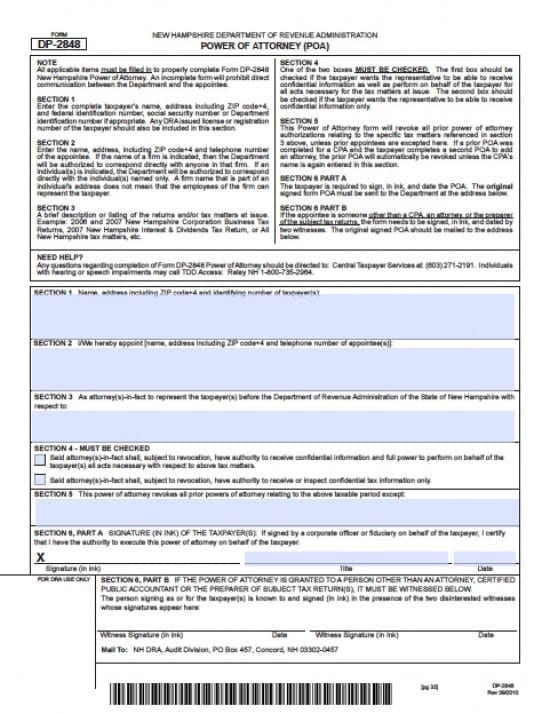

| New Hampshire Tax Power of Attorney Form |

The New Hampshire tax power of attorney Form is a legal document that permits a taxpayer to provide permission for an individual or business to complete tax forms. If needed the Agent(s) may also represent the taxpayers before any tax agency. The taxpayers must complete all of the fields on the form. Signatures must be submitted by both the taxpayer(s) and the Agent(s) or the form will be returned and therefore will cause a delay in the process. This form will revoke all previous powers documents unless otherwise stated by the taxpayers.

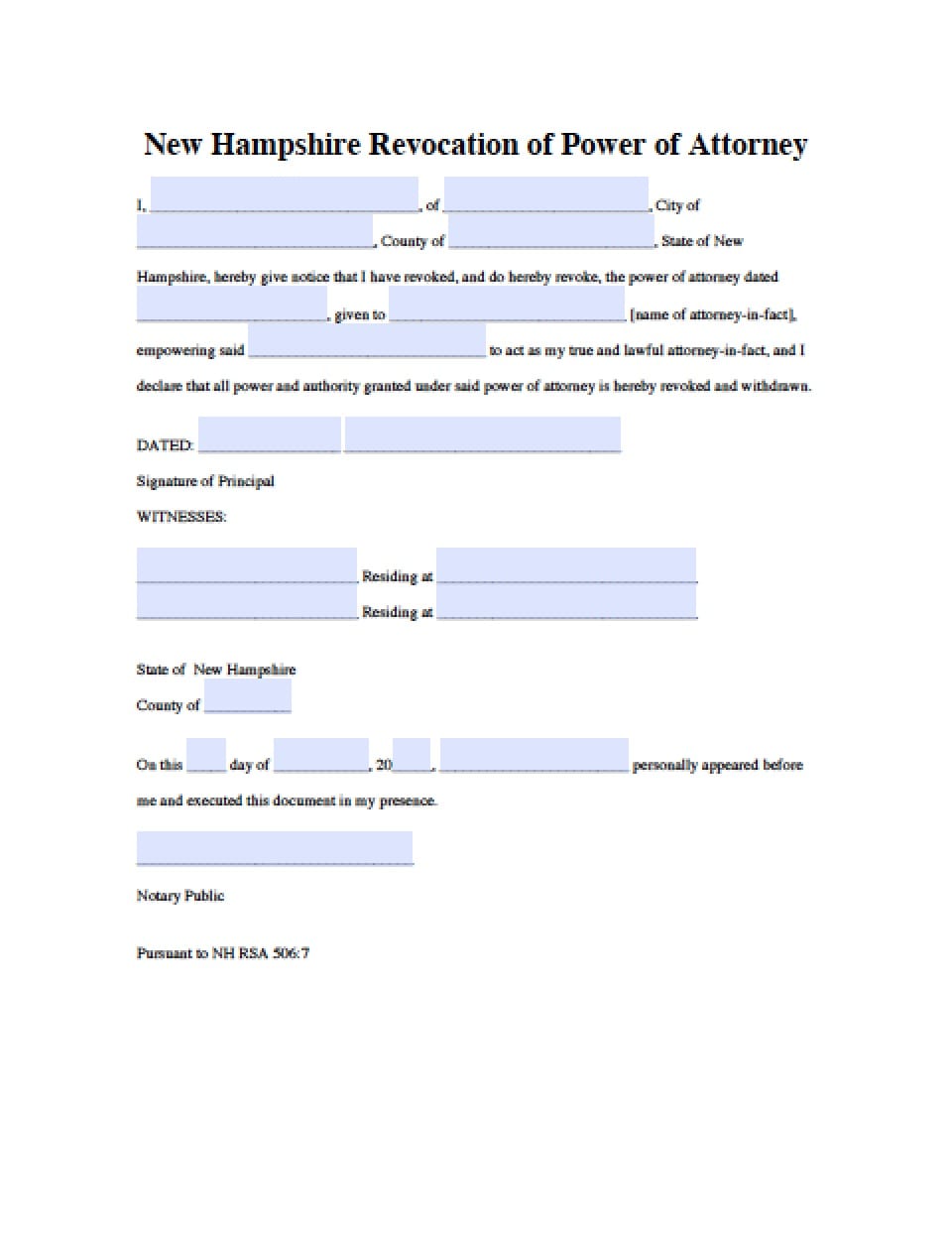

This document may revoked at the discretion of the taxpayer(s) by provision of a written revocation notice and delivery to the Agent(s).

