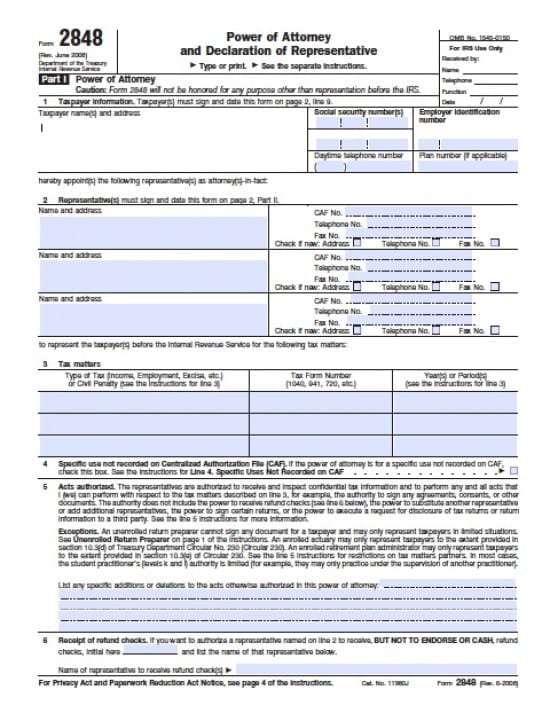

| Delaware Tax Power of Attorney Form |

The Delaware Tax Power of Attorney Form allows a Principal to grant permission to an individual, business entity or tax attorney to assist with tax preparation or to represent the Principal in the event of questionable issues with tax returns before the Internal Revenue Service. This can be a very important tool when dealing with Tax Matters, especially since a CPA or Attorney may require various disclosures and permissions ranging from very broad to specific, depending upon the case. This form will provide a reliably approved method of presenting this information correctly to the Internal Revenue Service. If any part of this form is unclear, it is highly recommended to consult with a professional.

How to Write

1 – Preparations

Gather the paperwork necessary to report all the information required on this form in a perfectly accurate manner. Select the “Adobe PDF” button above then save this file.

2 – Part I, Section 1, Taxpayer Information

The Taxpayer Information’s information will be the first piece of information to be reported. This entity (Principal or Taxpayer) will be granting powers of authority to another (Appointee, Representative, Agent) in dealing with the Internal Revenue Service. Report the Principal/Taxpayer’s information in the table provided:

- Taxpayer name(s) and address must be entered in the first box. You may enter the information for more than one Principal/Taxpayer

- Locate the term “Social security number(s)” then report the Principal/Taxpayer’s social security number beneath it

- Report the phone number where the Principal/Taxpayer may be reached during business hours under the words “Daytime telephone number”

- There will be a box on the right provided to report any “Employer Identification Number (EIN)” that applies

- If the Principal/Taxpayer is enrolled in any relevant plan report the account number in the “Plan Number (If Applicable)”

3 – Part I, Section 2, Representative(s)

Locate Item 2 in Part I of this page. Information regarding the entity who is receiving authority approval from the Principal/Taxpayer in dealing with the Internal Revenue Service on behalf of the Principal/Taxpayer must be clearly reported in the table. You must provide a report on at least one Representative and there is enough room for up to three. Each Representative’s information must be displayed in its own row. Enter the information for all Representatives as follows on each row:

- The Representatives Name must be reported in the “Name and Address” box.

- Enter the Representative’s CAF (Central Authorization File) Number on the dashed line following “CAF No.”

- Recort the Representative’s Telephone Number and Fax Number on the dashed lines following “Telephone No.” and “Fax No.” (respectively)

- On the “Check if new” line, mark the “Address,” “Telephone No.,” and/or “Fax No.” boxes if any of this contact information is new

