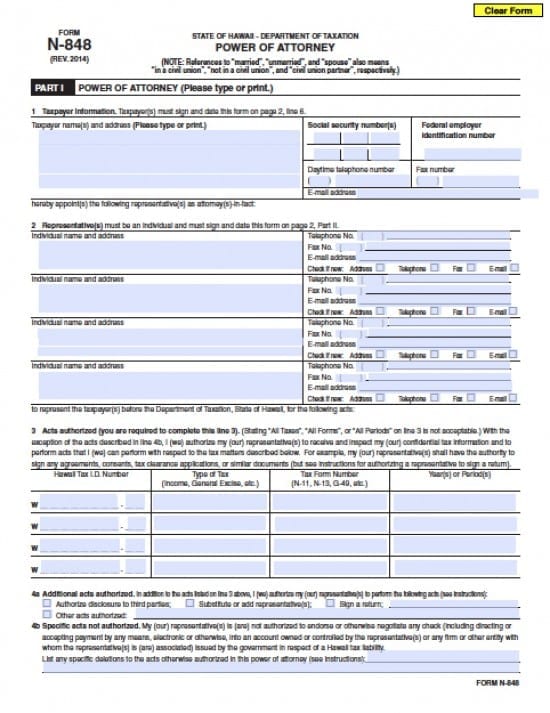

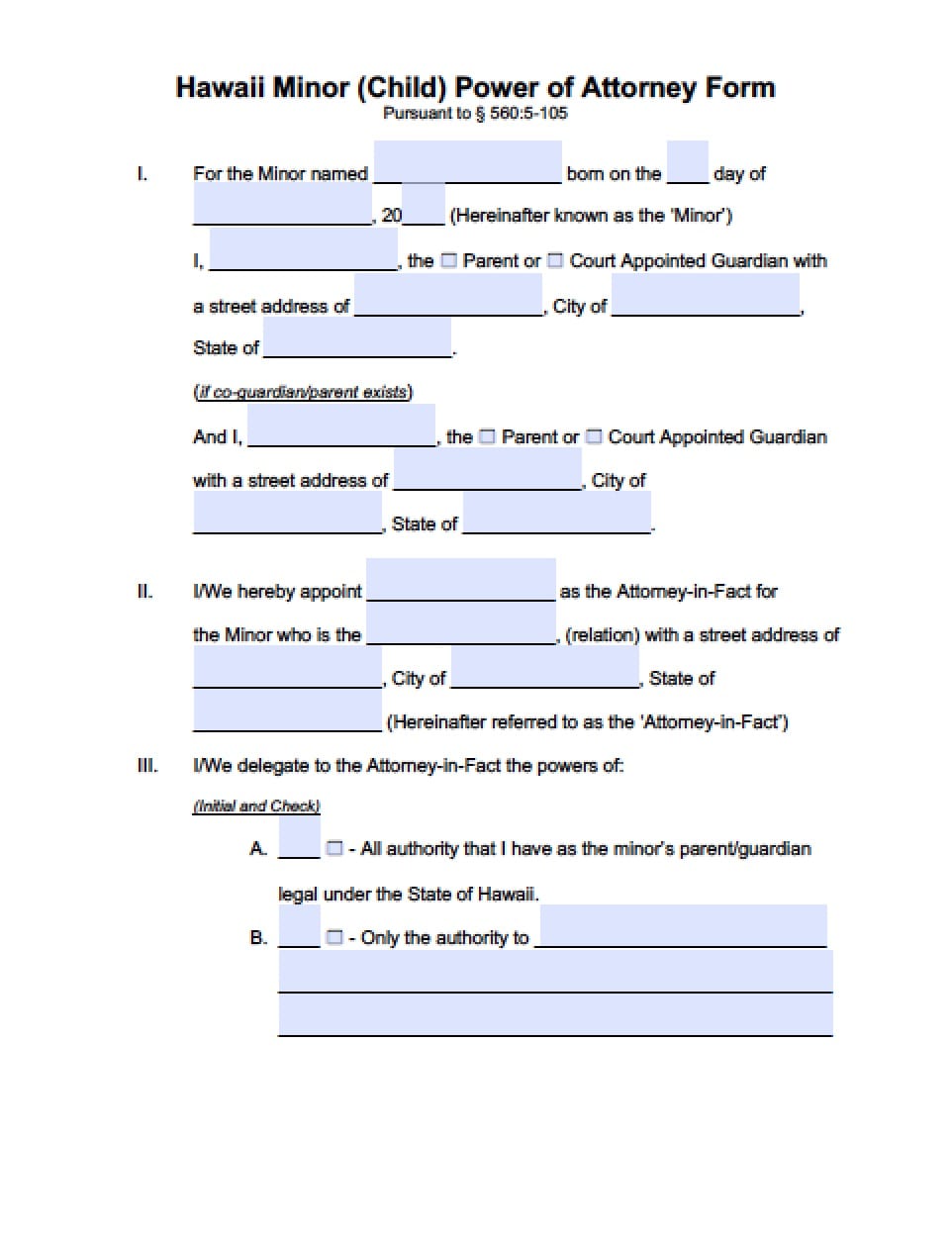

| Hawaii Tax Power of Attorney Form |

The Hawaii tax power of attorney form is a legal document that will allow a Taxpayer (Principal) to grant authority to a CPA, Tax Attorney, Individual or Firm to prepare and sign Hawaii tax documents on your behalf, representing you before the Department of Taxation. This would also allow any person or entity chosen by the taxpayer(s) to receive otherwise confidential tax information needed for proper preparation and representation. This document may be revoked at any time by placing the revocation in writing and delivering it to the Attorney In Fact/Agent or by execution of a new document unless otherwise stated in writing or by selection by the Principal(s). (See Act 022, 4/17/2014 (Gov. Msg. No. 1122)

How To Write

Step 1 – Download the form provided and begin by entering the taxpayer(s) information as follows:

- Taxpayer name(s) and address (type or print)

- Social security number(s)

- Federal employer identification number

- Daytime telephone number

- Fax number

- E-mail address’

Step 2 – Appointment of Representatives – Representative(s) must be individual and must sign and date this form on page 2. There are accommodations for 4 representatives information, if more room is required, add a sheet with continued information and attach it to this document. For up to 4 representatives on the form, provide the following information:

- Individual name and address

- Telephone Number

- Fax Number

- E-mail address

- On the form, check the box if any of the selections are new

- Address

- Telephone

- Fax

Step 3 – Acts Authorized – You must enter the type of tax information for the document to be valid. This section must be completed by the taxpayer(s) and provide the information as follows:

- Read the information in the paragraph before recording information in the boxes provided

- Hawaii Tax I.D. Number

- Type of Tax (Income, General Excise, etc.)

- Tax Form Number (N-11, N-13, G-49, etc.)

- Year(s) or Period(s)

Step 4 – Additional Acts Authorized – Taxpayer(s) may add additional permitted acts, by selecting the acts and checking the boxes that apply from:

- Authorize disclosure to third parties

- Substitute or add representative(s)

- Sign a return

- Other acts authorized – If you have other acts you wish to authorize type or print them on the line provided. If more room is required, add a sheet and attach it to this document

Step 5 – Specific Acts Not Authorized – If the taxpayer would like to specify acts they will not authorize for their representative(s) they may be typed or written on the lines provided. If more room is required, add a sheet and attach to this document

