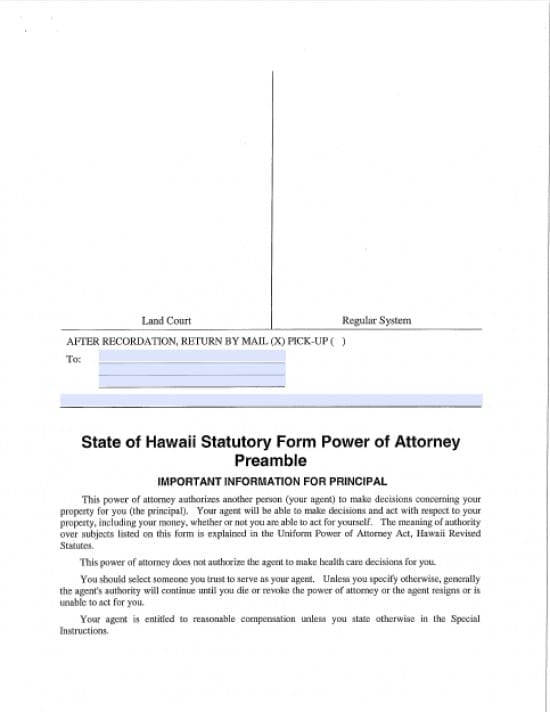

| Hawaii Durable Financial Power of Attorney Form |

The Hawaii durable financial power of attorney form is a legal document in which a person (the Principal) would appoint someone they trust as their Attorney In Fact/Agent to have the authority perform powers as specified in the document created by the Principal. The terms of a powers granted to the Attorney In Fact/Agent, may be limited or broad and sweeping. If the Principal so desires the power of attorney may be narrowly drafted and apply only to specific instructions. (See Hawaii Revised Statutes Chapter 551D) It will be important for the Principal to decide when a this document should become effective and when it shall terminate. This type of document is effective immediately. The primary distinction is that it shall remain effective even upon the principal’s incapacity. This durable document must contain language that will state that it will not terminate upon the principal’s incapacity. This document may be revoked by the Principal in writing at any time as long as they remain competent to do so.

