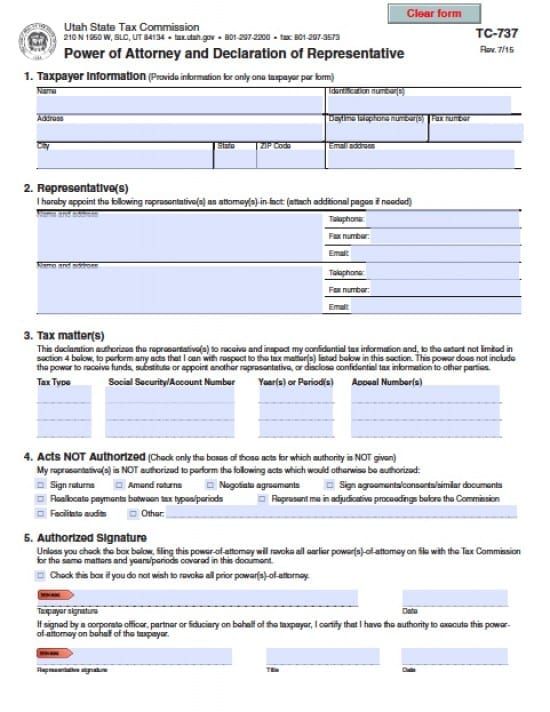

| Utah Tax Power of Attorney Form |

The Utah tax power of attorney form is a document that will allow a taxpayer to authorize powers for an individual or professional tax entity, to act as Agent on behalf of the taxpayer. The Agent(s) would then have the ability to review and request sensitive, confidential, financial information, so that they may properly complete the taxpayer’s tax document according to the law. This document may also provide permission, at the taxpayer’s discretion, to allow the Agent to sign tax documents on their behalf. The Agent will also have the ability to represent the taxpayer(s) before any Department of Revenue, should the requirement exist.

This document shall revoke all other previous tax powers document(s), unless otherwise stated by the taxpayer(s). This document may also be revoked, in writing, by the taxpayer(s) and by delivery or service to the Agent(s). Revocation will not be effective until the Agent(s) have received the revocation notice.

How to Write

Step 1 – Taxpayer Information – Complete the fields with the following required information:

- Taxpayer’s Name

- Address

- City

- State

- Zip Code

- Taxpayer’s Identification Number(s)

- Daytime Phone Numbers

- Fax Number

- Email Address

Step 2 – Taxpayer’s Appointment of Agent(s) – Submit the following:

- Name and complete address for each Agent

- Agent(s) telephone number

- Fax number(s)

- Email addresses respectively

Step 3 – Tax Matters – Submit the following:

- Tax Type

- Social Security Number or Account Number

- Year(s) or Tax Period(s)

- Appeal Number(s)

Step 4 – Act Not Authorized by Taxpayer(s) – Check any of the boxes that will not be authorized. If the powers are to be authorized, simply leave the box unchecked:

- Sign returns

- Amend returns

- Negotiate agreements

- Sign agreements/consents/similar documents

- Reallocate payments between tax types/periods

- Represent the Principal in adjudicative proceedings before the Commission

- Facilitate audits

- Other – If there is any other power that will be disallowed by the taxpayer, enter it into the line provided on the form

Step 5 – Authorized Signature(s) – Check the box if applicable and enter:

- The taxpayers signature

- The date of the signature in mm/dd/yyyy format

- If the Agent has permission to sign on behalf of the taxpayer, enter:

- Agent’s signature

- Title (if any)

- Date of Agent’s signature in mm/dd/yyyy format