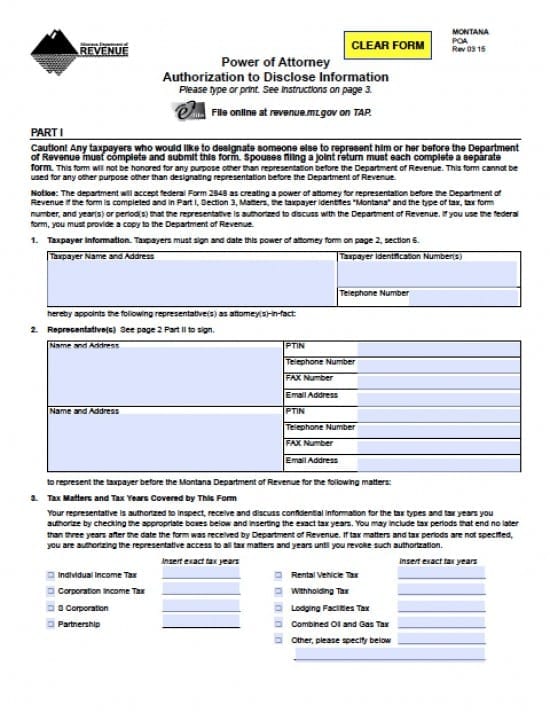

| Montana Tax Power of Attorney Form |

The Montana Tax Power of Attorney Form is a document that is used by taxpayers to provide authority to and individual or business to complete their tax forms, provide signature and/or represent the Principal before a tax entity. The document will provide taxpayer information, Agent information and permission for the Agent(s) to receive confidential financial information so that they may better account for the required accuracy. If the taxpayer is filing jointly with their spouse, each person must file their own form seperately.

This document may be revoked at the discretion of the Principal, with written notice, delivered to the Agent.

How to Write

Step 1 – Taxpayer’s Information – Principal must read the section at the top of the page and provide the following:

- Taxpayer Name and Address

- Taxpayer Identification Number(s)

- Telephone Number

Step 2 – Agent(s) Information – Enter the following information for all Agents involved with the tax project:

- Name and Address

- PTIN

- Telephone Number

- FAX Number

- Email Address

Step 3 – Tax Matters and Tax Years – The Principal must select from the following, check the selected box and enter the specific tax year for each into the line(s) provided:

- Individual Income Tax

- Rental Vehicle Tax

- Corporation Income Tax

- Withholding Tax

- S Corporation

- Lodging Facilities Tax

- Partnership

- Combined Oil and Gas Tax

- Other, please specify in the line provided

Step 4 – Authorized Acts for Agent(s) – The Principal must review the following and check the box(es) that best best apply:

- Representation – Department employees can provide confidential information to the representative

- Information sharing – Department employees can provide confidential information to the representative, but cannot discuss the information

- Decision-making authority – Department employees can provide confidential information to a representative, can discuss the information and the representative can act on the taxpayer’s behalf for all purposes, including settlement and waiver of appeal rights

Step 5 – Revocation of Prior Power(s) – Check the following box if the Principal wishes to revoke prior powers documents:

- Check this box if you want all prior POAs revoked

- If you are a representative and want to withdraw an existing POA, write WITHDRAW across the top of the existing form

Step 6 – Principal’s Signature – The Principal must enter the following:

- Signature

- Date of Signature in mm/dd/yyyy format

- Title (if applicable)

- Print Name Print name of Taxpayer

Step 7 – Declaration of Representatives – The Agent(s) must review the declaration statements and complete the table, to include the Agent’s signature(s)

- Designation – Insert Letter from Above (a-g)

- Relationship to Taxpayer

- Signature of Agents

- Date of signature(s) in mm/dd/yyyy format