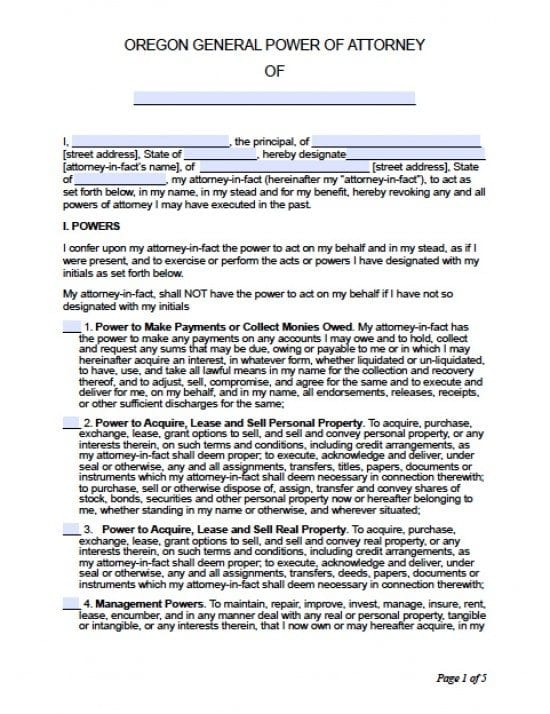

| Oregon General Financial Power of Attorney Form |

The Oregon general financial power of attorney form is a legal document that will transfer, to a selected Agent, by the Principal that will allow the Agent to oversee the Principal’s financial accounts of all types. As well, the Agent will have the ability to dispose of, sell, manage, refinance and/or conduct transactions with regard the Principal’s personal and real property. The powers contained in this document may be broad and sweeping. The Principal must be very clear with with the contents of this document and to their rights to limit and even restrict or remove powers. Before completion of this document, the Principal should closely review the entire document. If the Principal would find tha any of the document is unclear, then the Principal should consider a consultation with an Attorney who would have the ability to provide the legal advice required for the Principal to properly understand what they are preparing to sign.

