom the document was granted

- Date

- Address

- Zip Code

- OR

- The taxpayers may attach a copy of the document

Step 6 – Signatures – must be witnessed by a notary if anyone outside of a business entity is completing tax forms:

- Signatures of Witnesses

- Date of Signatures

- AND

Step 7 – Notarization –

Once the signatories have provided signatures, the notary shall provide the required information and their original seal to acknowledge the document.

Step 8 – Declaration of Representatives -The representatives must review all of the statements in this section and then enter:

- Designation

- Jurisdiction or Enrollment Card

- Signature(s)

- Date of Signature(s)