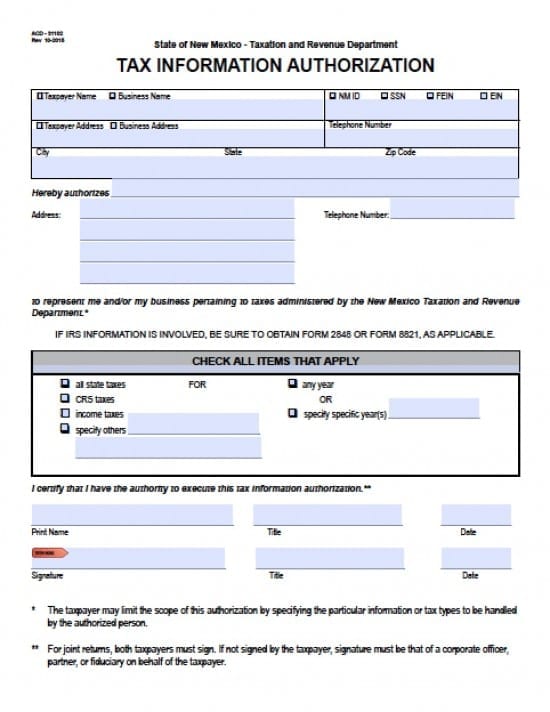

| New Mexico Tax Power of Attorney Form |

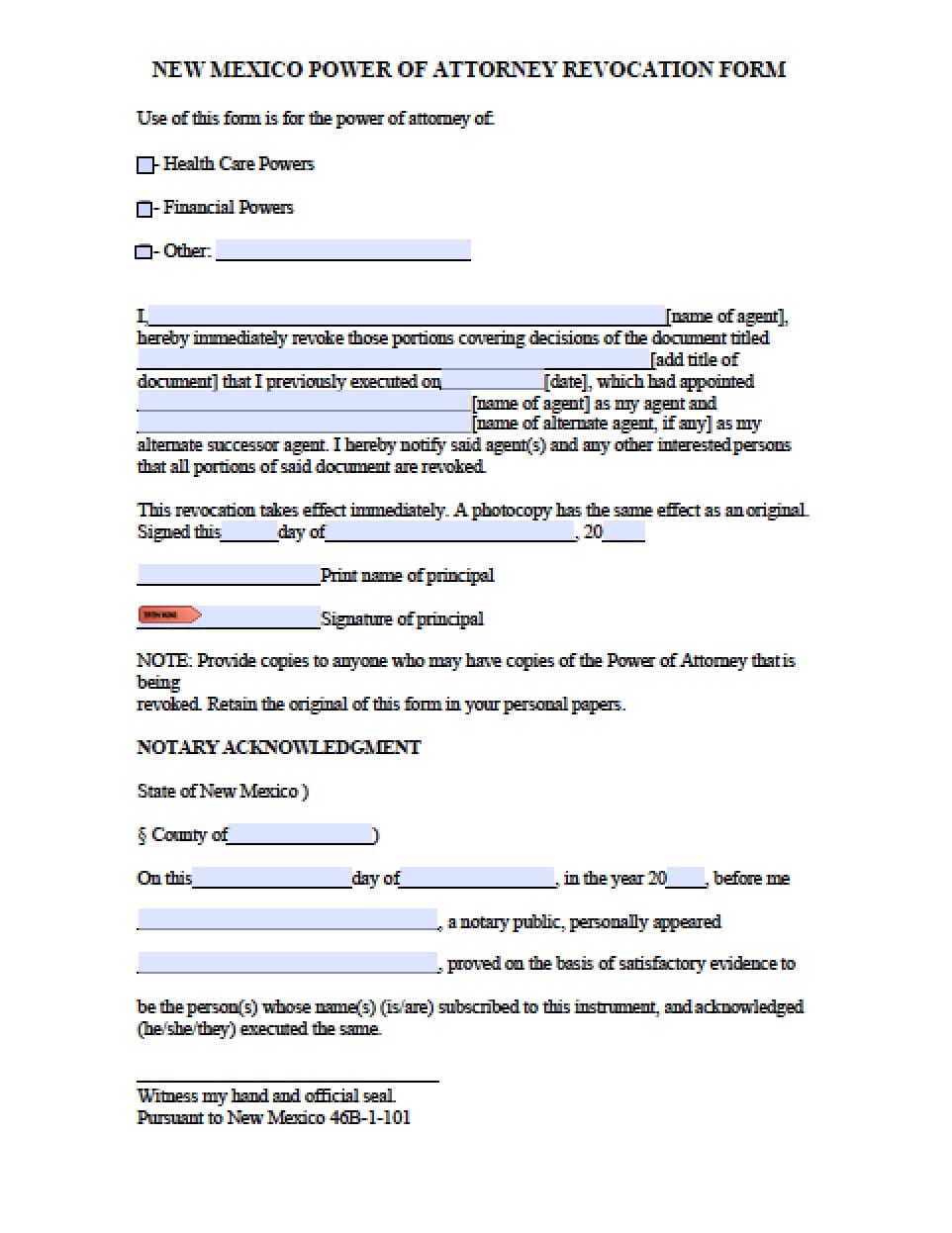

The New Mexico tax power of attorney form is a legal document that provides authorization by taxpayers to an Agent (Individual or Business Entity) to complete tax forms and/or represent the taxpayer(s) before the Department of Revenue. Completion of this document will revoke any other tax powers documents, unless otherwise stated in writing by the taxpayer.