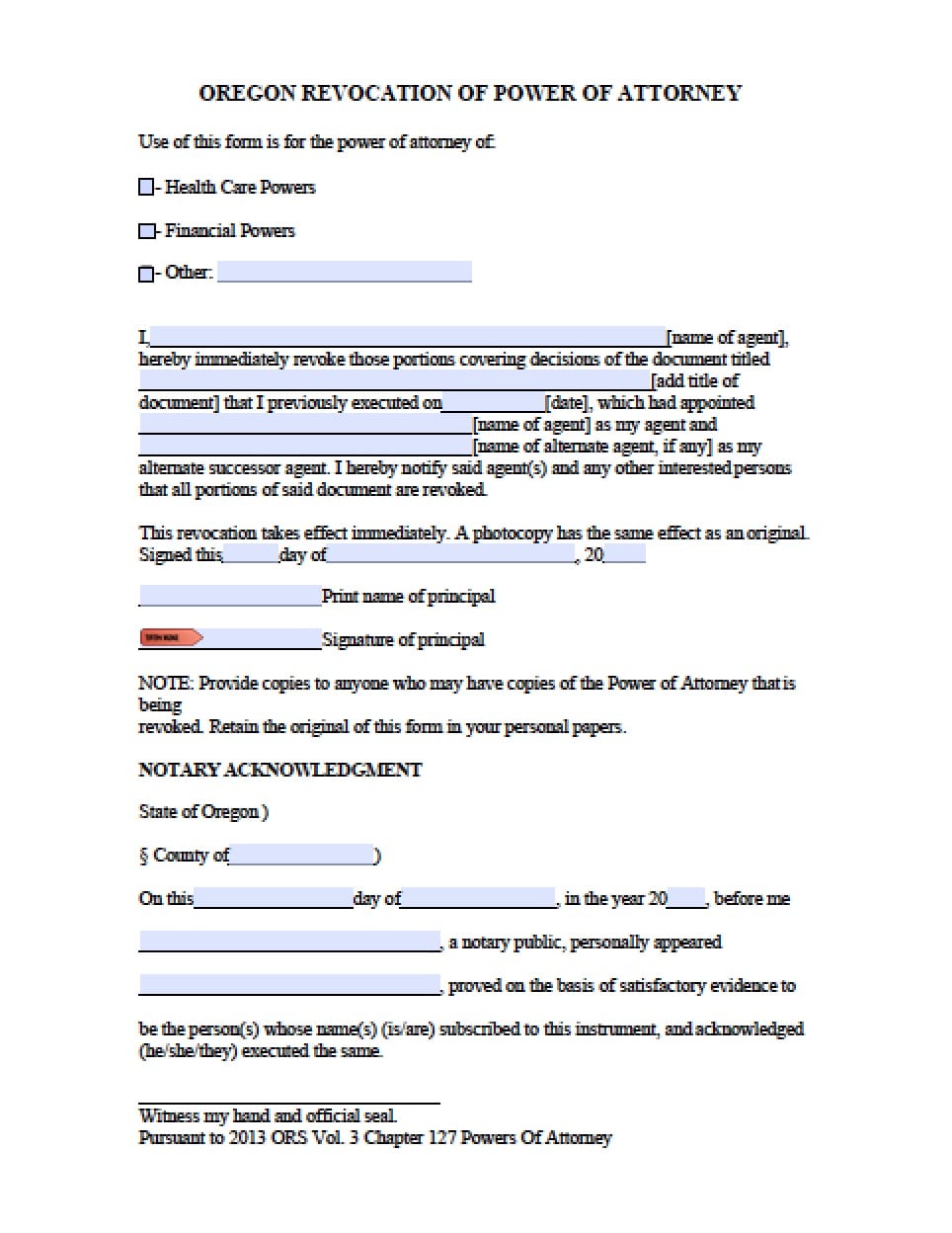

This document will require the signatures of two witnesses and all signatories must be present before a licensed Notary Public. This document may be revoked at any time, in writing and by service or delivery to notify the Agent.

