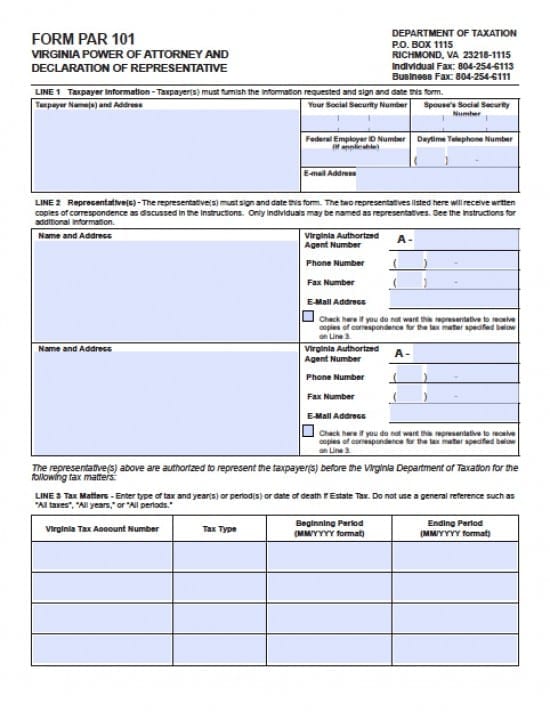

| Virginia Tax Power of Attorney Form |

The Virginia tax power of attorney form is a document that would be completed by a taxpayer to appoint an individual or business entity as their Agent so that they may complete their tax forms and, if needed, the Agent may represent the taxpayer before the Department of Revenue. The document will allow an Agent to request and review sensitive financial information and will likely authorize the Agent to sign on behalf of the taxpayer. All signatures must be entered or the form will be returned.

Unless otherwise stated by the Principal, this document will revoke all other tax powers documents.

How to Write

Step 1 – Taxpayer Information – Enter:

- Taxpayer Name(s) and Address

- Social Security Number

- Spouse’s Social Security Number

- Federal Employer ID Number (if any)

- Daytime Telephone Number

- Email Address

Step 2 – Appointment of Agents – Submit the following:

- Each Agent’s name and address

- Virginia Authorized Agent Number

- Phone number(s)

- Fax number

- Email addresses

- Check the box if the Principal does not want the Agent to receive copies of correspondence for the tax matter(s)

Step 3 – Tax Matters – Provide the information required for each column:

- Virginia Tax Account Number

- Tax Type

- Beginning Period in mm/yyyy format

- Ending Period in mm/yyyy format

Step 4 – Electronic Notices and Communications –

- Check the box if the Principal would like the listed Agent’s to receive communications

Step 5 – Acts Authorized –

- Principal must carefully review the information in this section

- Specify to whom powers were granted, date and address including zip code

- Attach copies of any previous powers documents and authorizations

Step 6 – Signature(s) of Taxpayers –

- Should the tax matter concern a joint return, both spouses must sign

- Taxpayer’s signature

- Printed name

- Title (if any)

- Date of signature in mm/dd/yyyy format

- AND

- Spouse’s signature

- Printed name

- Title (if any)

- Date of signature in mm/dd/yyyy format

Step 7 – Declaration of Agent(s) –

- Agent(s) must read and complete any required information within the declaration

- In the table provided enter:

- Virginia Authorized Agent Number (If applicable)

- Designation – Enter a letter from A through G

- Jurisdiction (state) or Enrollment Card Number (if any)

- Agent(s) signature(s)

- Date(s) of signatures in mm/dd/yyyy format

Step 8 – Mail the completed copy of the Form PAR 101 –

Virginia Department of Taxation

PO Box 1115

Richmond, VA 23218-1115

Individual Fax: 804-254-6113

Business Fax: 804-254-6111