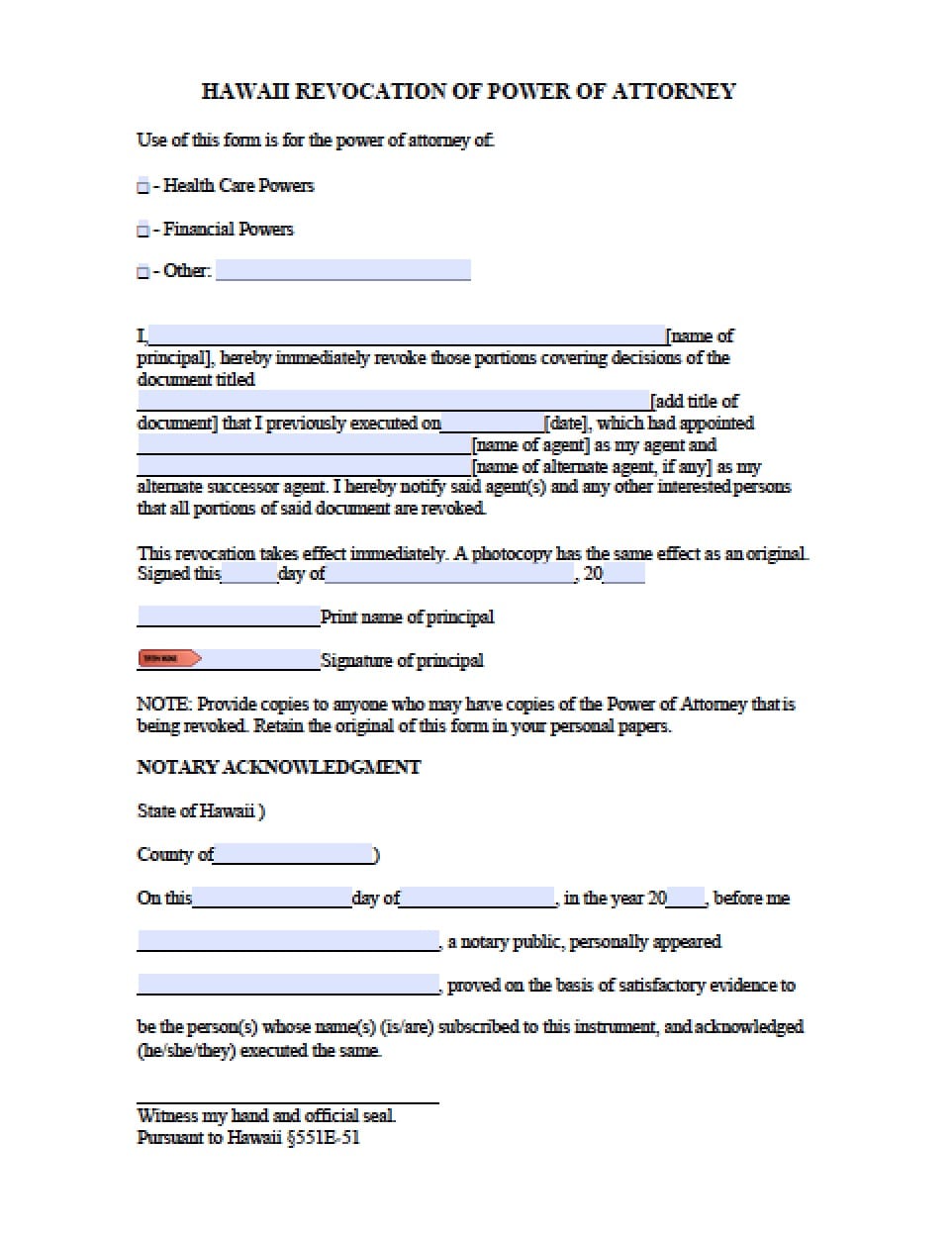

Step 6 – Retention/Revocation of Prior Power(s) – When filing this document it will automatically revoke all earlier power(s) on file with the State of Hawaii for the same tax matters and years or periods covered by this particular document. If you choose not to revoke a prior document, check the box on the form.

- If you do not wish to revoke a prior document, you must attach a copy of any powers document you wish to remain in effect, to this form

Step 7 – Taxpayer(s) Signature(s) – If a tax matter concerns a year in which a joint return has been filed, both spouses must sign the document, if joint representation will be requested. If signed by a corporate officer, partner, guardian, tax matters partner or person, executor, receiver, administrator, or trustee on behalf of the taxpayer, the representative must certify that they have the permission and authority to execute this form on behalf of the taxpayer. There are accommodations for both spouses to sign the document or any representatives – provide the following on the form:

- Signature

- Date

- Title (if applicable)

- Print Name

- Print name of taxpayer from line 1 if other than the individual

- If this document is not signed and dated, it will be returned to the taxpayer

Step 8 – Signatures and Information of Representative(s) – There are accommodations on this document for up to 4 representatives, if more room is needed place the same information on an added sheet and attach to the form. All representatives, must provide the following information:

- Social Security Number (Last 4 numbers only)

- Type or Print Name

- Signature

- Date of Signature

Taxpayers should acquire a copy of this document for their records