How to Write

Step 1 – Establish the Owner–

- Enter the full name of the Principal in the first line

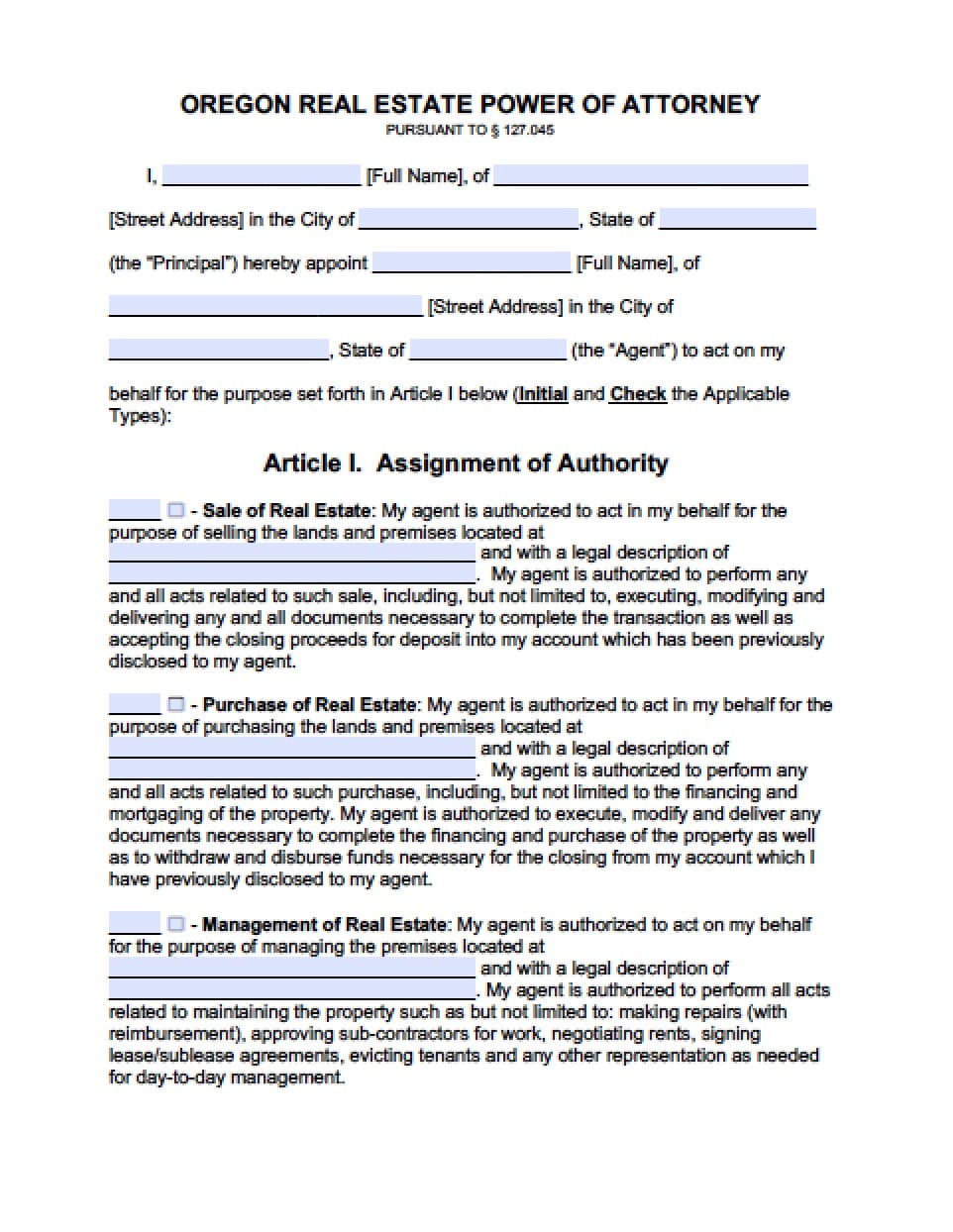

Step 2 – The Parties – Enter the following Information:

- Principal’s name

- Principal’s Street Address

- AND

- The Agent’s name

- The Agent’s Street Address

- Submit the Agent’s State of Residence

(This document shall revoke any past powers documents unless otherwise stated in writing by the Principal)

Step 2 – Powers – The Principal must carefully review the powers available for review. If the Principal would like to grant the reviewed power. They must then initial the line preceding each statement of power. If the Principal would prefer not to grant any specific power, place an “X” on that line or cross out the power statement. Read all powers as follows:

