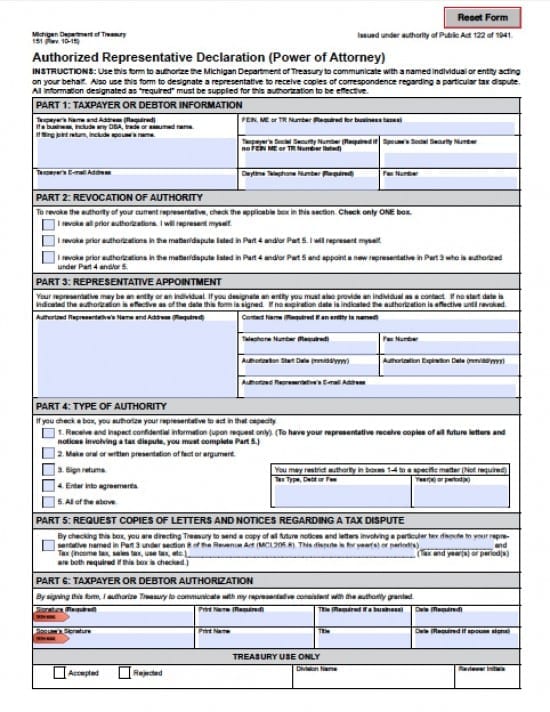

| Michigan Tax Power of Attorney Form |

The Michigan tax power of attorney form is a document that will allow a Principal to designate and Agent to complete their tax documents and/or represent them before any tax agency. This document must be completed so that the Agent may access confidential financial information in order to properly complete the documents for the Principal. This document will revoke all other documents unless otherwise specified.

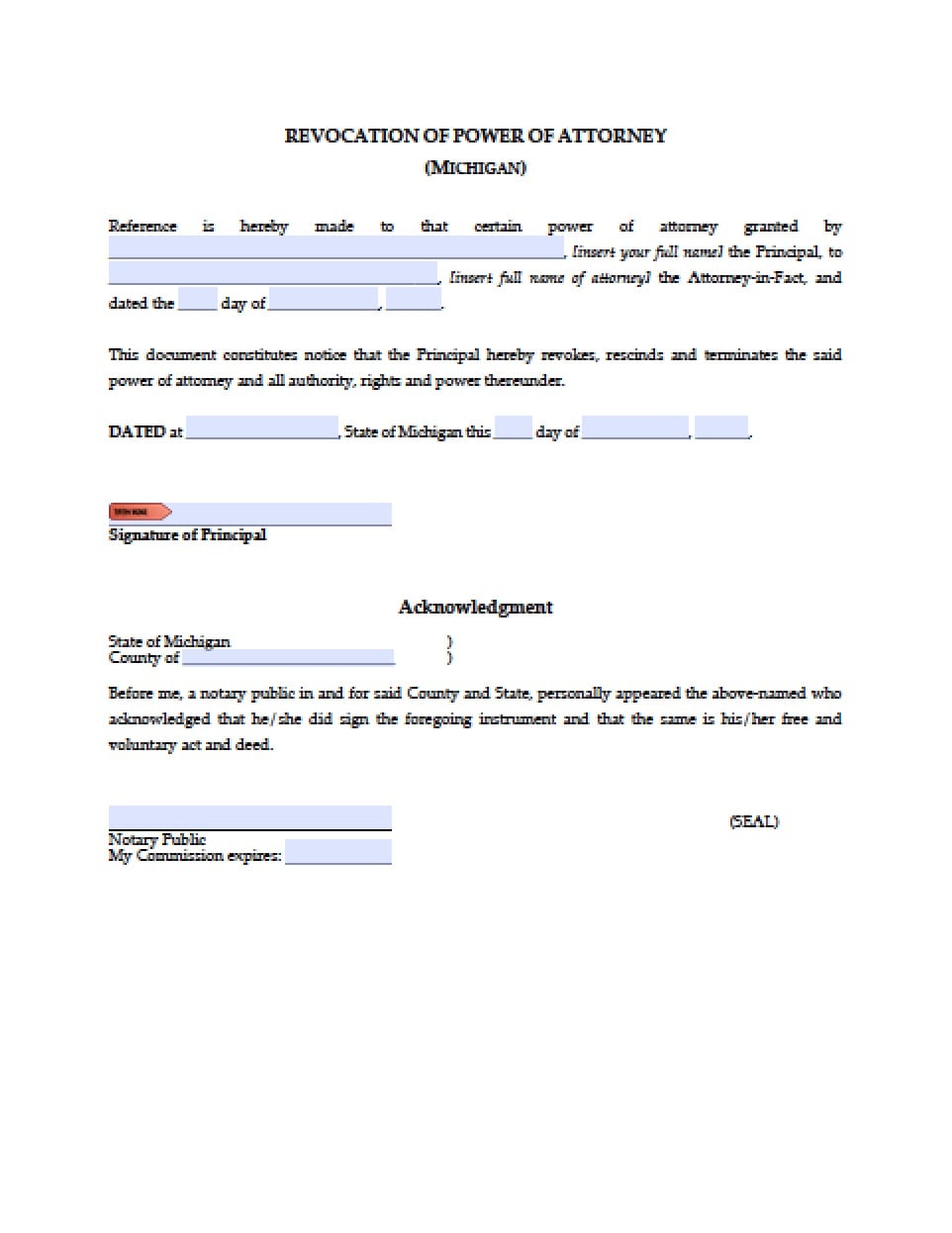

This document may be revoked at any time, by the Principal, in writing.

How to Write

Step 1 – Taxpayer Information – Enter the following information:

- Taxpayer’s Name and Address (Required)

- If this is a business, include any DBA, trade or assumed name. If filing joint return, include spouse’s name

- Federal Employee Identification Number (FEIN), ME or TR Number (This is required for business taxes)

- Taxpayer’s Social Security Number

- Spouse’s Social Security Number

- Taxpayer’s E-mail Address

- Daytime Telephone Number (Required)

- Fax Number

Step 2 – Revocation of Authority –

- To revoke the authority of the current Agent check one of the boxes in this section that applies

Step 3 – Representative Appointment – Provide the following information:

- Authorized Representative’s Name and Address (Required)

- Contact Name (Required if a business entity is named as an agent)

- Telephone Number (Required)

- Fax Number

- Authorization Start Date in mm/dd/yyyy format

- Authorization Expiration Date in mm/dd/yyyy format

- Authorized Representative’s E-mail Address

Step 4 – Type of Authority –

- Should the Principal choose to check a box in this section, the representative will be authorized your to act in the capacity that is stated by the checked box

- Receive and inspect confidential information upon request only

- Make oral or written presentation of fact or argument

- Sign returns

- Enter into agreements

- All of the above

Step 5 – Requesting Copies of Letters and Notices Regarding Tax Disputes –

- By checking this box, in this section the Principal is directing The Treasury to send a copy of all future notices and letters involving a particular tax dispute to your representative

Step 6 – Taxpayer(s) Authorization (Signatures) – Enter:

- Prinicpal and Spouses Signature(s)

- Printed Names

- Titles

- Date of Signatures in mm/dd/yyyy format