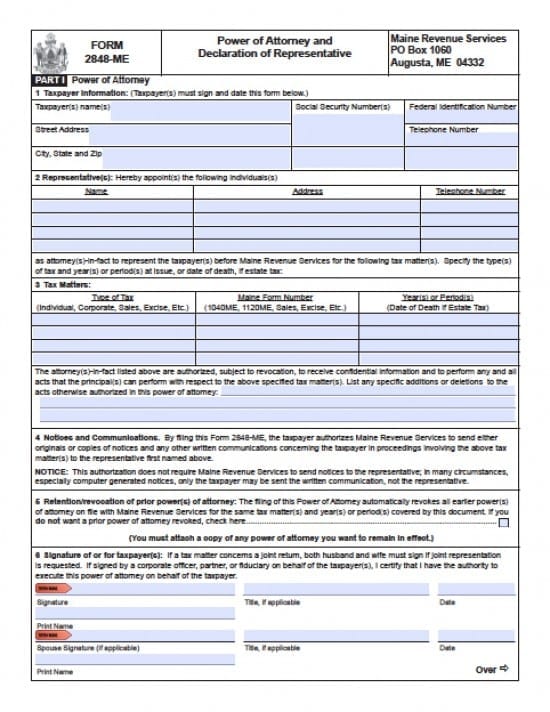

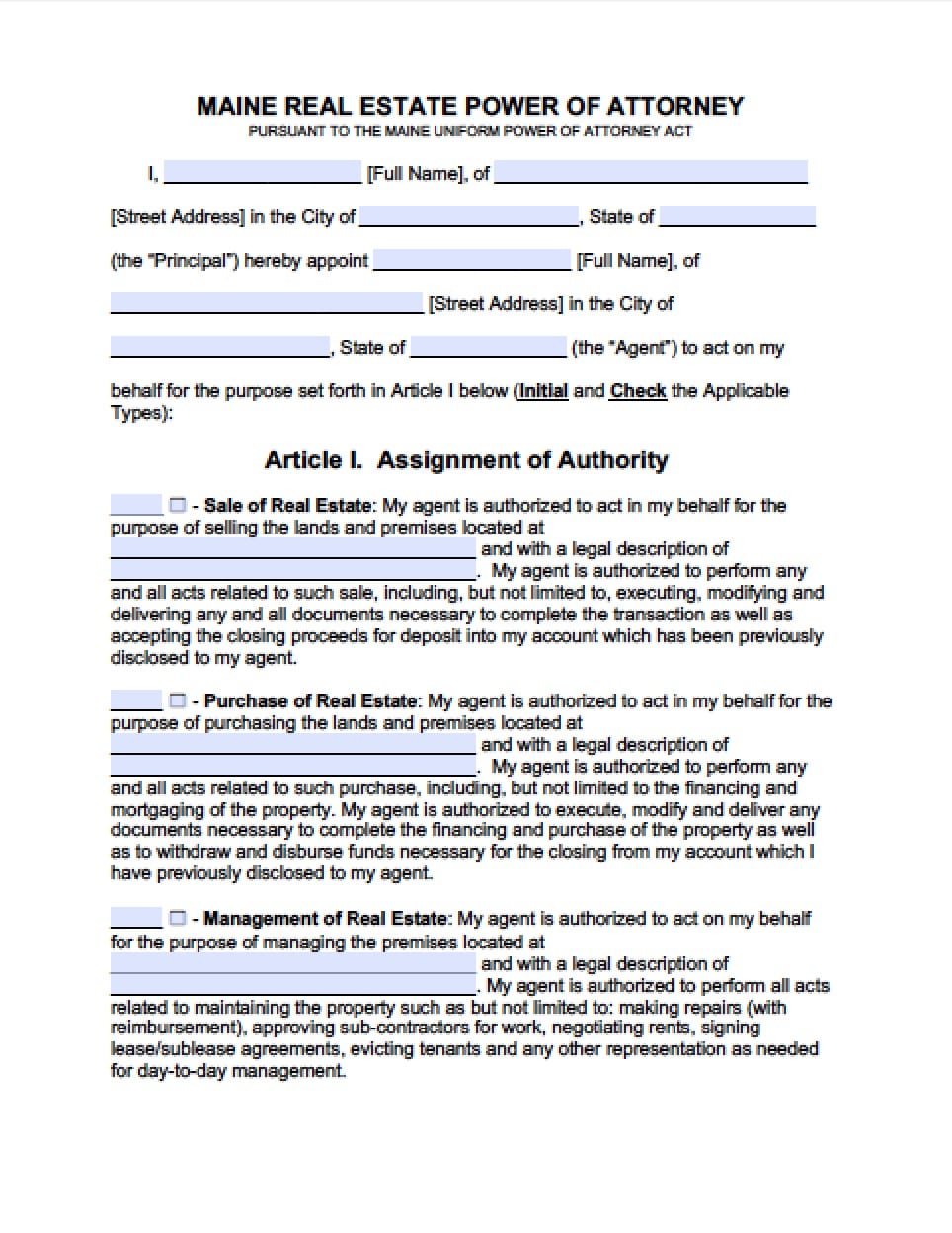

| Maine Tax Power of Attorney Form |

The Maine tax power of attorney form is a document that will grant permission from a taxppayer to name an Agent to complete tax forms and/or represent the Principal before any tax agency. The document will only be effective until the act has been completed. The form will require information with regard to the taxpayer, the Agent’s and will offer the ability to sign on behalf of the taxpayer.

This document may be revoked by the taxpayer(s) at any time they choose. The procedure would to be to place the revocation into writing and to deliver it to the Agent.

How to Write

Step 1 – Taxpayer Information – Enter:

- Taxpayer(s) name(s)

- Social Security Number(s)

- Federal Identifi cation Number (FEIN)

- Street Address

- Telephone Number(s)

- City, State and Zip Code

Step 2 – Representative(s) – The taxpayer(s) must specify the information regarding the appointed Agent(s) – Enter the following for each delegated Agent:

- Agent(s) Name(s)

- Address(es)

- Telephone Number(s)’

- AND

- Specify the types of taxes and the year(s) or period(s) that are of issue to the taxpayer or the date of the death of the taxpayer if they are deceased, if this is regarding estate tax

Step 2 – Tax Matters: Provide the following information:

- Type of Tax (ie: Individual, Corporate, Sales, Excise, Etc.)

- Maine form number (ie: 1040ME, 1120ME, Sales, Excise, Etc.)

