| New Hampshire General Financial Power of Attorney Form |

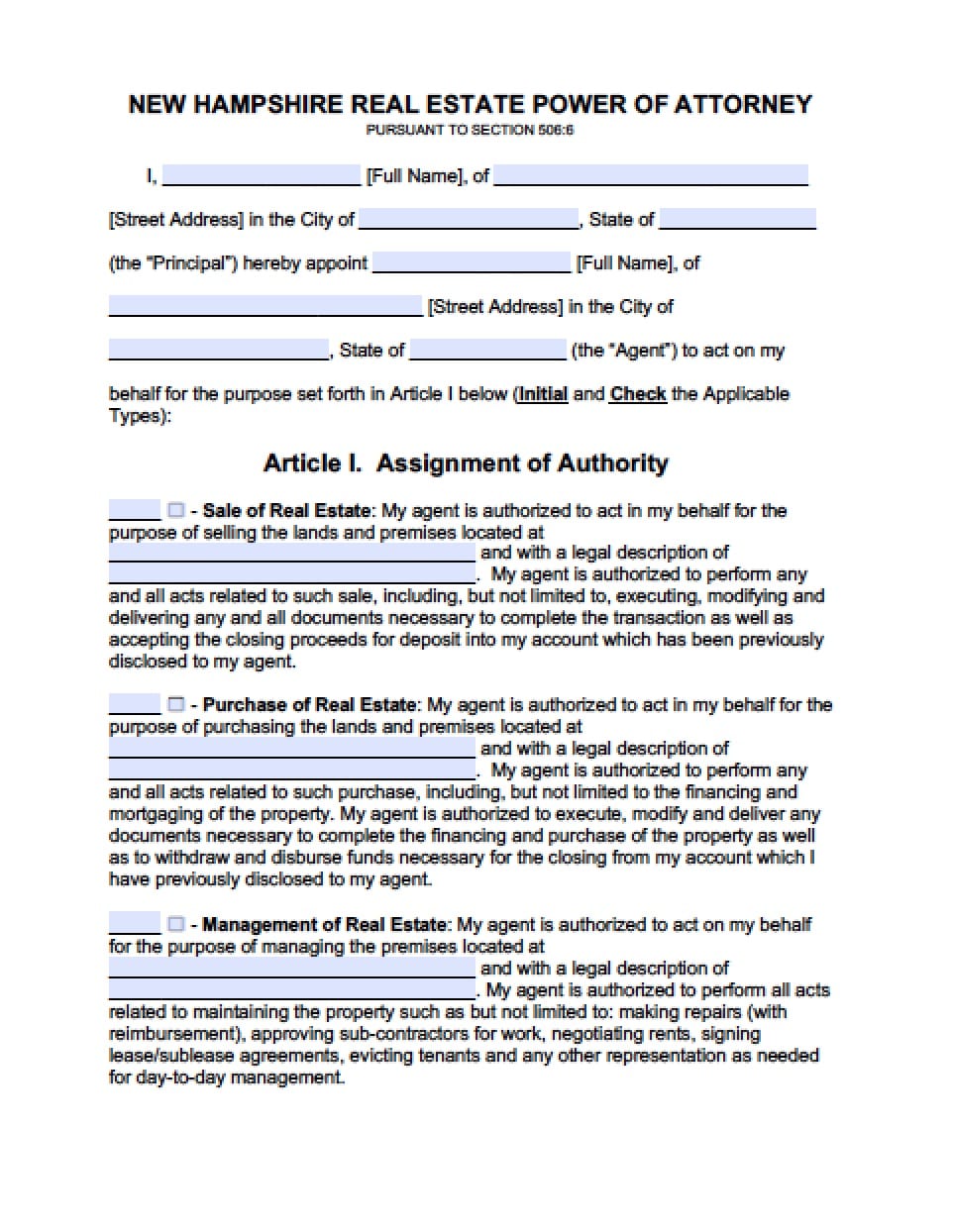

The New Hampshire general financial power of attorney form is a legal document that is designed to delegate an Agent that the Principal will grant specific powers to so that the Agent may properly oversee their financial accounts as well as their real property.

