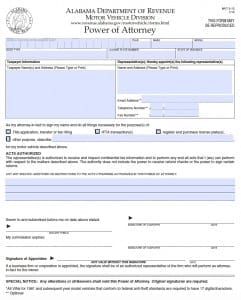

| Alabama Motor Vehicle Power of Attorney Form – MVT 5-13 |

This is Alabama motor vehicle power of attorney, also known as form MVT 5-13, is a document provided by a taxpayer to appoint an attorney in fact for the purpose of handling the registration, paying of motor vehicle taxes and other duties with regard to the licencing, registration and acquisition of license plates for any vehicle purchased by the principal. This form is often provided by those whom, for whatever reason cannot be available to handle these duties on their own, due to absents or the inability to complete the needed tasks prior to the end of the allowable time frame required by the state after the purchase of a motor vehicle.

Step 1 – Begin by downloading the document and providing the following information:

- Beginning at the top of the document, provide the Vehicle ID Number, also known as the VIN

- Also provide the year of the vehicle

- The make of the vehicle

- The model of the vehicle

- The body type

- The license plate number

- The state where the plate was issued

Step 2 – Taxpayer Information – This section will require that the taxpayer provide the following information:

- Type or print the taxpayer(s) name and physical address

Step 3 – In the next box you will appoint your representative(s). Print or type the following:

- Name(s) and address of the appointed representative(s)

- Email address

- Telephone number(s)

- Fax Number(s)

Step 4 – Check all of the boxes that apply for the selected duties that would apply to your attorney in fact:

- Title application, transfer or lien filing

- IFTA transaction(s)

- Registration and purchase of license plate(s)

- If any other purpose should be included, check the box next to the line provided and write in any additional duties allowed for the specific vehicle as described at the top of the document

Step 5 – Acts Authorized – This section will allow you to add or restrict any acts allowable by you to the attorney in fact.

- Read the brief “Acts Authorized” paragraph and then fill in any of the information you would like to add or restrict into the blank lines provided.

Step 6 – The taxpayer must then acquire the services of a notary public to complete the document. The notary public, must complete the information required on their part. Your appointee must be present to sign the document or it will be invalid. Original signatures are required. If anythings is marked though or stricken, the form will become invalid.

- Provide also, your signature

- Your spouse’s signature (if applicable)

- You must have the signature of the appointee – the document will remain invalid without their signature

Your notary public will then apply their stamp and the document will become immediately in force as of the date of the notary, unless otherwise stated by the taxpayer.