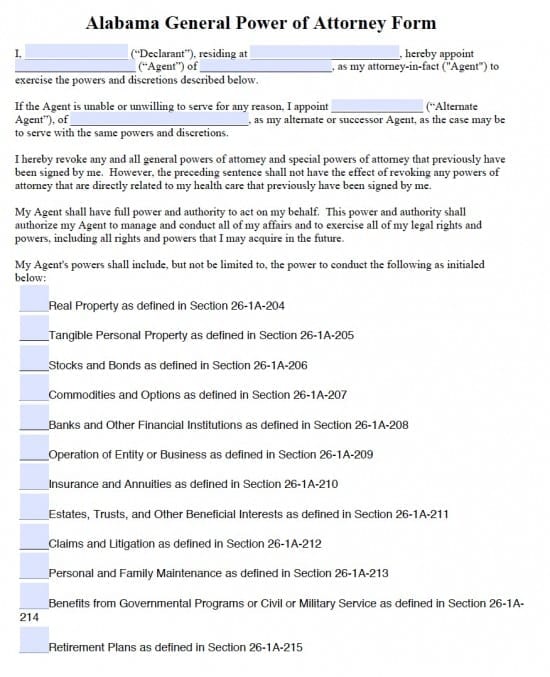

| Alabama General Financial Power of Attorney Form |

An Alabama general financial power of attorney form is a document that allows an individual (the principal) to designate another individual (the agent or attorney-in-fact) to carry out certain actions on the principal’s behalf. A power of attorney can be general, covering a broad range of financial and administrative matters, authorizing the agent to handle one specific transaction, such as paying their monthly bills or all of their financial matters including stocks, bonds, or any other financials. (See Section 26-1A-107) This document could be revoked at any time in writing and delivered to the agent.

Laws – Section 26-1A-107