This document may be revoked by the taxpayer(s) at any time, by provision of written notice to the Agent(s)

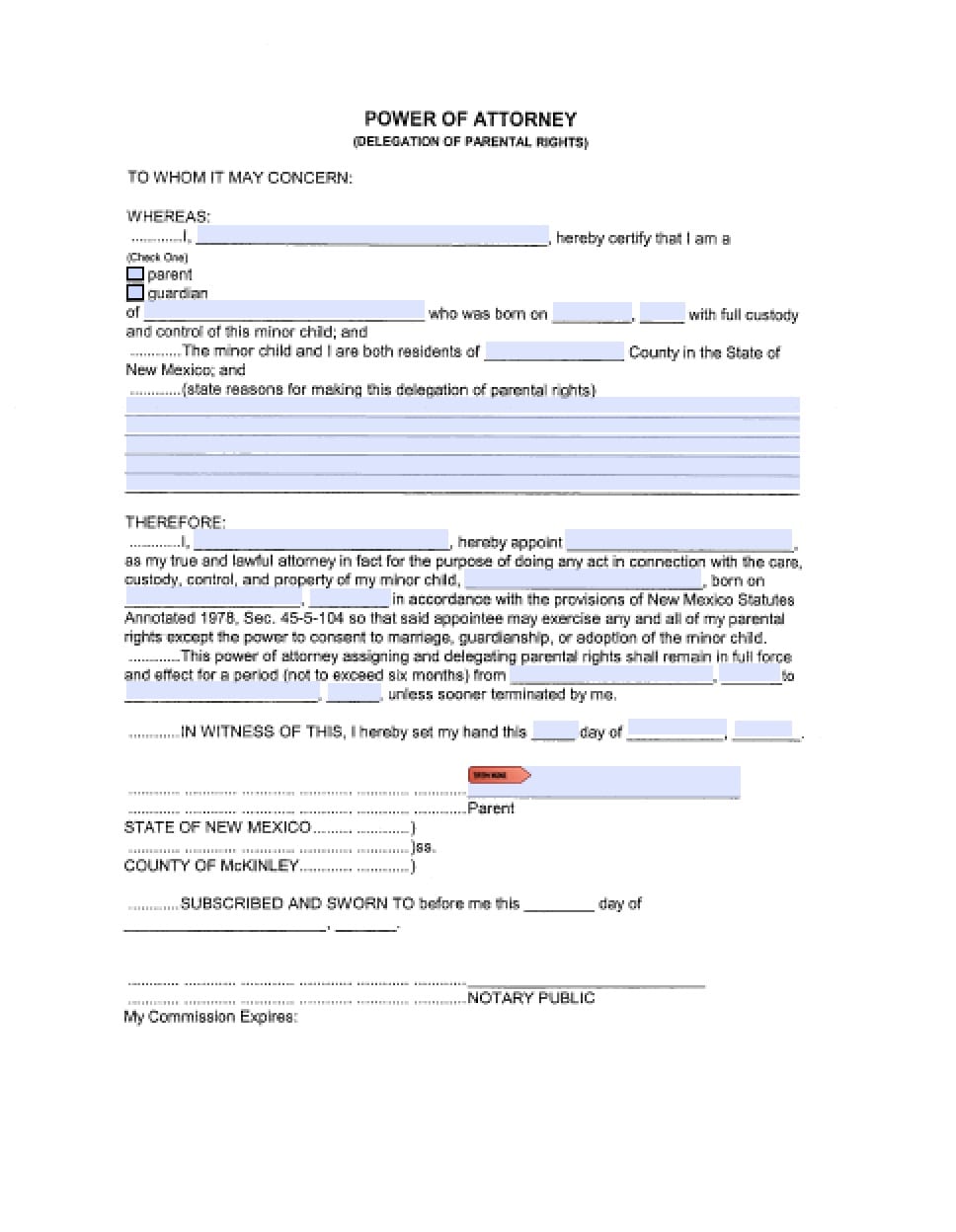

How to Write

Step 1 – Taxpayer Information – Enter the following:

- Taxpayer Name

- Business Name

- Taxpayer Address

- Business Address

- City

- State

- Zip Code

- NM ID, SSN, FEIN, EIN

- Telephone Number

Step 2 – Agent Delegation- Submit the following:

- Enter the name of the authorized Agent

- Full Address (include Zip Code)

- Telephone Number

Step 3 – Tax Matters – Check all that are applicable to this taxpayer on the form:

- All state taxes

- CRS taxes

- Income taxes

- Specify others

Relevant Year(s) –

- Any year

- Specify specific year(s)

Step 4 – Agent’s Information and Signature – Enter the following:

- Print Name

- Title

- Date

- Signature

- Title

- Date of Signature in mm/dd/yyyy format