- Years or Periods and date of death if this is estate related

- Provide any and all acts pertaining to the tax matters in the list before

- Read “Notices and Communications” and “Retention/Revocation of prior powers”

- If any prior powers documents are to remain in effect, a copy must be attached to this document

Step 3 – Signature(s) – These signatures must be submitted in the presence of a Notary Public:

- Enter the taxpayer(s) Signature(s)

- Printed Names

- Title (if any)

- Date the signatures in mm/dd/yyyy format

Step 4 – Declaration of Representative(s) – Agent(s) must circle one of the selections as follows

- A member in good standing of the bar of the highest court of the jurisdiction shown below

- Duly qualifi ed to practice as a certified public accountant in the jurisdiction shown

- An enrolled agent enrolled under U. S. Department of Treasury Circular 230

- A bona fide officer of the taxpayer’s organization

- A full-time employee of the taxpayer

- A member of the taxpayer’s immediate family (spouse, parent, child, brother or sister)

- A fiduciary for the taxpayer(s)

- Other (Explain)

- AND

- Each appointed Agent must provide the following information to be entered into the fields located in the table provided:

- Designation – (insert appropriate number from the list)

- Jurisdiction – (State etc)

- Agent’s Signature

- Date the Agent has submitted their signature in mm/dd/yyyy format