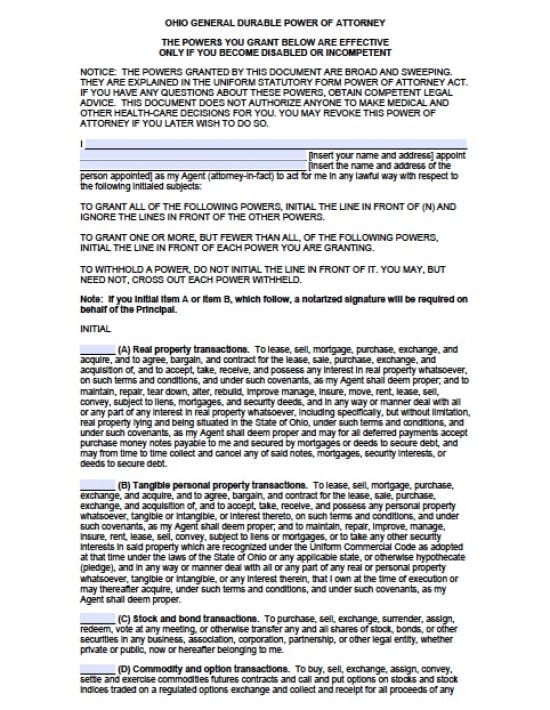

| Ohio Durable Financial Power of Attorney Form |

The Ohio durable financial power of attorney form is a document that will allow a Principal to grant powers to allow the Agent to act on behalf of the Principal with any task or business pertaining to the Principal’s real property and financials in either the absence or during the illness of the Principal. This document will not. in any way provide any form of authorization to make any medical decisions on behalf of the Principal. The Principal must carefully review this document prior to completion. If any portion of this document is unclear to the complete understanding of the Principal then it would be highly recommended that the Principal consult with an attorney who may clarify the information for the Principal.

This document is designed to become immediate effective for the Agent. The Principal must be clear that the Agent’s powers will not change even in the event the Principal would become incapacitated, disabled and/or unable to communicate their own financial wishes. The Principal must be advised that the document must be signed before a notary public, The Principal may revoke this document at any time by having delivered, written notice of revocation to the assigned Agent or by selecting another Agent and completing a new document which would then immediately revoke the document.

How to Write

Step 1 – The Parties – Enter:

- The full name of the Principal

- Principal’s address

- AND

- Enter the name of the appointed Agent

- Provide the address of the Agent

Step 2 – Granting of Powers – The Principal must select and initial each power that would they wish to grant power to their Agent – Carefully review each of the following powers prior to granting them to the agent:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from Social Security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

- All of the powers listed – If the Principal shall grant all powers, initial this line, as there will be no need to initial each individual power.

Step 3 – Special Instructions –

- If the Principal should wish to express any specific special powers to be provided, enter them into the lines provided on the form

Step 4 – Titled Sections –

The Principal must carefully review the titled sections as follows:

- Authority to Delegate

- Right to Compensation

- Right to Compensation – In the event that the initial agent should become unable to serve, name one or more Successor Agent(s) in the lines provided (optional)

- Choice of Law

Step 5 – Signatures- Must be signed before a licensed Notary Public:

- Date the signature in dd/mm/yyyy

- Principal’s Signature

- Principal’s Social Security Number

Notarization –

Once the Principal completes the document, the notary will then witness and acknowledge the document by entering their required notary public information.

Step 6 – Acknowledgement of Agent –

- The Agent must acknowledge their responsibilities to the Principal by typing or printing the Agent’s full name

- The Agent must enter their signature

Step 7 – Preparation Statement –

If the document was prepared by someone else,this person must enter the following:

- Print or type the name of the person who has taken the time to prepare the document

- Preparer must enter their signature