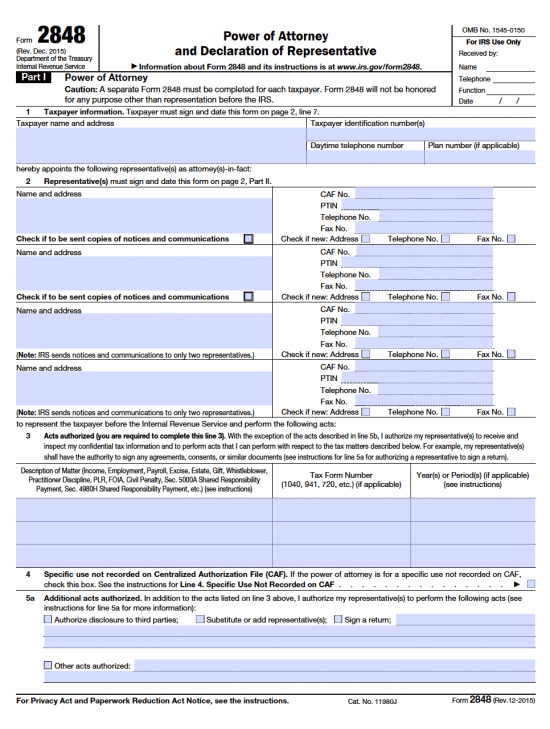

| Nevada Tax Power of Attorney Form |

The Nevada tax power of attorney form is not provided by the State therefore they accept most other types including the IRS Form 2848. Although, the State will accept any type of form that puts forward another individual to act on the behalf of the taxpayer (principal). Signatures of all parties and Agents must be submitted to this form, or it will be returned causing unnecessary delays in processing.

How to Write

Step 1 – Taxpayer Name and Address – Provide the following:

- Taxpayer name and address

- Taxpayer identification number(s) (SSN, EIN etc)

- Daytime telephone number

- Plan number (if it should apply)

Step 2 – Agent’s Information – All Agent’s must provide the following:

- Agent’s name and address

- Check the box, if copies are to be sent copies of notices and communications

- CAF number

- PTIN

- Telephone numbers

- Fax number

- Check any of the applicable boxes

Step 3 – Tax Matters -Acts Authorized – Completion required as follows:

- Description of tax matter(s)

- Tax form number (if applicable)

- Years or Periods (if applicable)

- If this use is not recorded on CAF – check the box provided

Step 4 – Additional Authorized Acts –

- Taxpayer may provide added powers authorized by checking the box and making additions in the lines provided

- Enter any other acts authorized in the additional lines if needed

- Enter any acts that are not authorized in the next section

- Check the box if there will be previous documents that shall remain in effect (attach copies of the document(s) to remain in effect to the document

Step 5 – Principal’s Signature – Submit:

- Taxpayer’s signature

- Date signature in mm/dd/yyyy format

- Title (if any)

- Printed name

- Printed name of taxpayer from line 1 if other than the individual states

Step 6 – Declaration of Representative/Agent(s) –

- Agent(s) must carefully read and agree to the declaration

- All Agents must enter required information in the table

- Designation – Enter one letter from A through R

- Licencing jurisdiction (state) or other licensing authority

- Enter Agent(s) Bar, license, certification, registration, or enrollment number

- Agents signature

- Date signature in mm/dd/yyyy format