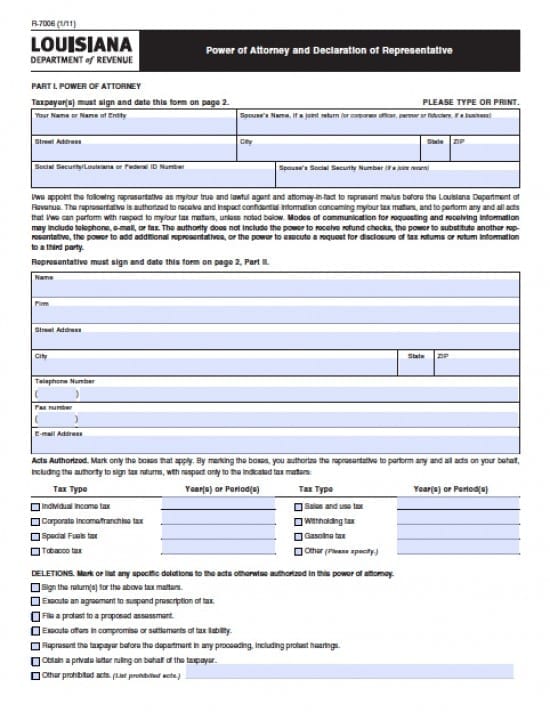

| Louisiana Tax Power of Attorney Form |

The Louisiana tax power of attorney form is a legal document that a legal document that is available for a Principal, so that they may appoint an Agent, whether this be an individual or a business entity. The document will allow the Principal to grant powers for an Agent to prepare their tax documents and/or, if needed, the Agent would be able to represent them before tax agencies. A tax Agent will require access to confidential tax and financial information from the Principal in order to provide proper services. This form will provide basic information with regard to the taxpayer(s) and representatives. The taxpayer(s) shall grant the permission needed to legally work with the Principal(s) private information.

