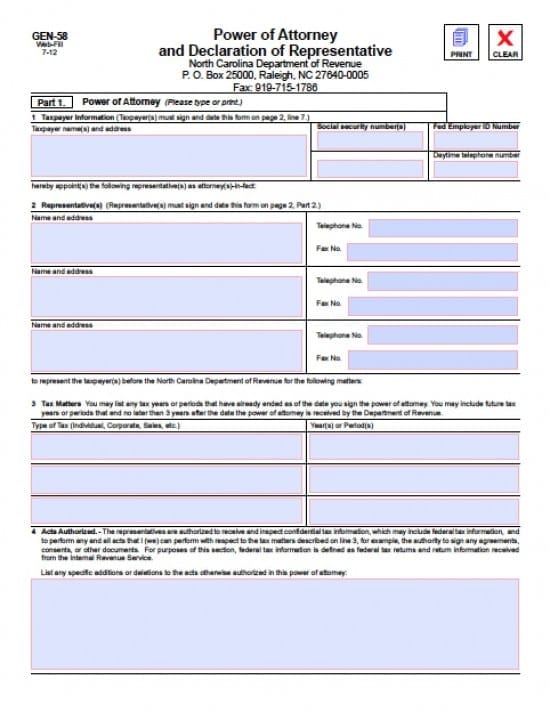

| North Carolina Tax Power of Attorney Form |

The North Carolina tax power of attorney form is a document that permits the taxpayer to provide authorization for an Agent (individual or business entity) to access confidential financial information so that they may complete the taxpayer(s) documents and, if needed will represent the taxpayer before any tax agency. The document will revoke all other tax powers documents, unless otherwise stated by the taxpayer(s)

This document must be signed by all parties or it will be returned to the Agent. This document may be revoked by the Principal, in written notice and delivery/service to the Agent

How to Write

Step 1 – Taxpayer(s) Information –

- Taxpayer name(s) and address

- Social security number(s)

- Fed Employer ID Number

- Daytime telephone number

Step 2 – Agent(s) – All Agents who shall work on behalf of the taxpayer, must provide the following information:

- Name and address

- Telephone Number

- Fax Number

Step 3 – Tax Matters – The taxpayer should be aware that they may list tax years or tax periods that have already ended as of the date that the taxpayer signs the power of attorney. The taxpayer may also include future tax years and/or periods that will end, no later than 3 years after the date the power of attorney is received by the Department of Revenue. – Enter the following information :

- Type of Tax ( is: Sales, Individual, Corporate etc)

- Year(s) or Period(s)

Step 4 – Acts Authorized –

- The taxpayer may enter specific additions or deletions to the acts otherwise authorized in this powers document. Enter this information into the box provided

Step 5 – Titled Sections – Read the following sections. The taxpayer may enter their selection to each by checking the preferred box at the end of each statement:

- E-Business Center Account

- Retention/Revocation of Prior Power(s) documents

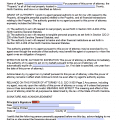

Step 6 – Signature of Taxpayer(s) – Each taxpayer must provide the following information. If the sections are left unsigned, the document(s) shall be returned:

- Signatures of each taxpayer

- Date the signatures in mm/dd/yyyy format

- Title (if applicable)

Step 7 – Declaration of Agents (Representatives) – The Agent(s) must read and agree to the statements contained in this section – If the signatures are not entered, the form will be returned -Enter the following information:

- Designation – Insert above letter from (A through G)

- Jurisdiction (State) or Enrollment Card Number

- Agent(s) Signature(s)

- Date the Agent’s signatures in mm/dd/yyyy format