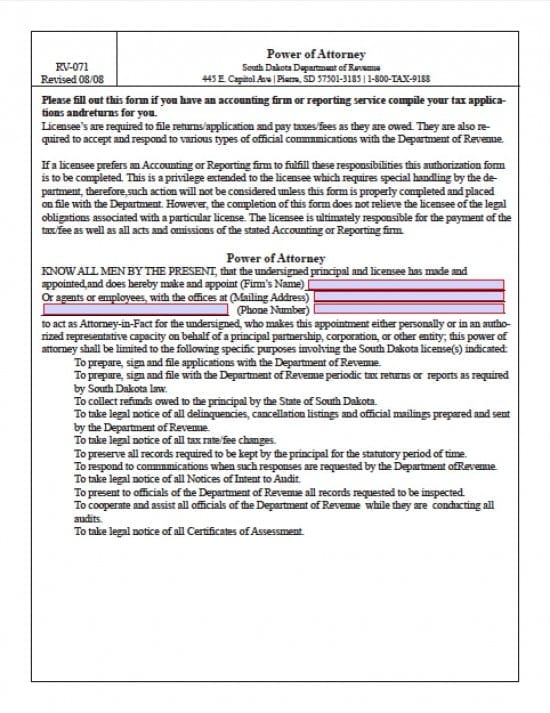

| South Dakota Tax Power of Attorney Form |

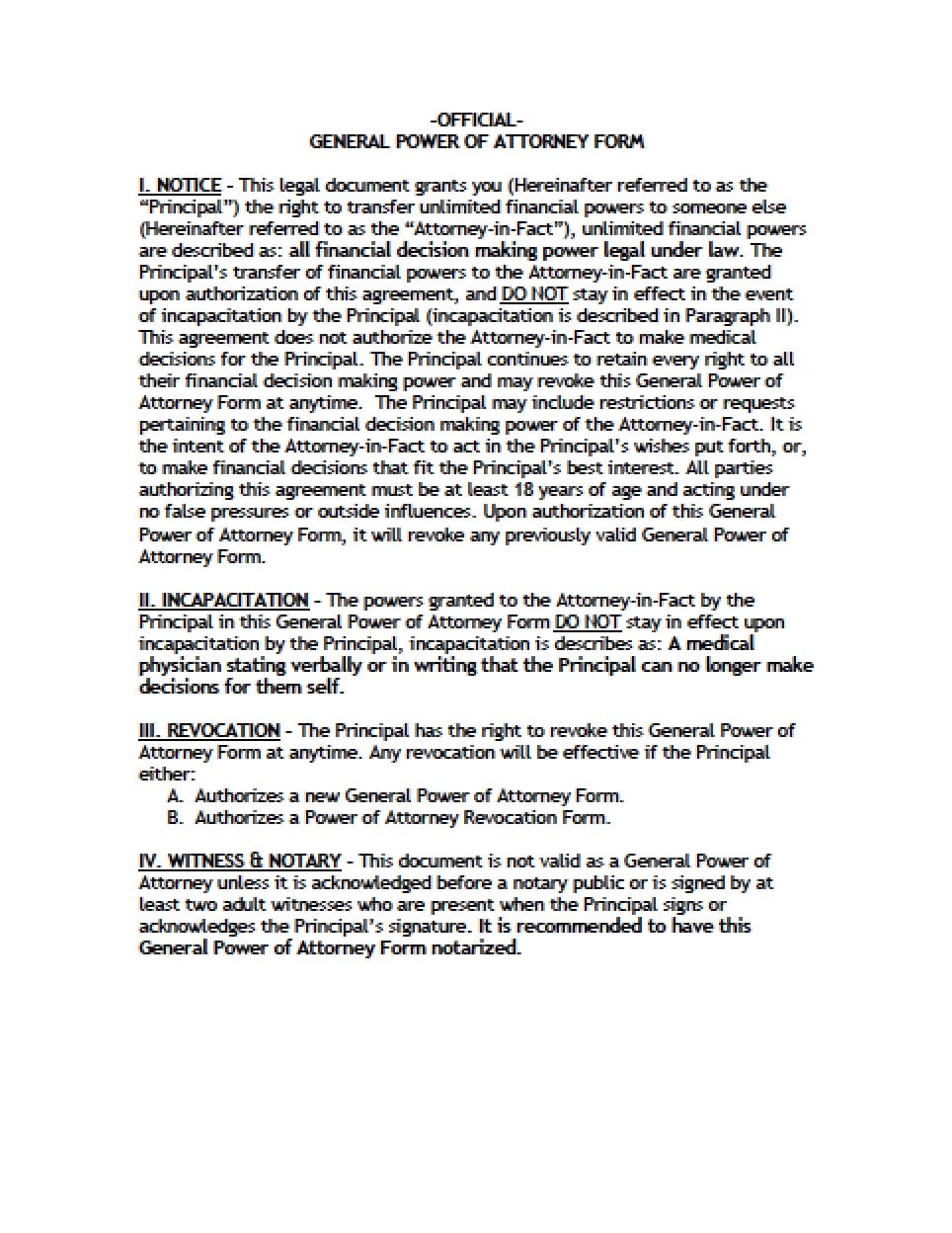

The South Dakota tax power of attorney form is a document to be completed if the Principal has an accounting firm or a reporting service who would complete their tax forms/applications/returns on behalf of the Principal. This firm would be considered the Agent for the Principal.