How to Write

Step 1 – Download the document – The taxpayer(s) must read the introduction (sections 1 through 6 -6 parts a and b)

Step 2 – Taxpayer Information – Enter the following information:

- Name

- Address (include the zip code+4

- Identifying number(s) of taxpayer(s)

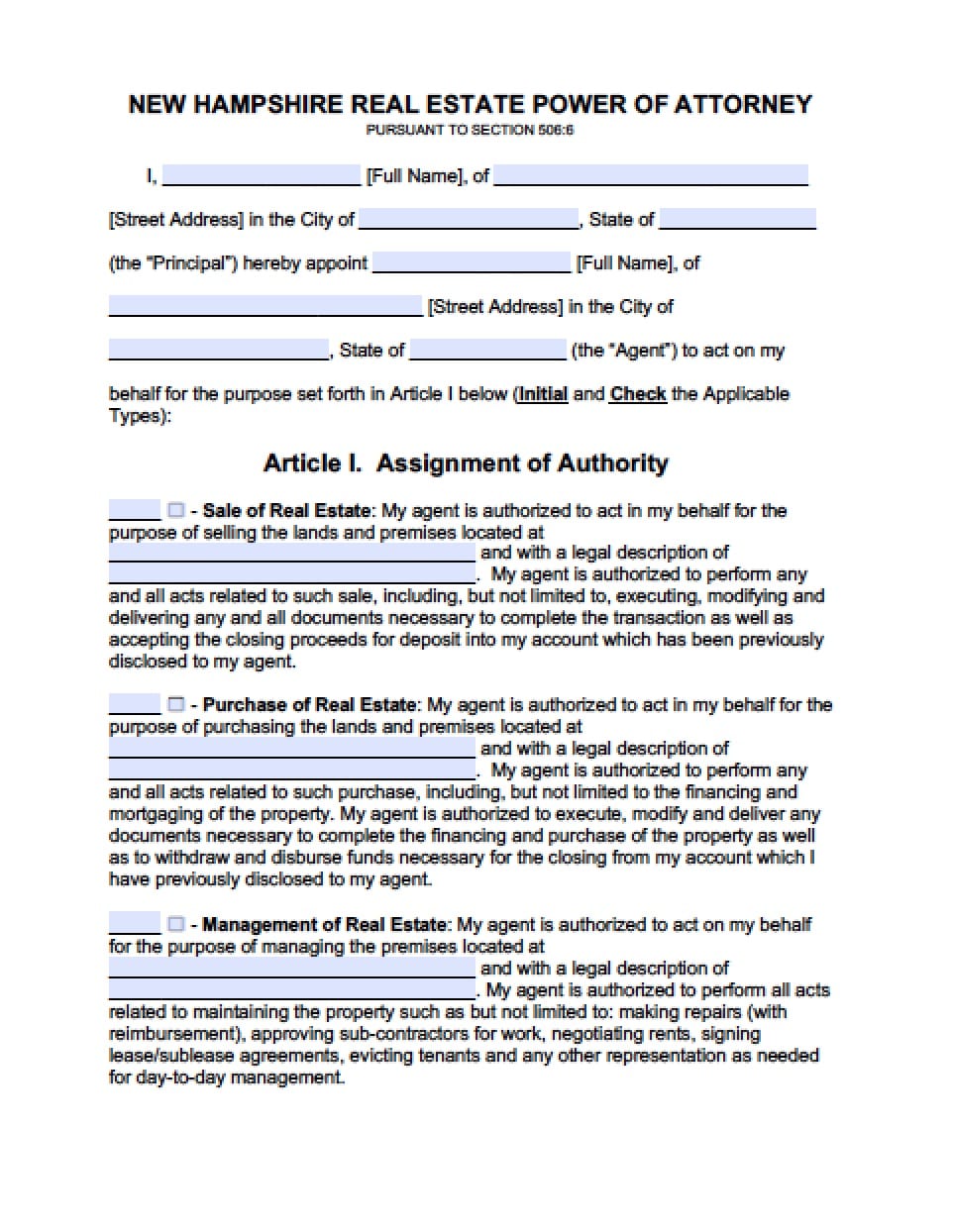

Step 3 – Tax Matters –

- Enter the tax matters that the Agent(s) will represent before the Department of Revenue Administration of the State of NH

Step 4 – Confidential Financial Information –

- The taxpayer(s) must check the box or boxes that would provide needed powers to receive and or inspect the taxpayers confidential financial information

Step 5 – Revocation of Prior Powers Documents –

- By completing this document, any prior powers documents will be revoked, if there will be previous powers documents that the taxpayer(s) would like to remain in effect, the taxpayer(s) must enter the titles of the documents and attach copies of the document(s) to this form

Step 6 –(Part A) – Signatures – Must be signed in Ink:

- Enter the signature of the Agent or the corporate officer or fiduciary stating that the Agent will have authority to execute powers on behalf of the taxpayer(s)

- Title

- Date the signature in mm/dd/yyyy format

Part B –

- Should these powers be granted to an individual other than an Attorney, CPA or a professional tax preparation specialist, the document must then be signed by two unrelated, disinterested witnesses

- Both witnesses must provide their respective signatures (in ink)

- Date each witnesses signature in mm/dd/yyyy format

Step 7 – Mail to:

- NH DRA Audit Division

- PO Box 457

- Concord, NH 03302-0457