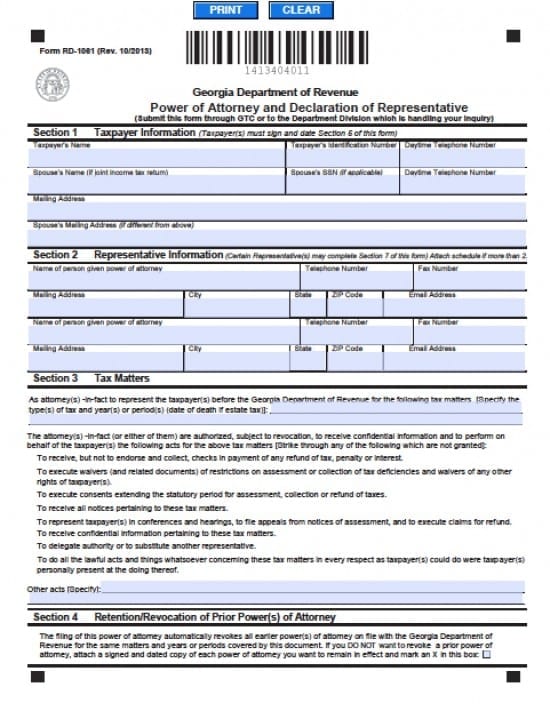

| Georgia Tax Power of Attorney Form |

The Georgia tax power of attorney form is a legal document which would allow a Principal to allow another person, persons or firm to prepare a tax filing with the Georgia Department of Revenue. Generally this form will be attached to your tax filing when your CPA, accountant, attorney, or any other person will be filing on your behalf. Unlike other power of attorney documents in Georgia, this does not need to be witnessed or notarized to be able to go into immediate effect. This document may be revoked at any time by the Principal. (See O.C.G.A. S.S. 48 1-6)

How To Write

Step 1 – Begin by downloading the form and completing Section 1 – Taxpayer Information by enter all required information into the appropriate boxes as follows:

- Taxpayer’s Name

- Taxpayer’s Identification Number

- Mailing Address

- Daytime Telephone Number

- AND

- Spouse’s Name (if joint income tax return)

- Spouse’s Social Security Number (if applicable)

- Daytime Telephone Number

- Spouse’s Mailing Address (if different)

Step 2 – Section 2 – Representative Information – This section will require information from your representative(s) as follows – Provide all information for one or more representatives:

- Name of person given power

- Telephone Number

- Fax Number

- Physical Address

- City

- State

- ZIP Code

- Email Address

Step 3 – Section 3 – Tax Matters – The Principal must enter the type(s) of tax(es) and year(s) and/or period(s) – (date of death if these are estate taxes) – Enter the information on the lines provided. If more room is required and a continuation sheet and attach to the document.

- You must then review all of the information with regard to acceptable and unacceptable acts with regard to the Attorney In Fact/Agent

- At the end of the section, there are lines provided for additional information, if you would like to add specific acts, enter them into the lines provided – if more space is needed, add a sheet with the additional information