- Check the boxes that apply

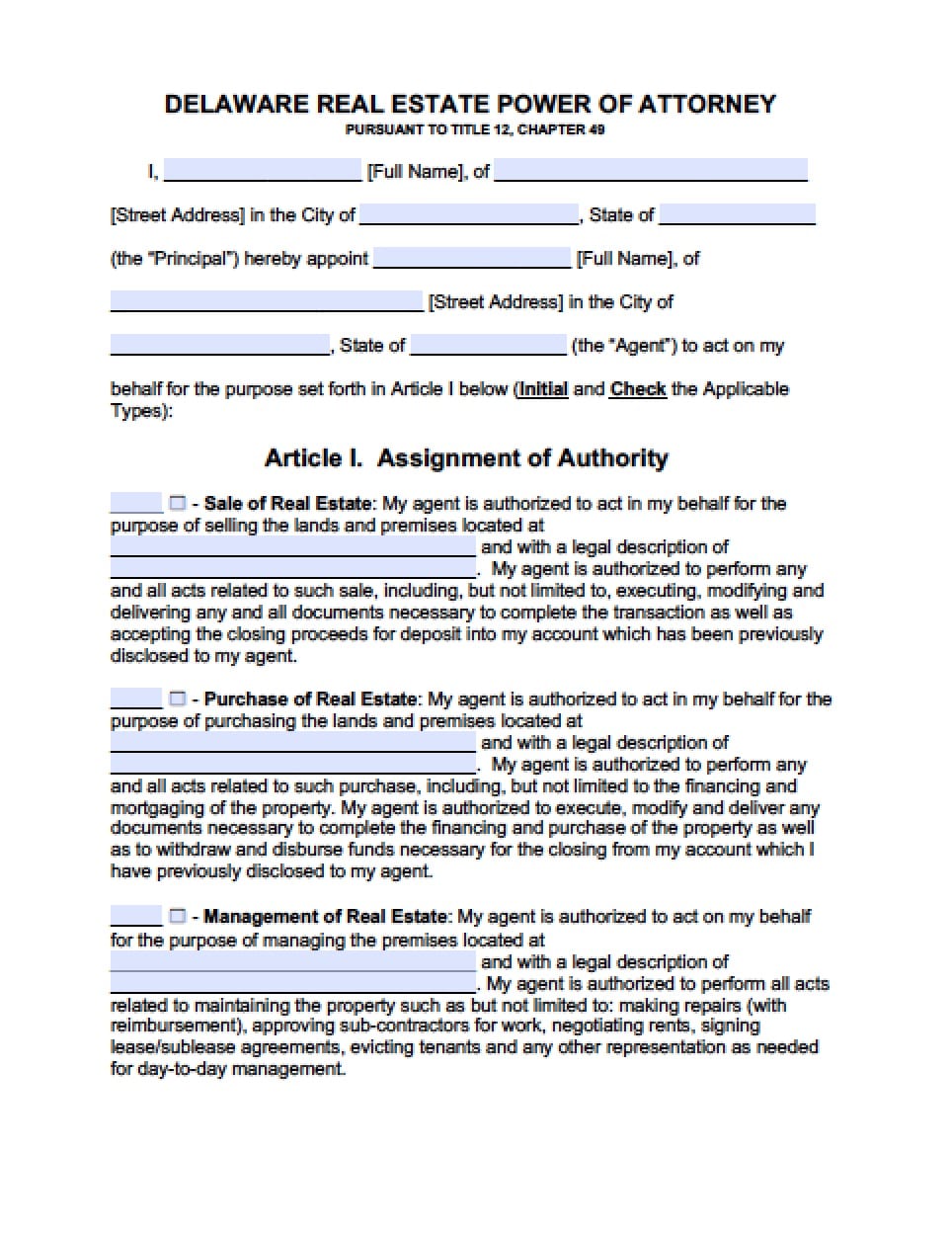

4 – Part I, Section 3, Tax Matters

The Representative must be formally approved in what tax matters he, she, or they may represent the Principal/Taxpayer on with the Internal Revenue Service. This may be done using the table in Item 3 (“Tax Matters”). Provide the following information for each matter the Principal/Taxpayer grants power in (Note: Be very specific):

- Type of Tax (Income, Employment, Excise) or Civil Penalty

- Tax Form Number (1040, 941, 720, etc.)

