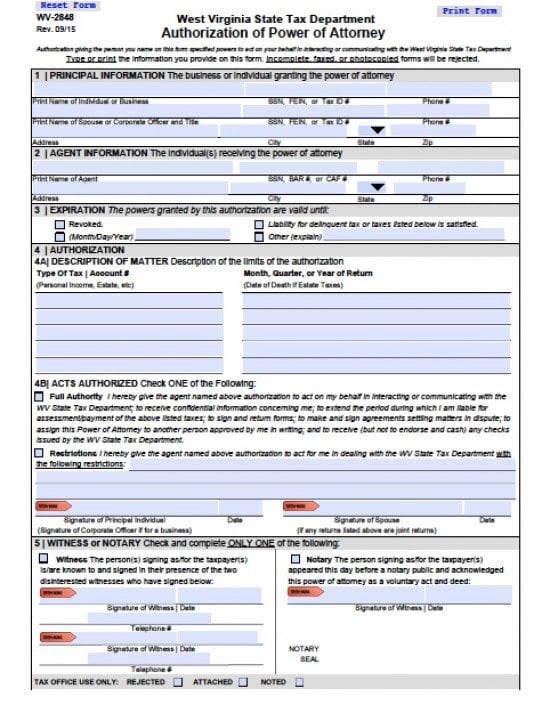

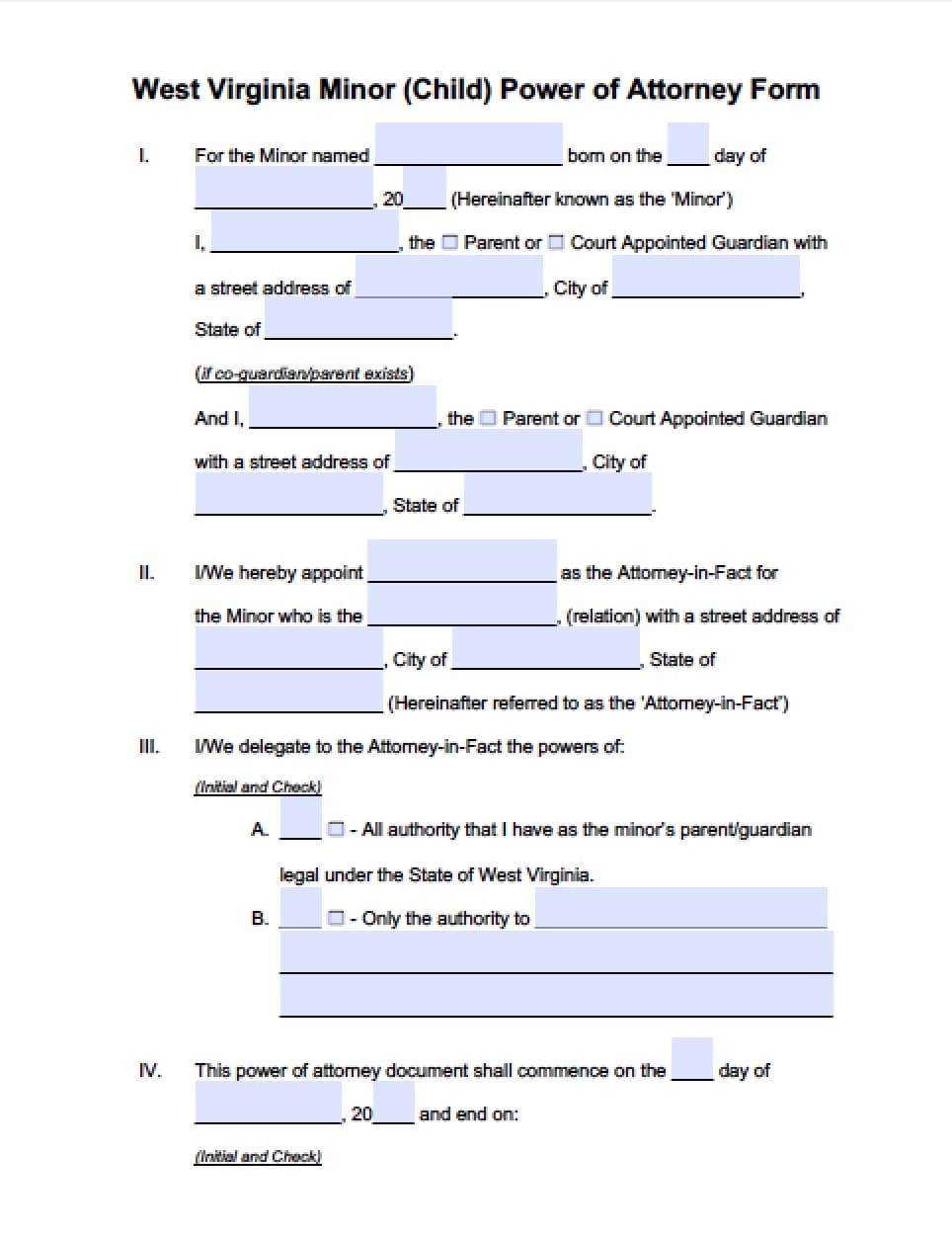

| West Virginia Tax Power of Attorney Form |

The West Virginia tax power of attorney form is a legal document that is used by taxpayers to allow authorization to an individual or a business entity(Agent) to access confidential financial information so that the Agent may properly complete their tax forms. The Agent may also represent a taxpayer before the Department of Revenue if needed. Unless otherwise stated by the taxpayer, all previous tax powers will be revoked. This form may also be revoked by the taxpayer at any time. This document must be witnessed.