The document will become immediately effective and available to the Agent as of the date of the document. The Agent will then have the ability to maintain financial accounts and manage, sell, purchase, refinance and even do transactions pertaining to the properties for which the Principal will grant powers to the Agent. They may also choose to make the document available contingent upon when the Principal is no longer able to conduct their own business as a result of incapacity or incompetency. If the Agent simply wishes to allow someone else handle all of their finances and property regardless of their physical and/or mental condition they must simply enter the date of execution.

The powers document should be entered into cautiously, inasmuch as the document will essentially allow permission the Agent to take complete control over the property and finances of the Principal’s estate. If the Principal finds that they are uncertain with regard the legal meanings, they may wish to consult with an attorney so that they may be clear about what they’re signing.

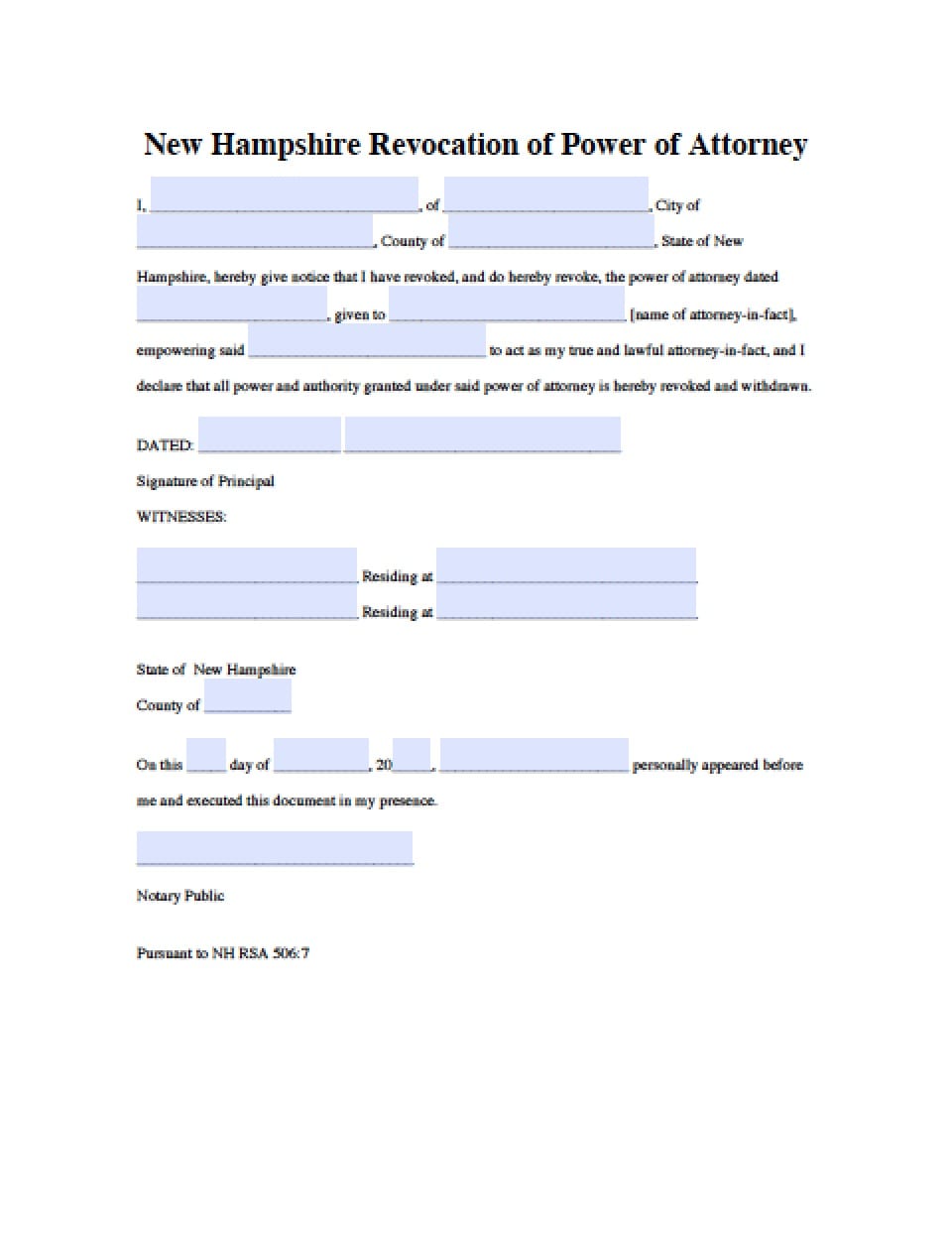

This document must be notarized in order to be effective and therefore must be signed before a notary. The Principal must be aware that they will retain the right, to revoke this document when their own discretion, by provision of a written notice to the Agent.

How to Write

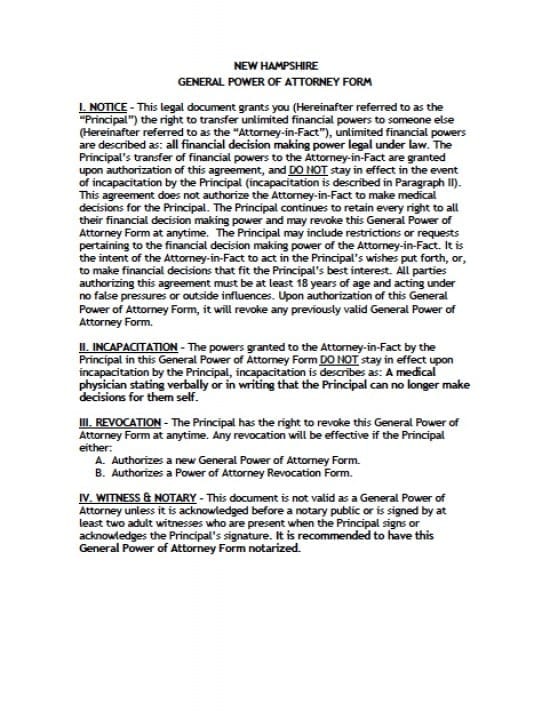

Step 1 – Titled Sections -The Principal must read the following Titles:

- Notice

- Incapacitation

- Revocation

- Witness and Notary

Step 2 – The Principal – Must submit the following:

- The Principal’s name

- Complete Address

- City

- State

- AND

- Provide the name of the Agent

- Agent’s Address

- City

- State

- Provide the name of the State where the document will be used

- AND

- In the event the original Agent becomes unable or unwilling to serve – Submit the name of a Successor Agent (optional)