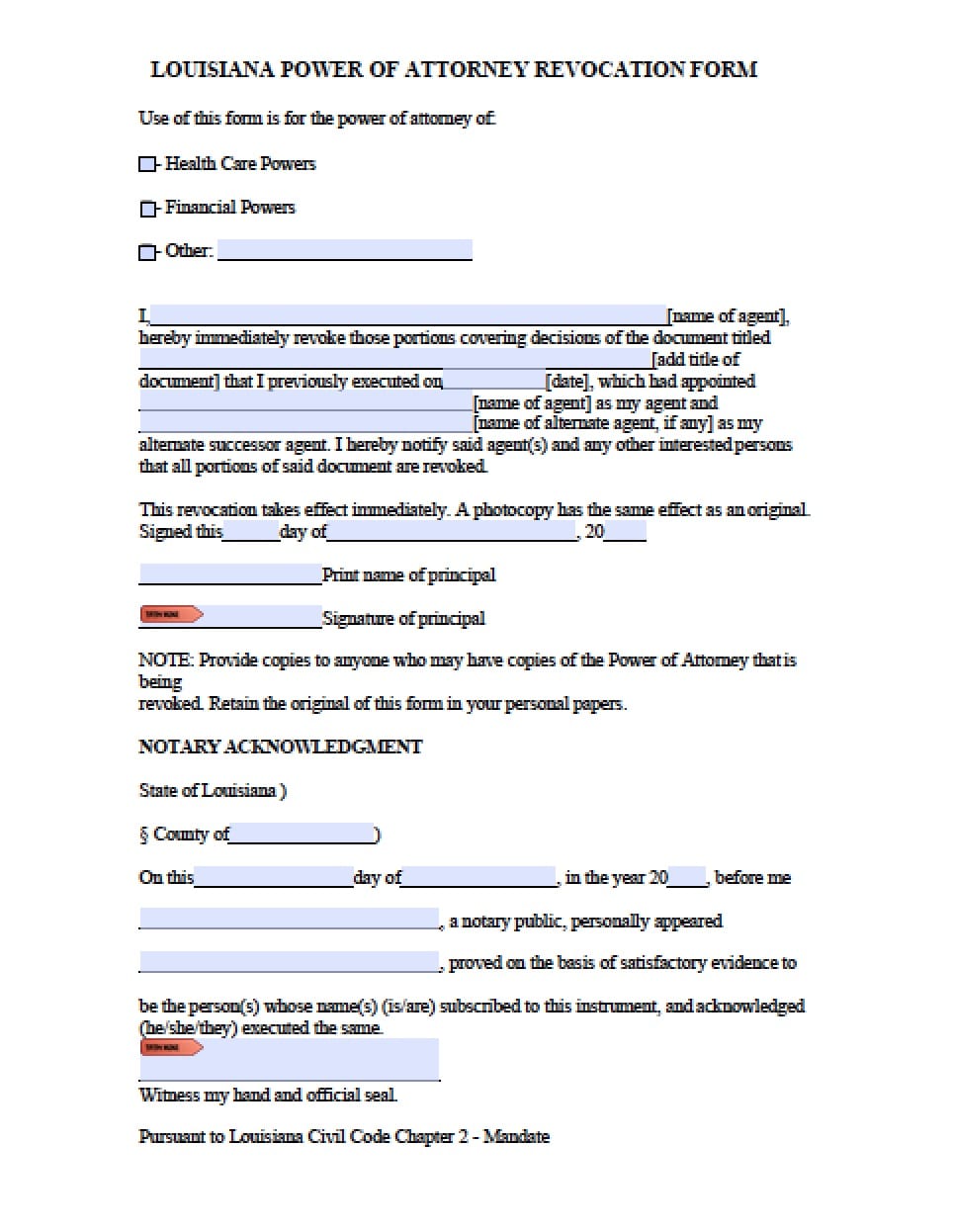

This document may be revoked by the Principal at any time, given written notice and delivery to the Agent or by implementation of a new powers document.

How to Write

Step 1 – Taxpayer(s) Information and Document – Provide the following information:

- Taxpayer’s Name or Name of Entity (business)

- Spouse’s Name, if a joint return (or corporate officer, partner or fiduciary, if a this is a business)

- Street Address

- City State ZIP

- Social Security/Louisiana or Federal ID Number

- Spouse’s Social Security Number (if this is a joint return)

- Carefully review the information in the next paragraph before proceeding

Step 2 – Attorney In Fact/Agent – Enter:

- The Name of the appointed Agent(s)

- Firm

- Street Address

- City State Zip Code

- Telephone Number

- Fax number

- E-mail Address

Step 3 – Acts to be Authorized – Check the applicable boxes, to include years and periods:

- Individual income tax

- Sales and use tax

- Corporate income/franchise tax

- Withholding tax

- Special Fuels tax

- Gasoline tax

- Tobacco tax

- Other (Specify any other acts to be authorized that are not listed)

Step 4 – Deletions – Taxpayers must check any boxes or a prohibited acts as follows:

- Sign the return(s) for the above tax matters

- Execute an agreement to suspend prescription of tax

- File a protest to a proposed assessment

- Execute offers in compromise or settlements of tax liability

- Represent the taxpayer before the department in any proceeding, including protest hearings

- Obtain a private letter ruling on behalf of the taxpayer

- Other prohibited acts – (List any additional prohibited acts)

Step 5 – Titled Sections – The taxpayer(s) must read the following three (3) sections before proceeding:

- Notices and Communications

- Revocation of Prior Power(s)

- Signature of Taxpayer(s)

Step 6 – Signature(s) of Taxpayer(s) – Provide the following:

- Taxpayer signature Date (mm/dd/yyyy)

- Date of Signature in mm/dd/yyyy format

- Spouse signature Date (mm/dd/yyyy)

- Signature of authorized representative, if the taxpayer is a corporation, partnership, executor or administrator

- Date of Signature in mm/dd/yyyy format

Step 7 – Declaration of Representative – The appointed Agent, must carefully review the following information ( the declarations will be signed under penalties of perjury)

- I am not currently under suspension or disbarment from practice before the Internal Revenue Service

- I am authorized to represent the taxpayer(s) identified in Part I for the tax matters specified there

- AND

- I am one of the following: (insert applicable letter in table below)

- Attorney—a member in good standing of the highest court of the jurisdiction shown

- Certified Public Accountant—duly qualified to practice as a certified public accountant in the jurisdiction shown below

- Enrolled Agent—a person enrolled to practice before the Internal Revenue Service

- Officer—a bona fide officer of the taxpayer organization

- Employee—an employee of the taxpayer. f. Family Member—a member of the taxpayer’s immediate family (state the relationship to the taxpayer)

- . Former Louisiana Department of Revenue Employee. As a representative, I cannot accept representation in a matter with which I had direct involvement while I was a public employee

Step 8 – The Agent – Must provide the following in the table provided (if this is not provided, the document shall be returned):

- Designation-Insert – Letter (a-h)

- State Issuing License

- State License Number

- Signature

- Date the Agent’s signature, in mm/dd/yyyy format