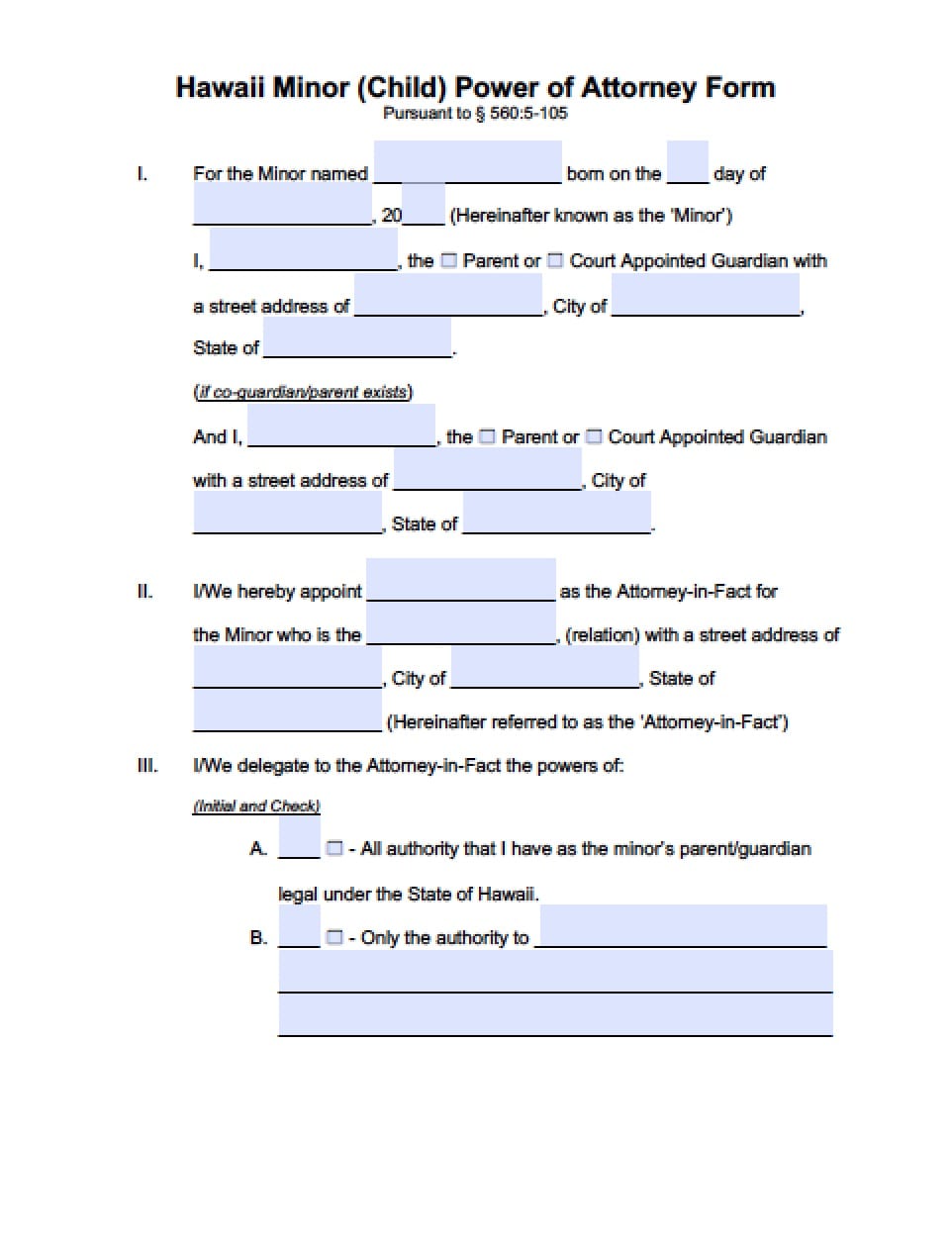

How To Write

Step 1 – Download the document provided and read the information at the bottom of page one and the beginning of page two

Step 2 – Designation of Agent – The Principal must provide the following information with regard to Principal, the Attorney In Fact/Agent and the Successor Agent as follows:

- Name of Principal in the first line of the document

- First Selected Agent –

- Name of Agent

- Agent’s Physical Address

- Agent’s Telephone Number

Step 3 – Designation of Successor Agent(s) (Optional) – If you do not name any Successor Agent’s if your first agent is unable or unwilling to serve, this document will no longer be in effect and you may be left vulnerable. It’s wise to consider at least one Successor Agent if at all possible. If you do appoint additional Agent(s), provide the following information:

- First Selected Successor Agent –

- Name of Agent

- Agent’s Physical Address

- Agent’s Telephone Number

- Second Selected Successor Agent –

- Name of Agent

- Agent’s Physical Address

- Agent’s Telephone Number

Step 4 – Grant of General Authority – As stated, you may grant as many or as few powers as you wish as Principal of this document by initialing only those powers you wish to grant to your Agent(s), on the form, as follows:

- Real Property

- Tangible Personal Property

- Stocks and Bonds

- Commodities and Options

- Banks and Other Financial Institutions

- Operation of Entity or Business

- Insurance and Annuities

- Estates, Trusts and Other Beneficial Interests

- Claims and Litigation

- Personal and Family Maintenance

- Benefits From Governmental Programs and Civil or Military Service

- Retirement Plans

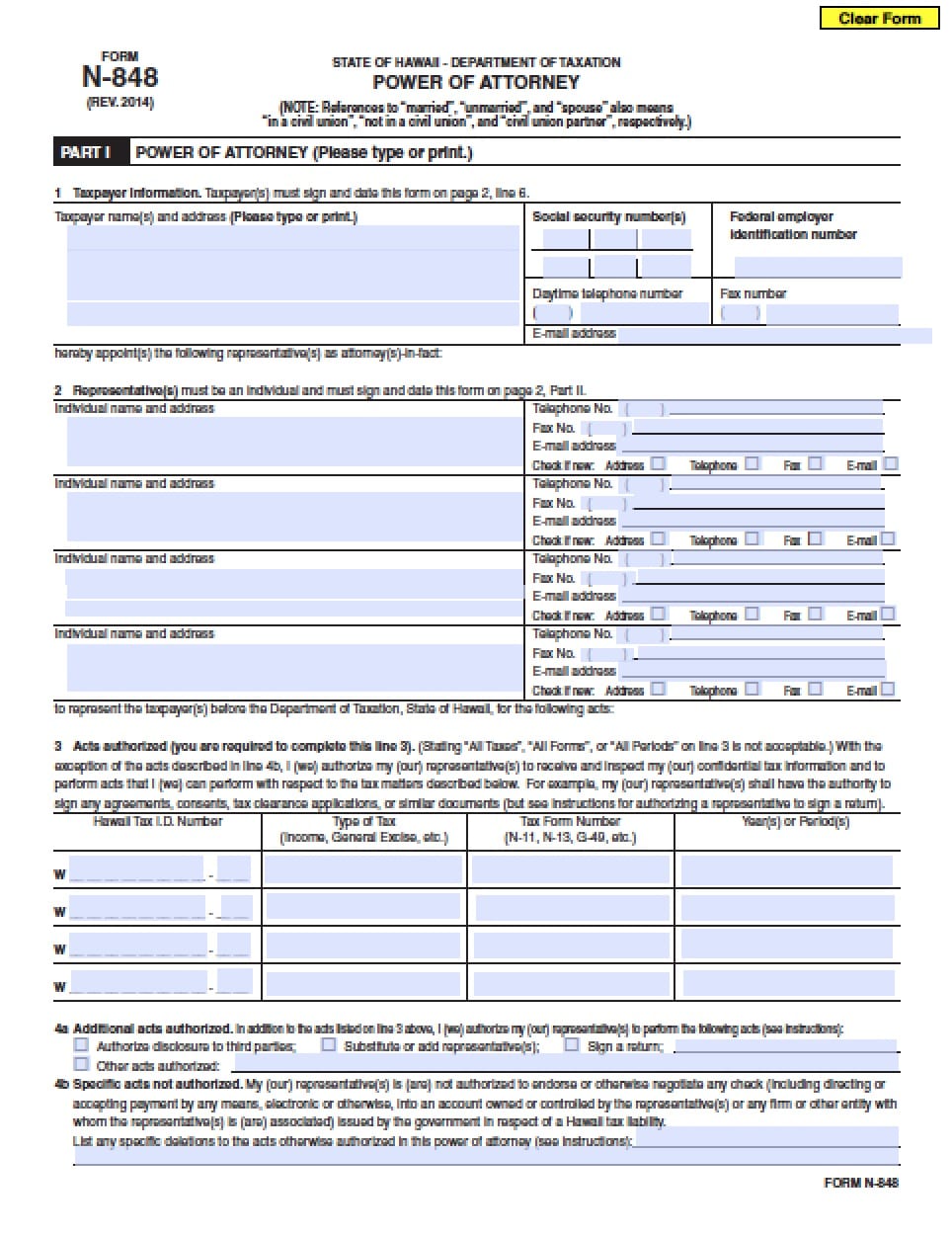

- Taxes

- All Preceding Subjects (if this is your option, you only need to initial this one on this document)

Step 5 – Grant of Specific Authority – In this section of the document, there are 8 options you must initial in order for your Agent to exercise any power over any of them. Be very cautious with regard to these powers as your Agent may be able to significantly reduce your estate or it’s distribution at your death.

- Read each item on the form and initial only what you wish to relinquish power over to your Agent (if any of them at all) You are not required to grant any of these powers whatsoever. If you aren’t sure what you should do or if you’re feeling pressured, consult with an attorney of your choice, privately, for assistance and your legal protection as well as your intended beneficiaries of your estate.

- Read the following section “Limitation on Agent’s Authority”

Step 6 – Special Instructions – If the Principal would like to provide special or very specific instructions, they may do so by typing or printing on the lines provided in this section, if there are no special instructions, leave the lines blank. If you have special instructions and require additional space, add a sheet continuing your instructions and attach it to this form

Step 7 – Effective Date of the Document – If you (the Principal) would like the effective date begin at the signing and dating of this document you need to do nothing more. If you would like it to become effective in the future, place that date or at what event or occurrence you would like the document to go into effect into the “Special Instructions”

Step 8 – Nomination of Conservator or Guardian (Optional) – Should the courts decide to appoint a conservator or guardian over your estate or over your person, you may nominate someone by placing their information in this section on the form. Provide the following information for each:

- Nominee for Conservator –

- Name of Nominee for Conservator Over the Estate

- Nominee’s Physical Address

- Nominee’s Telephone Number

- Nominee for Principal’s Guardian –

- Name of Nominee for Guardian Over Principal’s Person

- Nominee’s Physical Address

- Nominee’s Telephone Number

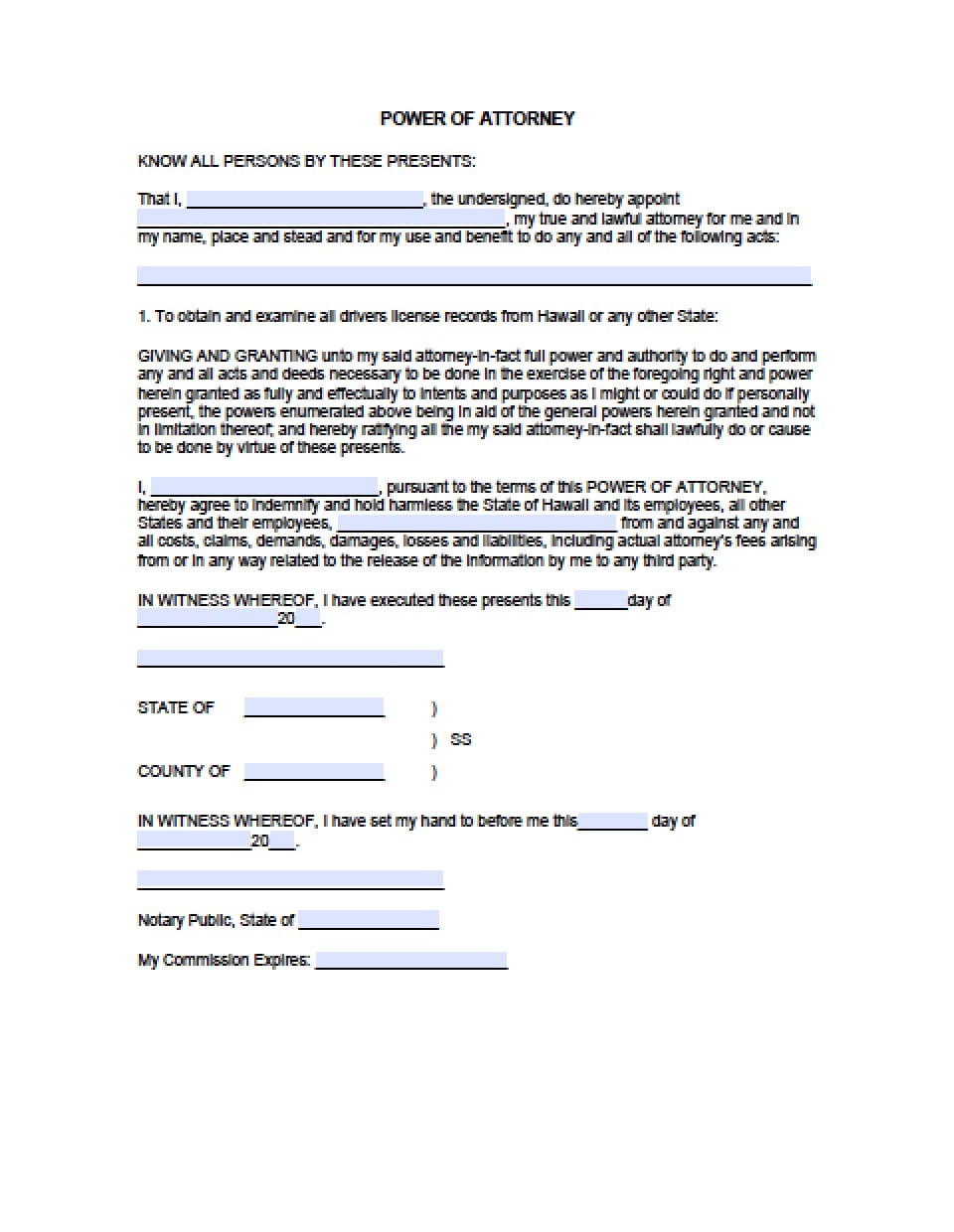

Step 9 – Reliance on These Powers – Prior to providing the Principal’s signature and personal information, you must acquire the services of a notary public. Once you are before the notary, first provide the following information:

- Principal must first provide the date in which they are providing their signature on this document in mm/dd/yyyy format

- Principal’s Physical Address

- Principal’s Telephone Number

- Principal’s Signature

- Principal’s Printed or Typed Name

Step 10 – Notarization – The remainder of this document will be completed by the notary, providing all required information. They will then affix their state seal.

