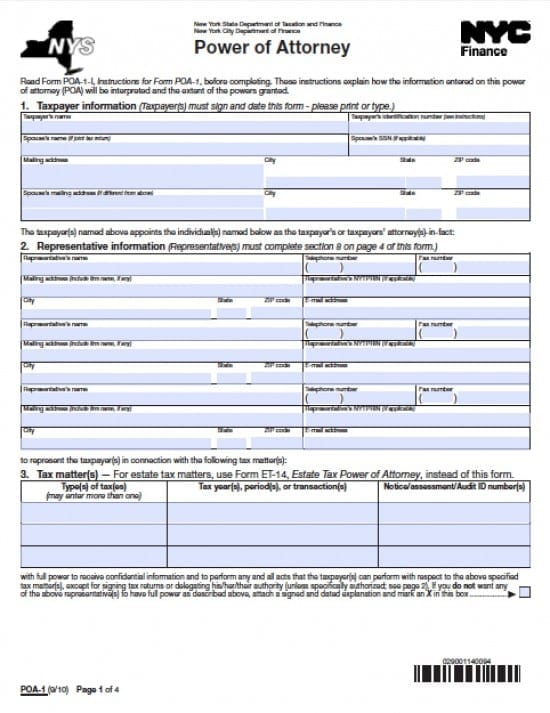

| New York Tax Power of Attorney Form |

The New York tax power of attorney form is a document that is made available to a taxpayer to provide powers to a business or individual so that they may legally obtain information, accurately complete tax forms on behalf of the taxpayer. As well, in the event it’s required, the Agent may properly represent the taxpayer before a tax entity.