This powers document shall become effective once it’s received by the Department of Revenue. The document shall remain effective until the time a cancellation or revocation is properly filed with the department.

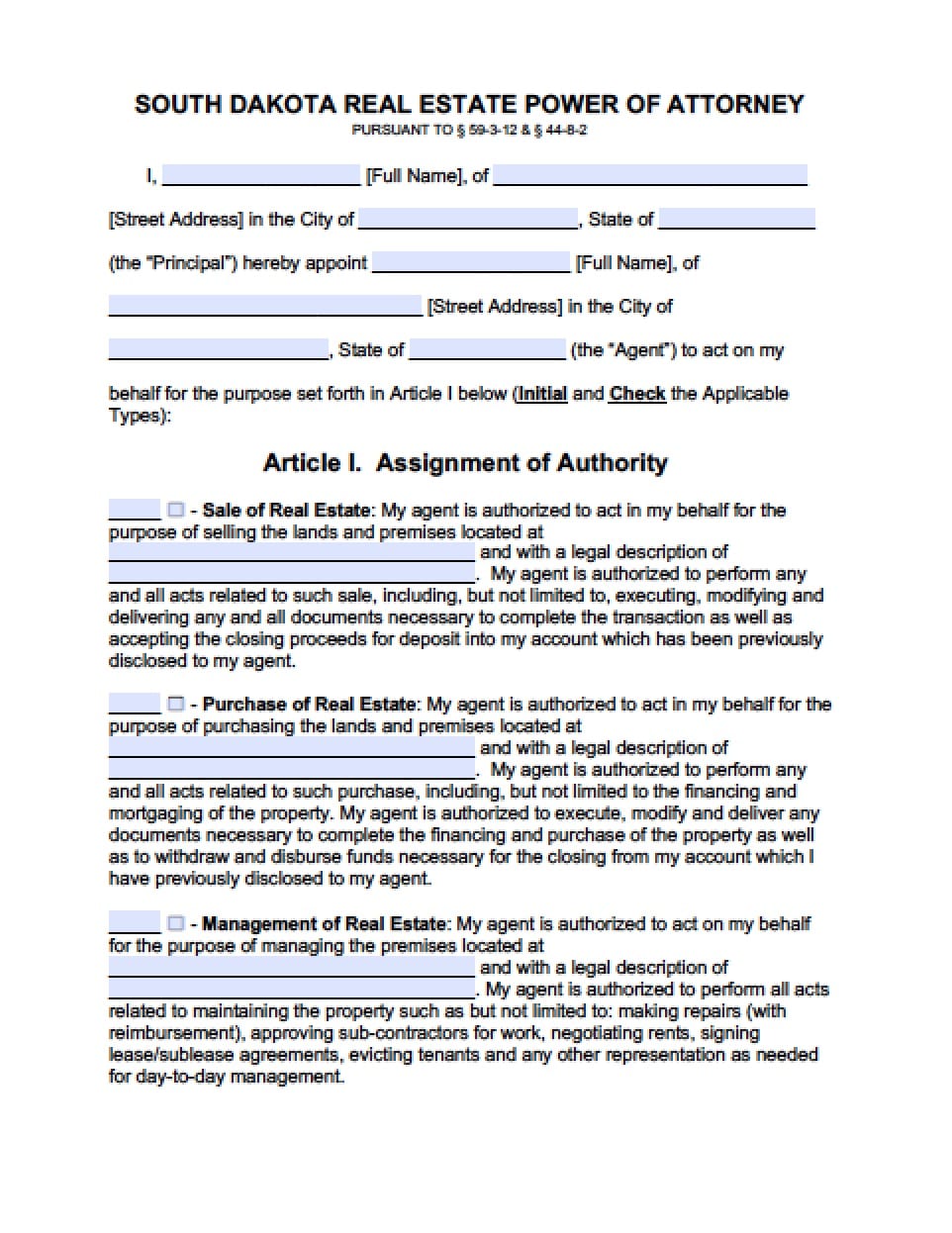

How to Write

Step 1 – Licensing – Check the applicable boxes that the firm already possesses or for which application is requested:

- Sales/Use Tax License

- Manufacturers License

- Wholesalers License

- Contractors’ Excise Tax License

- AND

- Enter any Tax License Number(s) if they have been assigned previously, in the lines provided

- AND

- Check the applicable Special Licenses boxes as follows:

- Alcohol Wholesalers License

- Tobacco Distributor License

Step 2 – The Parties – Complete the following:

- Accounting or Reporting Firm By

- Company Name

- Federal Employer Identification Number (FEIN) or the Social Security Number (SSN)

- Signature of Owner/Legal Representative

- Title

- Mailing Address

- City/State

- Phone Number

- AND

- Principle and Licensee By

- Company Name

- Federal Employer Identification Number (FEIN) or the Social Security Number (SSN)

- Signature of Owner/Legal Representative

- Title

- Mailing Address

- City/State

- Phone Number

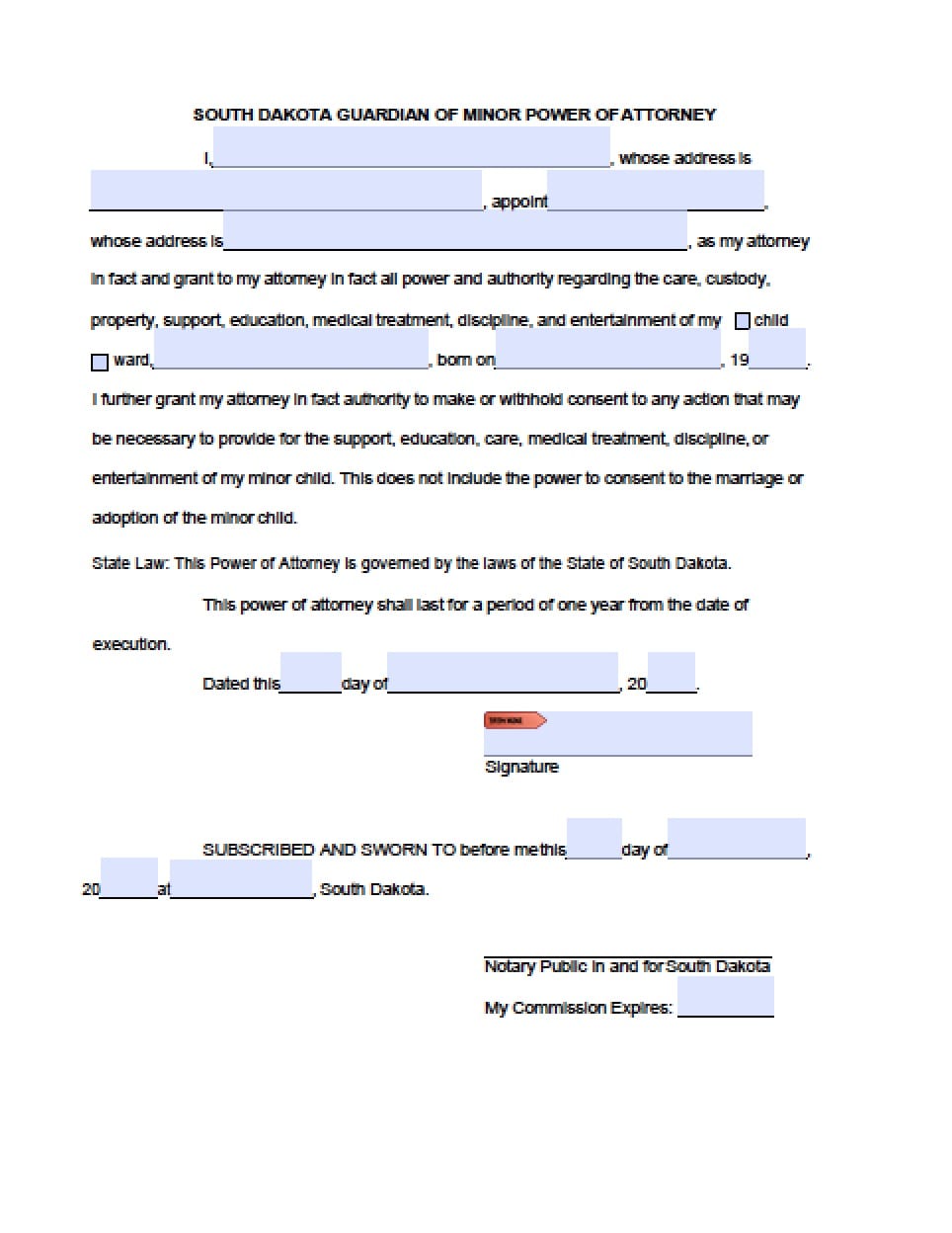

Step 3 – Location – Enter the following:

- State

- Name of the county of execution

Notarization –

As the document is completed, the Notary Public will then complete the document with the required state information that will prove acknowledgement of the document