- Year(s) or Period(s) (you may not list years more than three years from the receipt of this form)

5 – Part I, Section 4, Specific Use Not Recorded On CAF

Generally, the Internal Revenue Service will keep track of the authority Representatives, Appointees, Agents, etc. have been given. However, if this document is a specific or one-time use (i.e. applying for an EIN) type, it may not be in the CAF. If so, mark the check box in Item 4 following the words “Uses not recorded on CAF”

6 – Part I, Section 5, Acts Authorized And Exceptions

The Principal/Taxpayer must carefully review “Acts Authorized” and “Exceptions” paragraphs. This will generally describe what a Representative may or may not do. If the Principal/Taxpayer wishes to provide specific instructions, conditions, terms, restrictions, limitations, etc. regarding the Representative’s power, behavior, authority, etc., this should be documented on the dashed lines following the statement beginning with the words “List any specific…”

- Receipt of refund checks. If you want to authorize a representative named on Iine 2 to receive, not to endorse checks, refund checks, initial on the lines provided

7 – Part I, Section 6, Receipt of Refund Checks

In some cases, it may be wise to have Refund Checks sent to the designated Representative. To be clear, this means the Representative may receive, but not cash or endorse Refund Checks. A Principal/Taxpayer may elect to a recipient of such materials in Item 6 by presenting the following:

- To show Principal Approval for naming the Representative as a recipient of Refund Checks, the Principal must initial the space in the Item 6 statement

- The Name of the Representative approved to receive such materials must be entered on the blank line following the words “…refund checks”

8 – Part I, Section 7, Notices And Communications

An important aspect when using a Representative to deal with the Internal Revenue Service is determining whether that individual shall receive Notices and Communications at the time the I.R.S. sends them. By default, the Internal Revenue Service will send a copy of all Notices and Communications to the first Representative listed in Section 2. The Principal/Taxpayer may choose to control this by selecting the appropriate check box in Item 7:

- Mark in the check box for Item 7a, if there is a second Representative and that party should receive copies of I.R.S.Notices and Communications

- Place a mark in the check box corresponding to Item 7b if neither Representative should receive copies of Notices and Communications from the I.R.S.