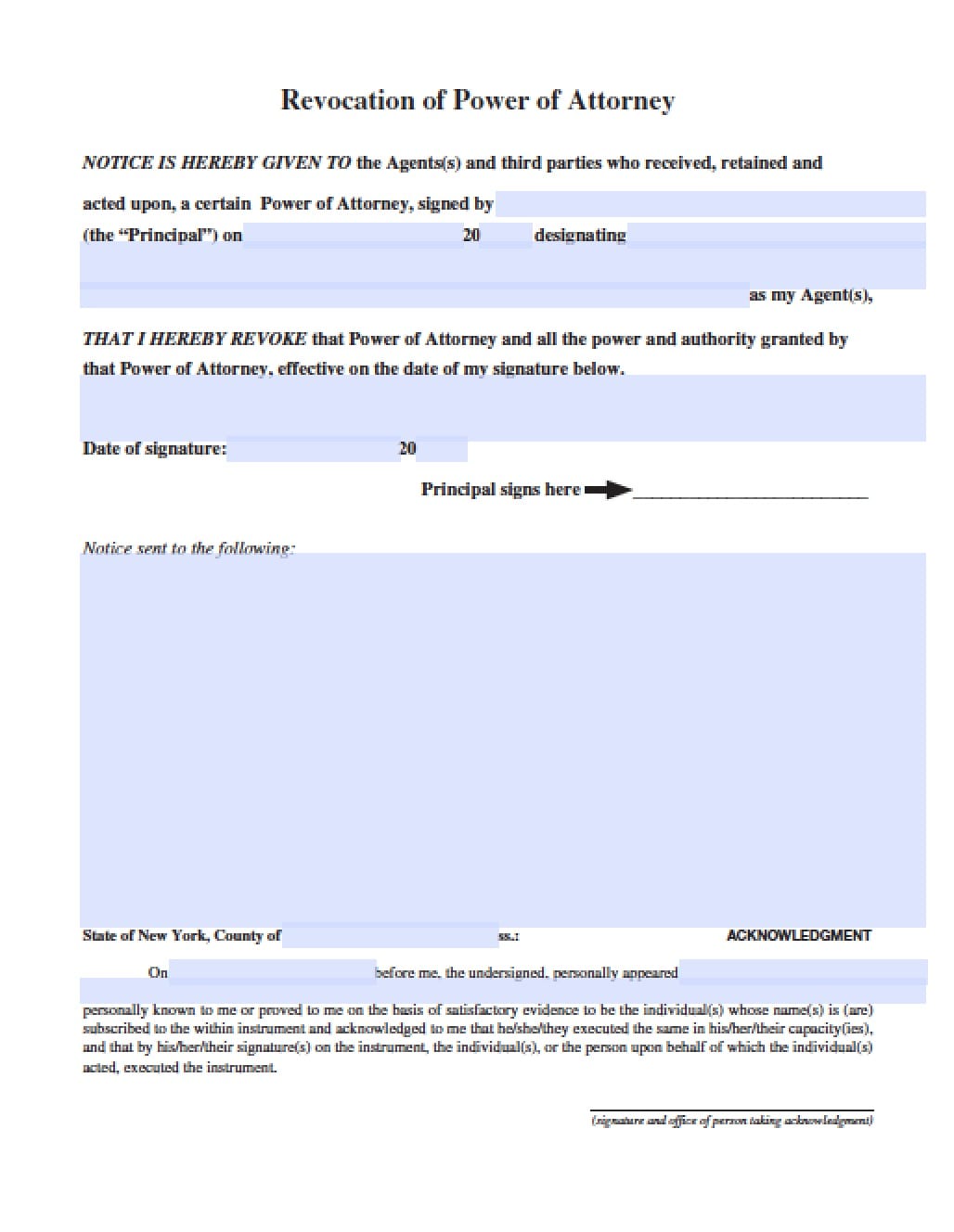

All signing parties must be present before a notary before signing this document. Although this document will (unless otherwise stated by the taxpayer) revoke all other powers documents. This document may also be revoked by the taxpayer.

How to Write

Step 1 – Taxpayers Information –

- Taxpayer’s name

- Taxpayer’s identification number

- Mailing address

- City, State, Zip Code

- AND

- Spouse’s name

- Spouse’s SSN (if applicable)

- Spouse’s mailing address ( only if different from above)

- City, State, ZIP Code

Step 2 – Agent(s) Information – Enter the following information for all participating Agents –

- Agent’s name

- Mailing address

- City, State, Zip Code

- Telephone number

- Fax number

- Enter the Agent’s New York Tax Preparer Registration Identification Number (NYTPRIN) if applicable

- E-mail address

Step 3 – Tax Matters –

- Type(s) of tax(es)

- Tax year(s), period(s), or transaction(s)

- Notice/assessment/Audit ID number(s) ( taxpayers may enter more than one)

Step 4 – Signature(s) – Taxpayer and Spouse must provide the following:

- Taxpayer’s identification number

- Your signature

- Date

- Spouse’s signature

- Date of signature

- AND

- Spouses signature

Step 5 – Titled Sections –

- Retention/revocation of prior power(s) of attorney

- Notices and certain other communications

- Taxpayer signature

- After reading the information provided, both taxpayers must provide signature in agreement:

- Taxpayer Signature

- Name of person signing this form (type or print)

- Taxpayer’s telephone number

- Taxpayer’s fax number

- Date of signature

- AND

- Spouse’s signature

- Spouse’s telephone number

- Spouse’s fax number

- Date of signature

Step 5 – Acknowledgment or Witnessing the Powers Document – The witnesses must read the information provided. If in agreement, provide the following:

- Signatures of witnesses

- Names of witnesses(type or print)

- Mailing addresses of witnesses (type or print)

- City, State, Zip Code

Step 6 – Notarization –

This section will provide proper notarization for Agents who are individuals, corporate, limited liability, partnerhip/limited liability (LLP). The notary public will select the appropriate sections and complete them in acknowledgement.

Step 7 – Declaration of Agents (Representatives) –

The Agent(s) must read the first paragraph in this section. They must agree to the entire statement prior to signing this document. Once they’ve read the paragraph, read the numbered statements. Each Agent must fit the description of at least one (or more) of the numbered descriptions or, if there is another legal description, place it in the line marked “other” – Each Agent must enter the numbers, in their section of the table provided – Once each Agent has agreed – enter the following information:

- Designation(s) (use number(s) from the numbered list of descriptions)

- Agent’s Preparer Tax Identification Number (PTIN), Social Security Number (SSN), or Employer Identification Number (EIN)

- Signature

- Date of Agent’s signature in mm/dd/yyyy format