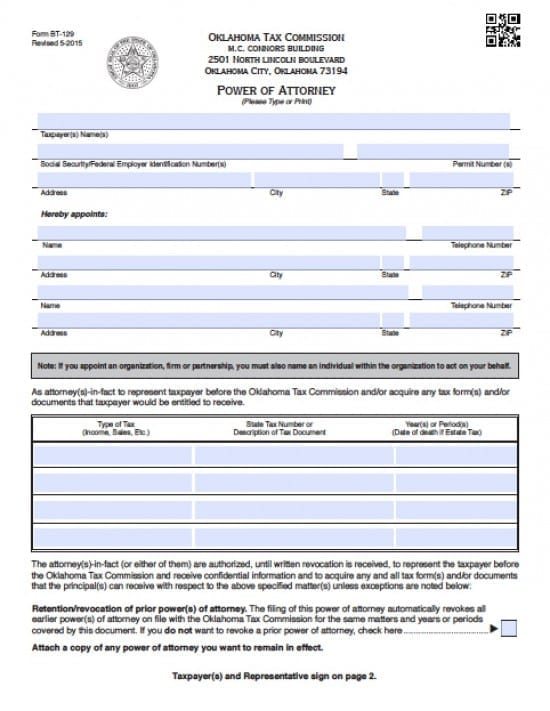

| Oklahoma Tax Power of Attorney Form |

The Oklahoma tax power of attorney form is a legal document that is designed for a taxpayer to grant powers to an individual or a business that employs tax professionals and/or attorneys to complete their required tax documents and if needed, the Agent(s) will have permission to represent the taxpayer before any tax entity or department. This document will request permission from the taxpayer, for the Agent’s to access confidential financial documents and to sign on behalf of the taxpayers.

Preparation of this document shall revoke all other tax powers document, unless, the taxpayer states otherwise. This document too, may be revoked at any time.

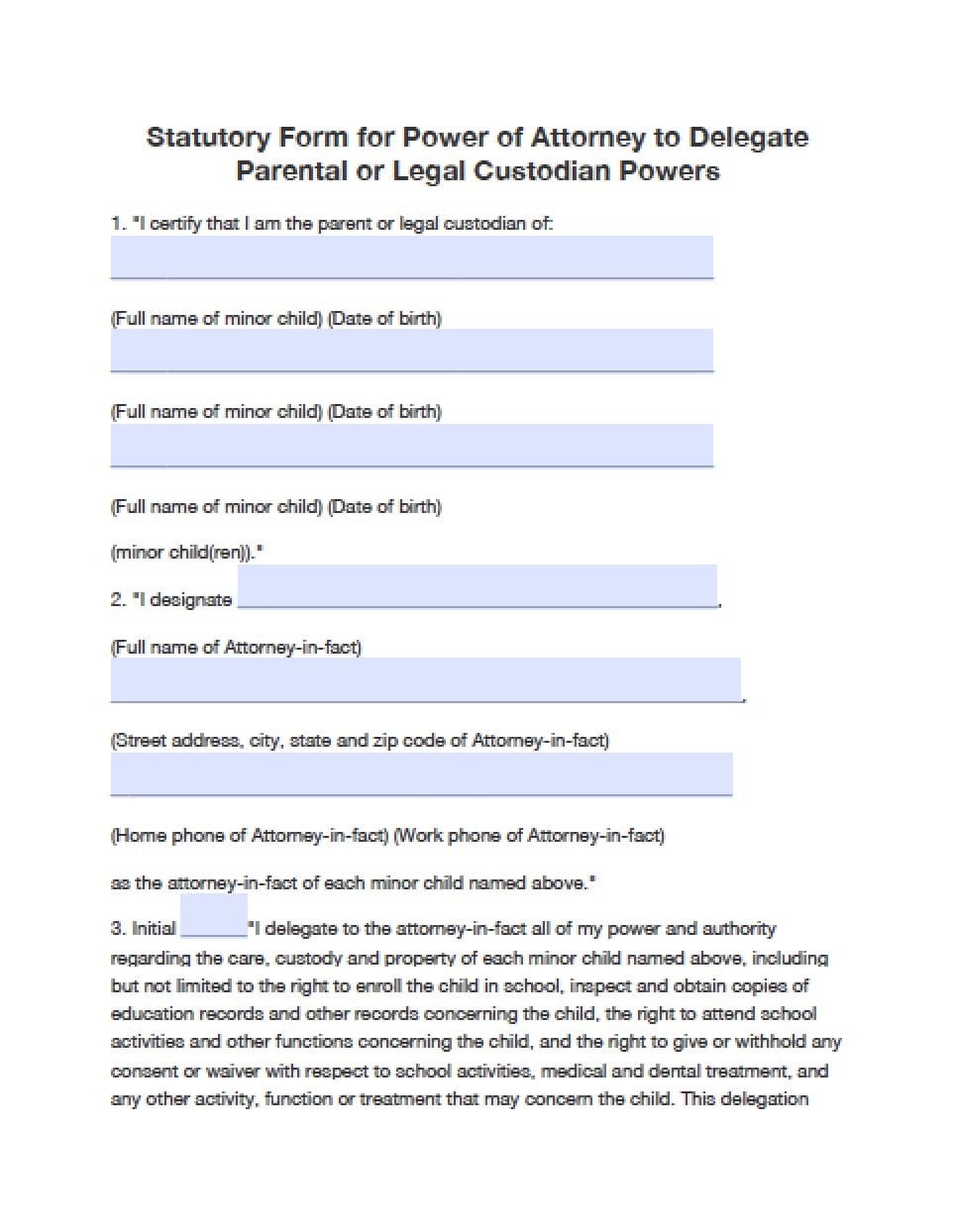

How to Write

Step 1 – Taxpayer’s Information – Provide the following information:

- Taxpayer(s) Name(s)

- Social Security/Federal Employer Identification Number(s)

- Address

- City

- State

- Zip Code

- Permit Number (s)

Step 2 – Agent(s) Information – Enter the following information for all participating Agent(s):

- Name

- Address

- Telephone Number

- City, State, Zip Code

Step 3 – Tax Information – Submit the following information – More than one year/period may be entered in the fields provided:

- Type of Tax (Income, Sales, Etc.)

- State Tax Number or Description of Tax Document

- Year(s) or Period(s) ( Or date of death if Estate Tax)

Read the remaining paragraphs – With regard to the Retention/Revocation sections – if the taxpayer(s) would like to revoke all other previous tax powers documents, simply check the box to the right. If this is the case, be certain to attack a copy of any power that the taxpayer would like to remain in effect

Step 4 – Taxpayer(s) signature and date of signature –

- Enter the taxpayer’s signature

- Enter the date of the signature in mm/dd/yyyy format

- OR If Agent(s) are authorized to sign on behalf of the taxpayer –

- Enter the Agent’s Signature

- Enter the Agent’s Title (if any)

- Date the signature in mm/dd/yyyy format

- In the next field, should the Agent sign for a taxpayer who is not an individual- Print or Type the Agent’s signatory

- Agent’s Title

- Date the signature in mm/dd/yyyy format

Step 5 – Declaration of Agent (representative) –

- The Agent must read the options provided and select one that best indicates your position

- Enter the Signature of the Agent

- Date the signature in mm/dd/yyyy format

- Enter the Licensing Jurisdiction, if applicable

- License Number, if applicable