- Full Street Address

- City

- State

- Provide the State where the document will be utilized

Step 3 – Additional Titled Sections –

- Terms and Conditions

- Third Parties

- Compensation

- Disclosure

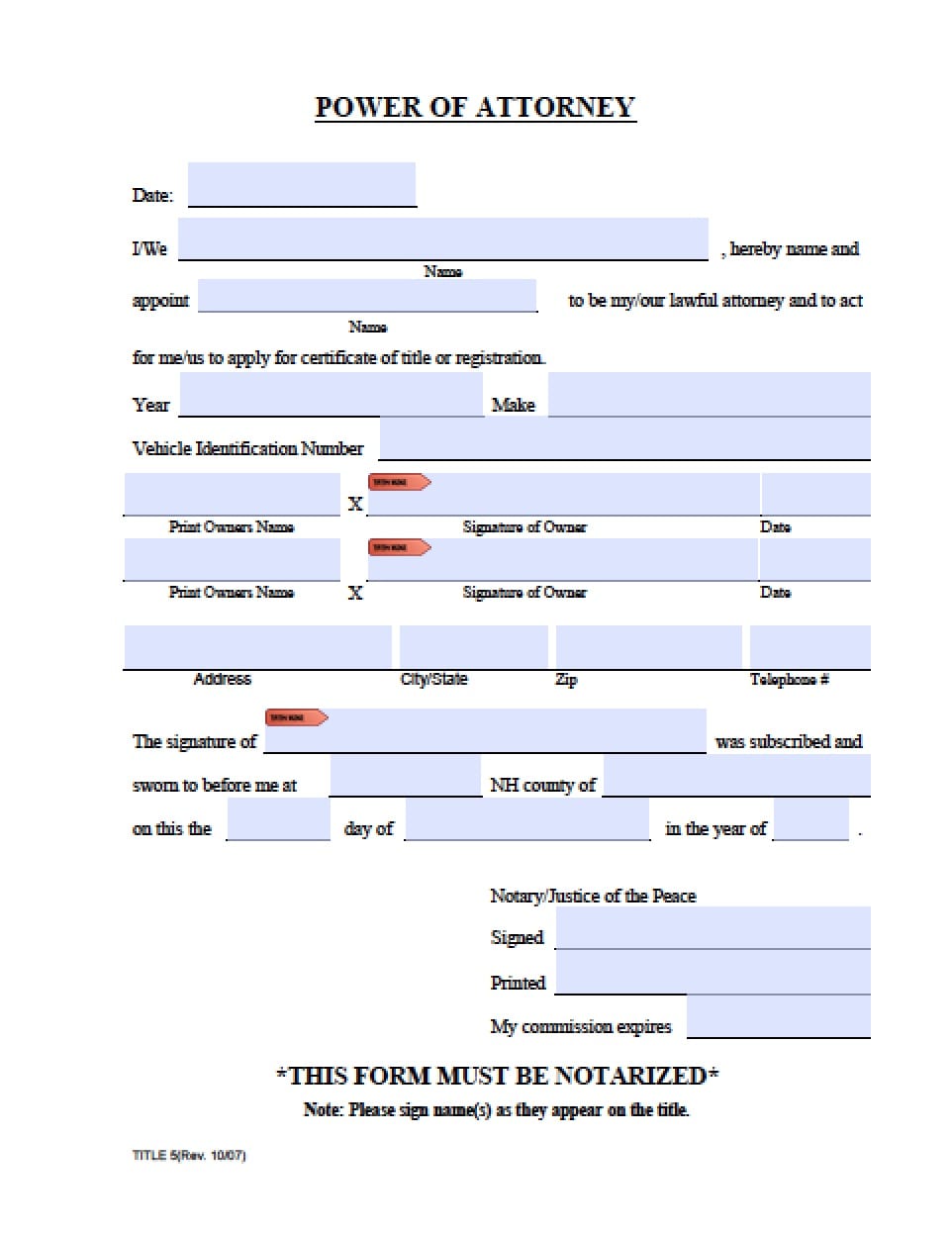

Step 4 – Signatures – All parties must provide their signatures before a Notary Public – Submit the following:

- Principal’s Printed Name

- Date the signature in dd/mm format

- Signature of Principal

- AND

- Agent’s Printed Name

- The Agent’s Signature

- Date the signature in mm/dd/yyyy format

- AND

- The Successor’s Printed Name

- Successor’s Signature

- Date the signature was entered in mm/dd/yyyy format

Step 5 – Notarization –

Once the Notary has witnessed the Principal’s signature, they must complete the notary required information that is required by state law. The notary will also affix their official seal, in acknowledgement

Step 6 – Acknowledgements of Agents – The Agent’s must read the paragraphs:

- Each Agent must enter their printed name

- Both Agents must submit their respective signatures

- Date the signatures in mm/dd/yyyy format

Step 7 – Witness Attestation – Each witness must review the witness attestation, if in agreement, provide (located in the same paragraph):

- Print the name of each witness

- Provide the signature of both witnesses