- Power to Make Payments or Collect Monies Owed

- Power to Acquire, Lease and Sell Personal Property

- Power to Acquire, Lease and Sell Real Property

- Management Powers

- Banking Powers

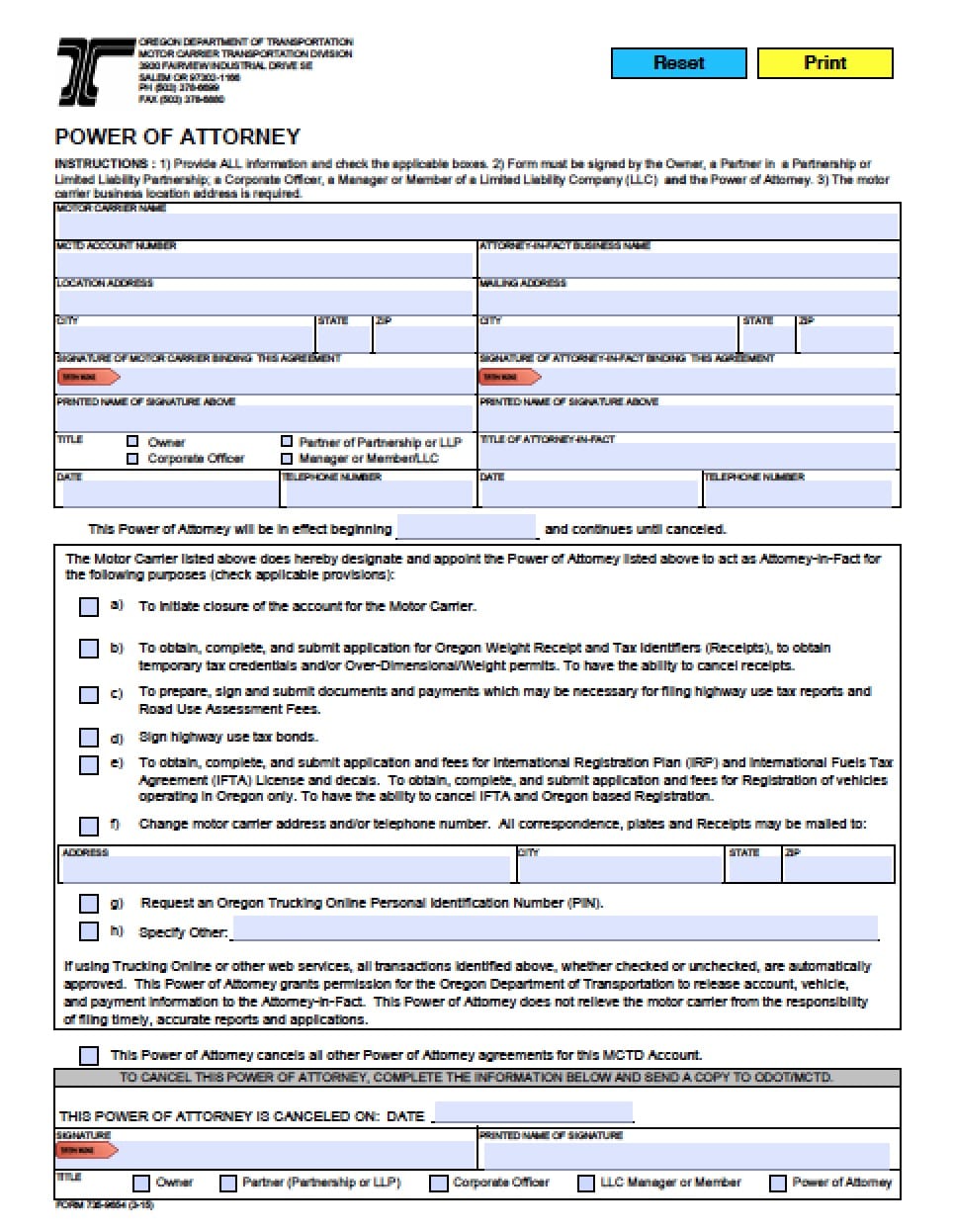

- Motor Vehicles

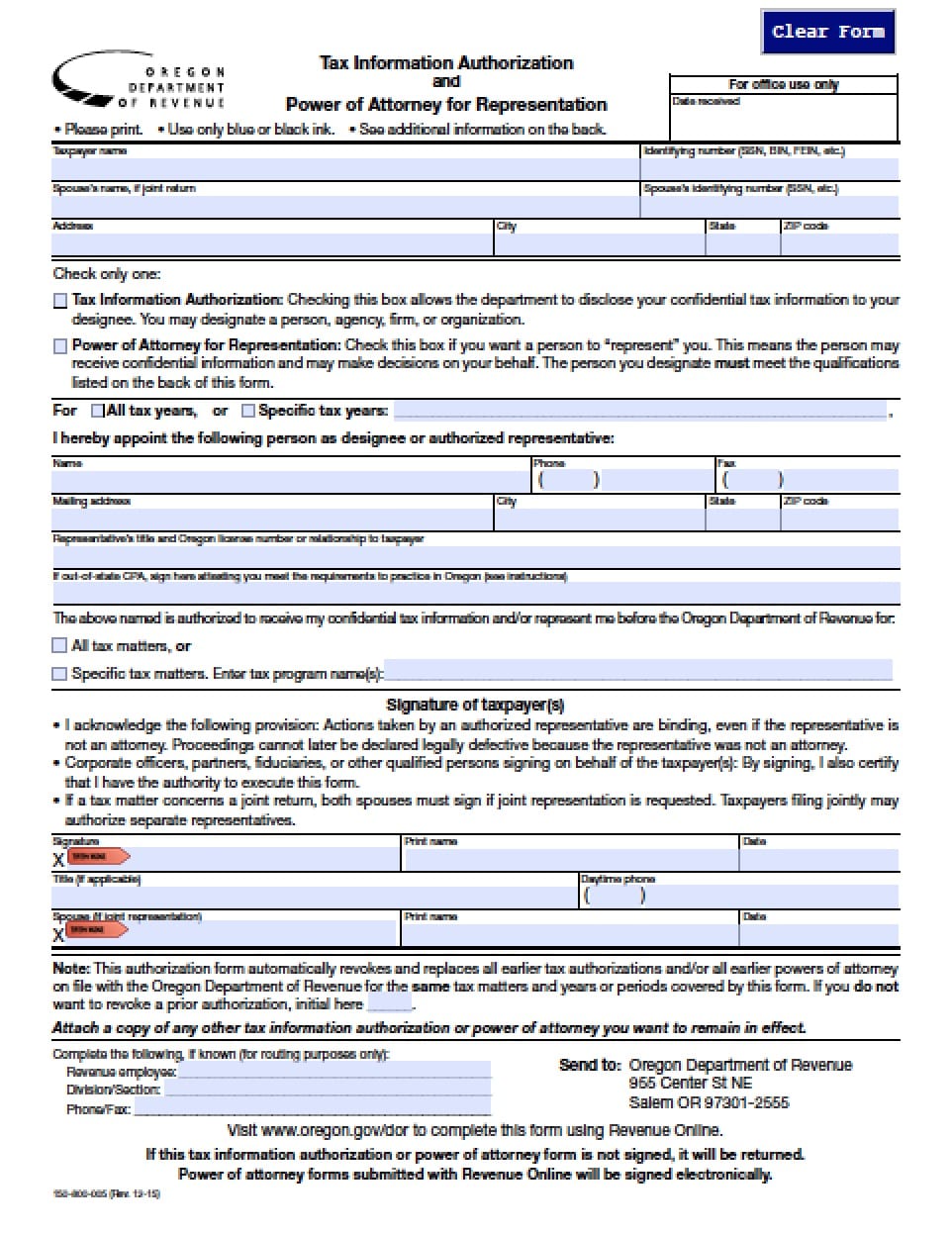

- Tax Powers

- Safe-Deposit Boxes

- Gift Making Powers

- Lending and Borrowing

- Contracts

- Health Care

- HIPAA

- Power to Hire and Pay for Services

- Reimbursement of Attorney-in-Fact

- Power to Sue Third Parties Who Fail to Act Pursuant to Power of Attorney

- Other – Utilize these lines to add special instructions, any limitations, or restrictions etc…

Step 3 – Effective Date and Termination –

Enter the commencement and termination of this document by initialing according to the Principal’s wishes (if the selection requires a date, enter the Principal’s choice of commencement and the date of termination)

Step 4 – Third Party Reliance and Signatures – The Principal must read the Reliance section of this document. If in agreement, (portions of the section may be stricken by marking through any sentence that does not agree with the wishes of the Principal) -Provide the following:

- Date the Principal’s signature in dd/mm/yyyy format

- The Principal must enter their signature

- Enter the Printed name of the Principal

Step 5 – Acceptance of Agent’s Appointment – The Agent must enter:

- The Agent’s signature

- The Agent’s Printed name

Step 6 – Witnesses Attestations – The witnesses must read the attestation paragraph. If each witness is in agreement, enter the following:

- Each witness must enter their signature

- Each witness must enter their complete mailing address

Step 7 – Notarization –

As the document is completed and the licensed Notary Public has witnessed all signatures, the notary must then enter the state required information that will acknowledge the validity of the document. The Notary will then affix the official seal