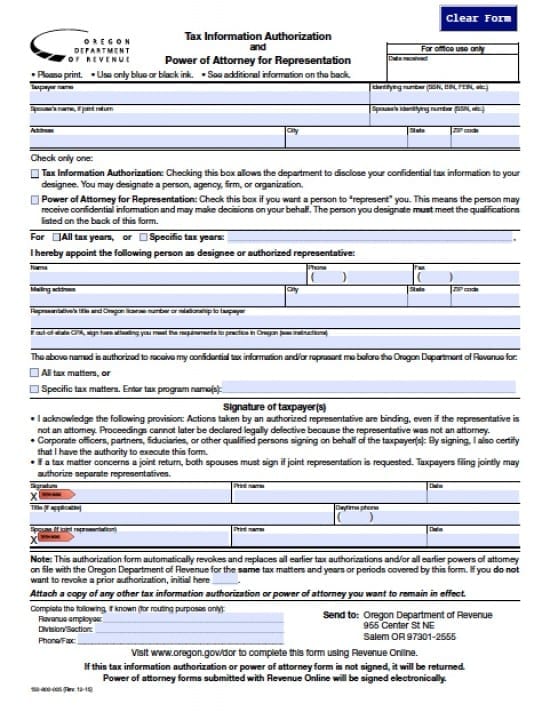

| Oregon Tax Power of Attorney Form |

The Oregon tax power of attorney form is a document that is completed and provided to an individual, attorney(s) or tax professional(s) so that they may have written authorization to complete tax information on behalf of the taxpayer(s). This document would also authorize the Agent(s) to represent the taxpayer(s) before any tax agency if required. This document will revoke all previous tax powers documents unless otherwise stated in writing by the Principal.

This document may be revoked at any time in writing by the Taxpayer.

How to Write

Step 1 – Taxpayer’s Information – Print or type the following:

- Taxpayer name

- Identifying number (SSN, BIN, FEIN, etc.)

- AND

- Spouse’s name, if joint return

- Spouse’s identifying number (SSN, etc.)

- Address

- City

- State

- Zip Code

Step 2 – Authorization of Powers – Check only one of the boxes –

- Tax Information Authorization

- Power of Attorney for Representation

Step 3 – Tax Year(s) or Period(s) – Check one of the following – If filing for specific tax years enter the years for which your Agents will provide services:

- All Tax Years

- OR

- Specific Tax Years

Step 4 – Appointment of Authorized Agent –

- Agent(s) Name(s)

- Mailing Address

- City

- State

- Zip Code

- Phone Number

- Fax Number

- Representative’s title and Oregon license number or relationship to taxpayer

- If out-of-state CPA, sign here attesting you meet the requirements to practice in Oregon

Step 5 – Authorization to Receive Confidential Information – Check one of the following:

- All Tax Matters

- OR

- Specific Tax Matters (Enter tax program name(s)

Step 6 – Taxpayer’s Signature(s) – Taxpayer(s) must read the information in this section – If in agreement, submit the following:

- Signature

- Print name

- Date the signature in mm/dd/yyyy format

- Title (if any)

- Daytime Phone number

- AND

- Spouse (if joint representation should be required)

- Print name

- Date the signature in mm/dd/yyyy format

Step 7 – Note –

- Initial this section if the Taxpayer(s) do not wish to have prior powers documents revoked by this document

- Attach a copy of any tax document information, that would authorize any powers that the taxpayer chooses to remain in effect

Step 8 – Complete the Following, if known –

- Revenue Employee

- Division/Section

- Phone/Fax

- Mail to: Oregon Department of Revenue

- 955 Center St NE

- Salem OR 97301-2555

Step 9 – Copies –

- Make copies of the document for record keeping

- Keep the “Additional Information” page for reference, if needed