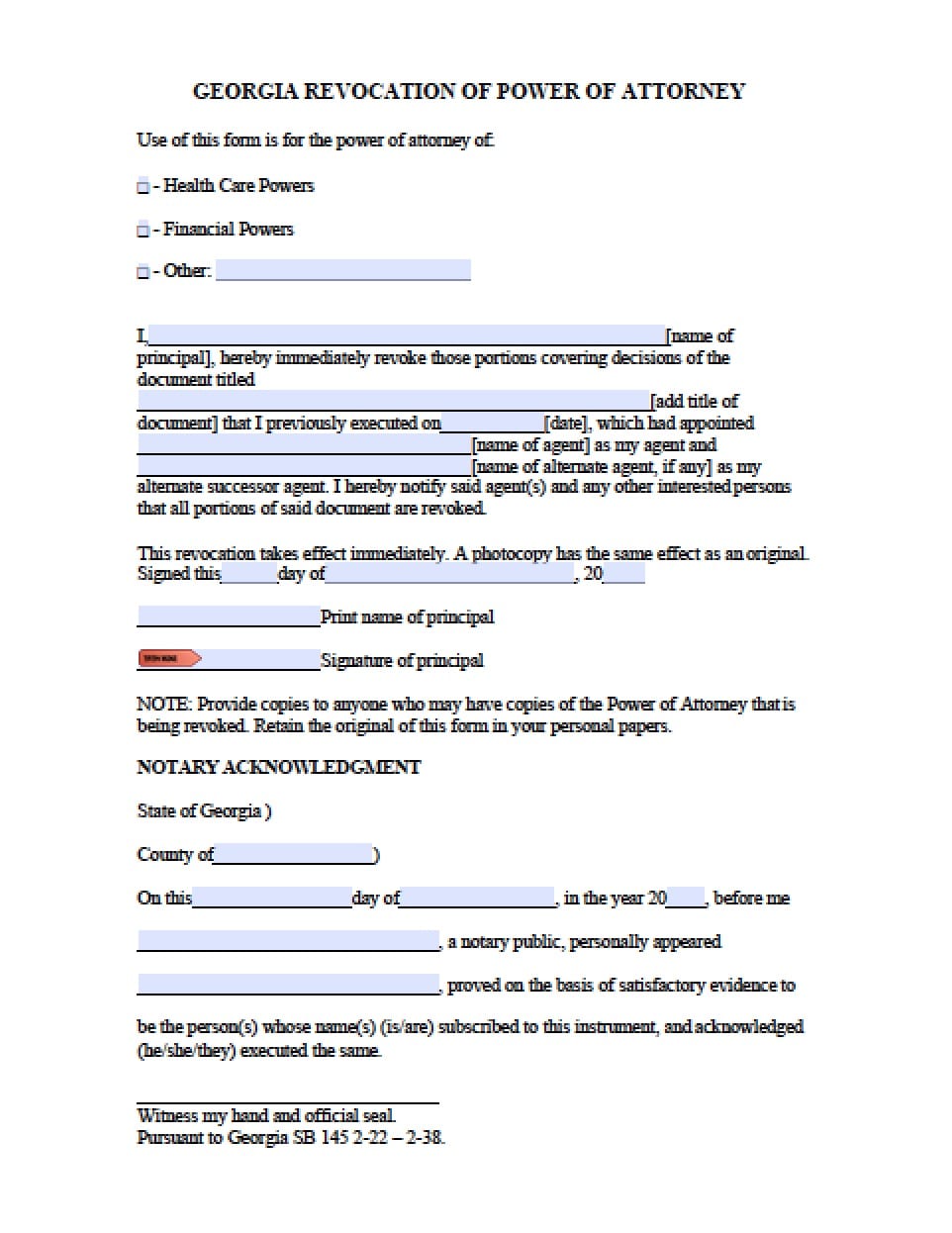

Step 4 – Section 4 – Retention/Revocation of any Prior power(s) of attorney –

- If you choose NOT to revoke previous powers of attorney, place an “X” in the box provided and attach a copy of any previous document you would like to keep in place

Step 5 – Section 5 – Taxpayer(s) Authorization and Signature(s) – Taxpayers must sign the document in this section providing the following information:

- Signature

- Print name

- Date of signature

- Title (if officer, etc)

- AND

- Spouse’s signature (if joint)

- Print spouse’s name

- Date of signature

Step 6 – Section 6 – Witnessing or Acknowledgment – In this section, should you choose to have 2 witnesses sign and execute your document, each witness must provide their information and signature. Complete the information by entering the required information into the boxes:

- Signature of Witness

- Name of Witness (type or print)

- Mailing Address of Witness (type or print)

- City

- State

- Zip Code

- OR

- If you would prefer to execute the document by signing before a notary, simply check the box stating your preference

- The notary will complete that section and affix the seal to the document

Step 7 – Section 7 – Declaration of Representative – This section must be completed by the representative(s) who will be participating in the representation of your tax matter(s). Your document will then be complete. Make copies to provide to anyone who has signed the document to include your own records.