- The notary will hand the document back to the Principal

- Make copies to provide to all person’s named on this document for their records

- Provide the original to your Agent

- Provide copies to any and all financial institutions for which you hold interest to be certain that they know your exact wishes with regard to your financials

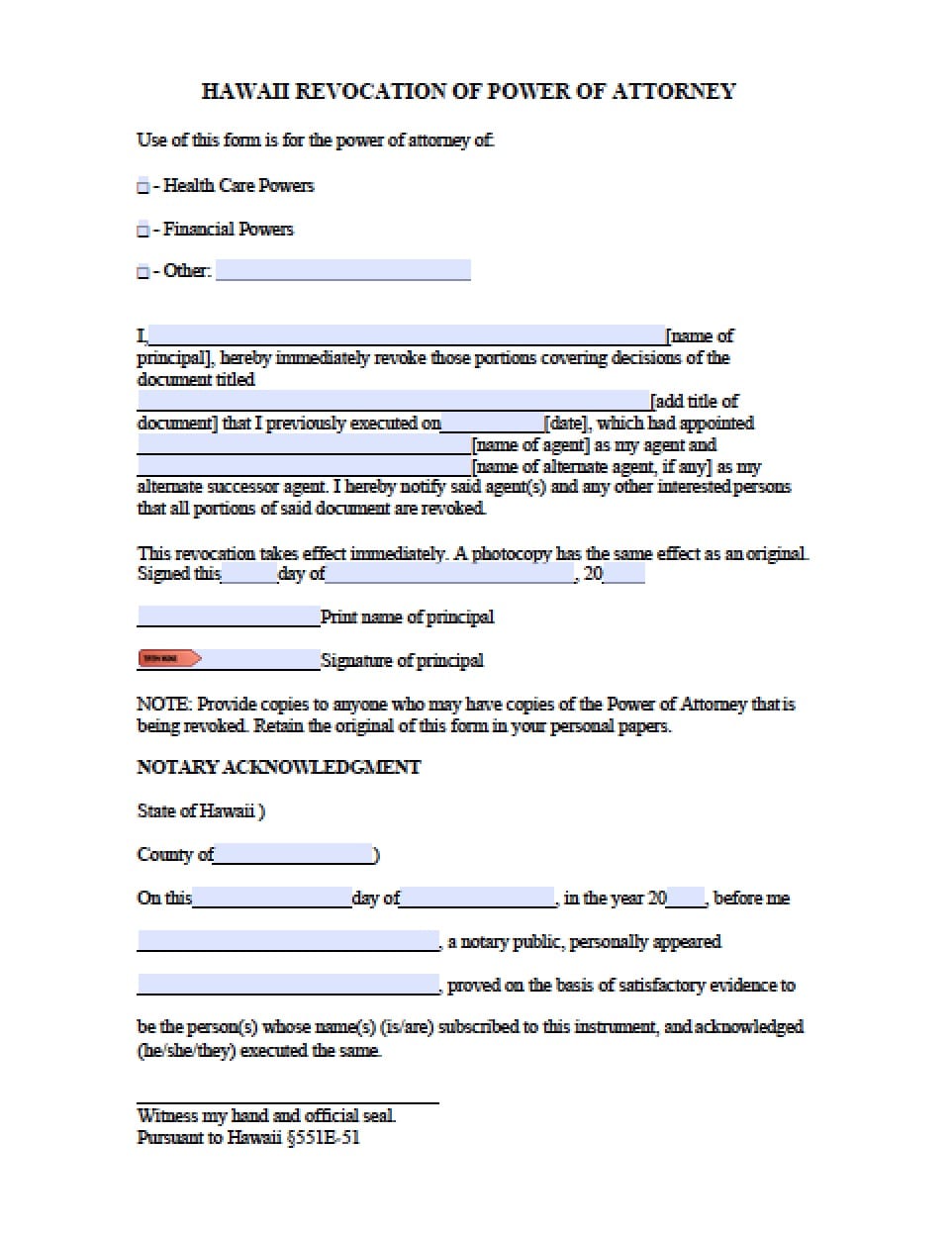

- This document may be revoked at any time in writing by the Principal and delivery to the most current Agent and notification should be provided to all financial institutions for which you’ve provided copies, so that they will be aware of the document revocation