How to Write

Step – Taxpayer(s) Information – Enter the following:

- Printed name of the taxpayer or business

- SSN, FEIN, or Tax Identification Number

- Telephone number

- AND

- Printed name of Spouse or Corporate Officer and Title

- SSN, FEIN, or Tax Identification Number

- Telephone number

- AND

- Address

- City

- State

- Zip Code

Step 2 – Agent Information – Submit:

- Printed name of Agent

- SSN, BAR Number or CAF Number

- Telephone number

- Address

- City

- State

- Zip Code

Step 3 – Expiration – Provide the following information:

- Check the applicable box

- If providing an expiration date check the box and enter the date in mm/dd/yyyy format

Step 4 – Authorization and Description of Tax Matter(s) –

- Enter the type of tax and tax account number

- Enter the tax period(s)

Step 5 – Acts Authorized –

- Select and check one of the boxes

- If there will be restrictions, type or print into the lines provided

- Signature of Individual

- Date signature in mm/dd/yyyy format

- Signature of Spouse (if any)

- Date Spouse’s signature in mm/dd/yyyy format

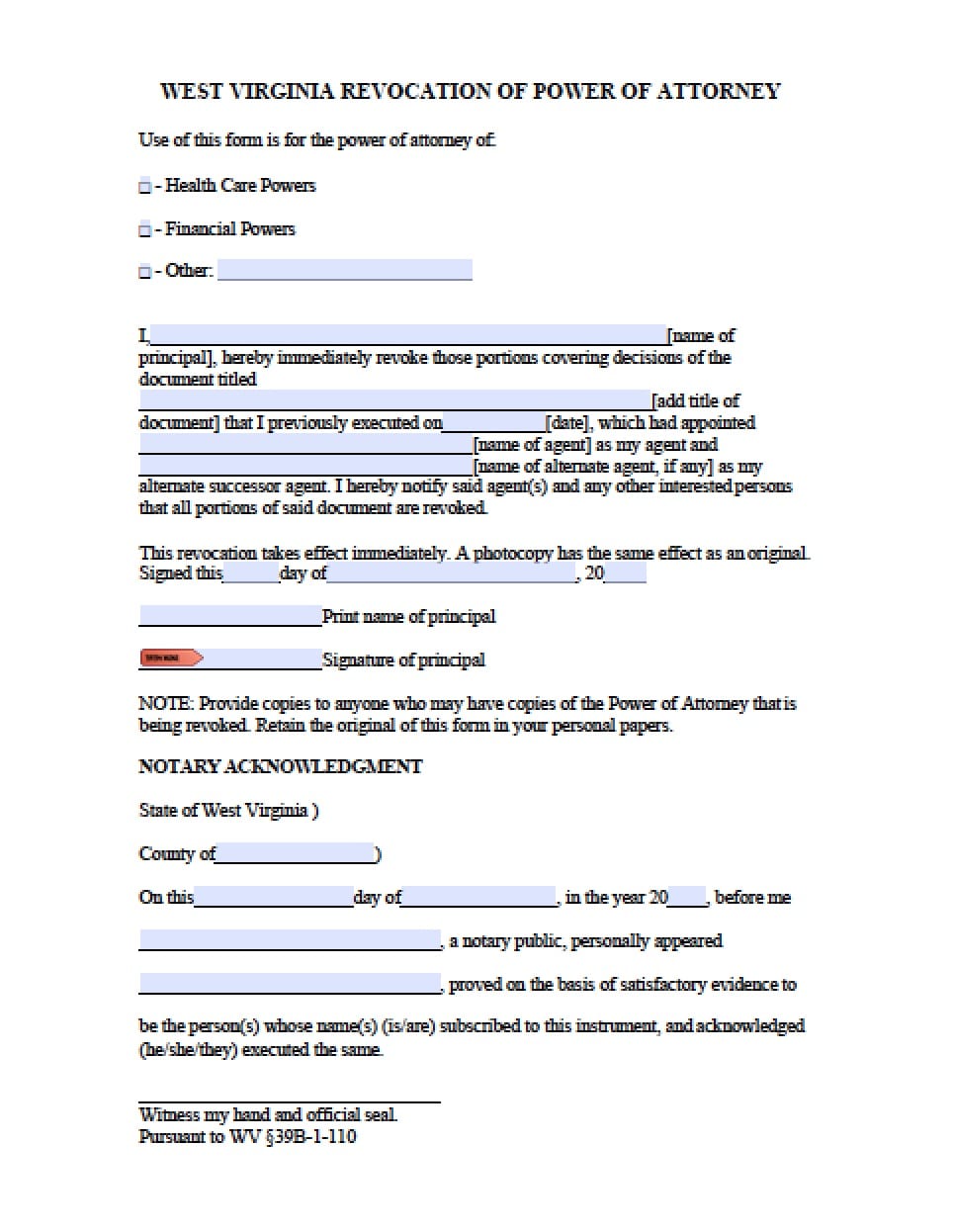

Step 6 – Witness of Document –

- Select only one of the boxes

- If selecting the witness of a notary, signatures must be provided in the presence of the notary