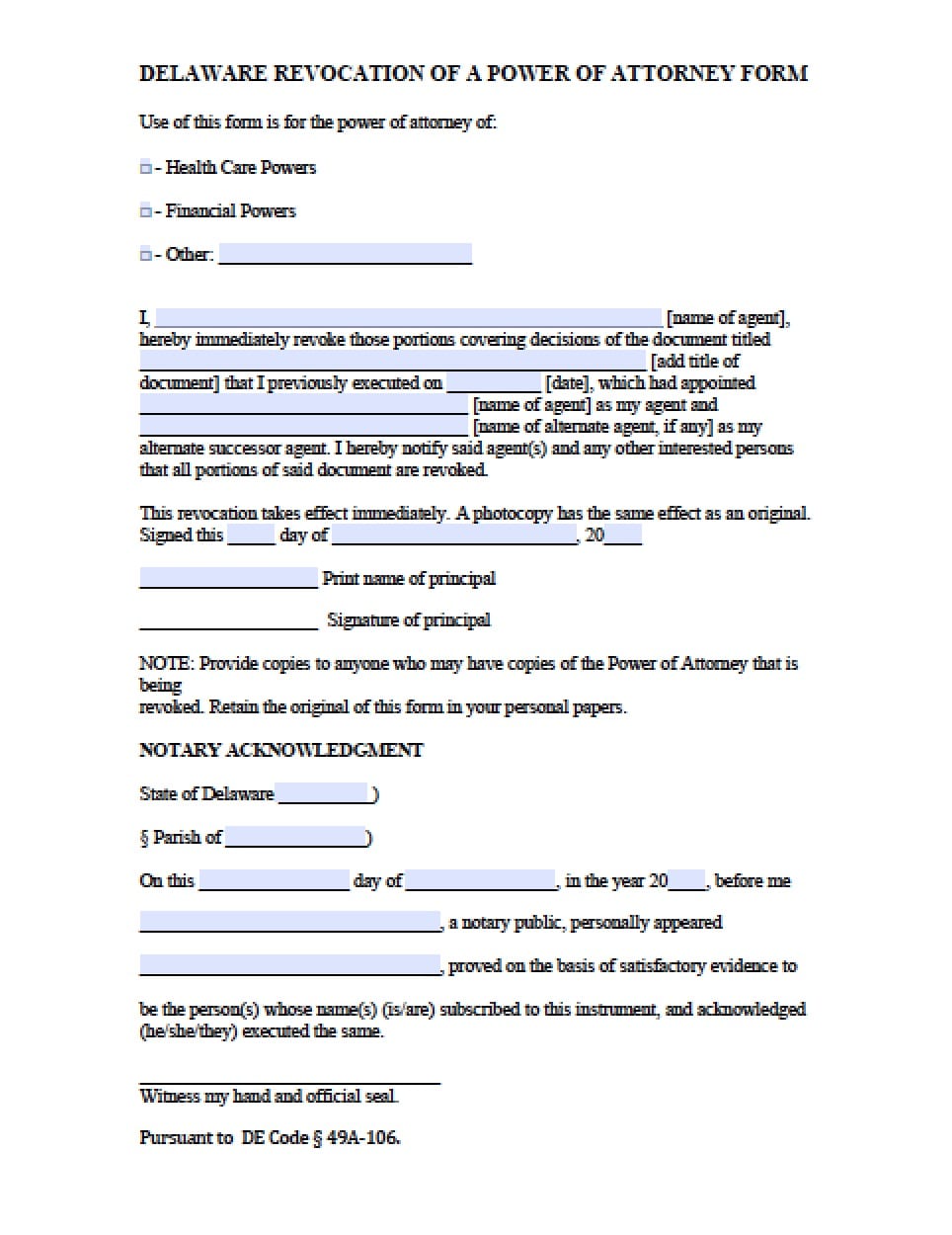

9 – Part I, Section 8, Retention/Revocation of Prior Power(s) of Attorney

Normally, issuing this document will terminate conflicting documents previously issued, however the Principal reserves the right to keep previous powers documents valid despite this filing. If so then mark the box in Item 8 and attach the authority documents that should remain in effect even after this one has been executed.

10 – Part I, Section 9, Signature of Taxpayers

In order to properly execute this document, its authenticity must be certified by the Principal/Taxpayer. This may only be done by virtue of a notarized signature produced by the Principal/Taxpayer. There will be enough room for up to two Principal/Taxpayers to provide the items required of them. Thus, supply the following in Item 9:

- Signature of Taxpayer(s) or Authorized Representative of Taxpayer

- Date of Taxpayer (or Authorized Representative of Taxpayer) Signature

- Title of Signature Party

- Printed Name of Signature Party

- PIN of Taxpayer

- If a Representative/Agent provided the Signature, then document enter the Printed Name of the Taxpayer in Item 1

- PIN Number

- Print name of taxpayer from line 1 if other than the individual

11 – Part II, Declaration of Representative

The Representative must review and Sign Part II. He or she will need to read the initial statements. Then read the list of statements describing different entities (Statement A through through K, L, and R). The table below this must be filled in with:

- The Representative’s Designation—Insert above letter (choose A through K, L, or R)

- Jurisdiction (state) or Identification of the Representative

- Signature of the Representative

- Date of Signature for the Representative’s signing of this document

12 – Tax Information Authorization

The next page will be a separate form which will provide Principal Authorization so the Representative, listed on the previous pages, may have the right to disclosure of the Principal/Taxpayers information (within confines of the power of attorney). To begin, locate Item 1 on this page, then supply the following:

- Taxpayer name(s) and address (type or print)

- SS Number(s)

- Daytime Phone

- Employer ID Number (EIN)

- Plan Number, if applicable

13 – Appointee With Authorization

In Item 2, name at least one entity who will receive Authorization through this document in the table provided. This will require the Representative’s information supplied in the following fields:

- Name and Address

- CAF Number

- Telephone Number

- Fax Number

- Indicate if any of these items are new by checking the appropriate box following the words “Check if new”

14 – Tax Matters

The Tax Matters table in Item 3 will need the specifics on what precisely the Principal/Taxpayer approves for disclosure on to the Representative being named. Provide these definitions in the appropriate cells:

- Type of Tax (Income, Employment, Excise, etc.) or Civil Penalty

- Tax Form Number (1040, 941, 720, etc.)

- Year(s) or Period(s)

- Specific Tax Matters

15 – Defining CAF Status

If this document does is not and will not be recorded on the CAF then, mark the box in Item 4. (Note: if marking this box skip the next two sections)

- Specific use not recorded on Centralized Authorization File (CAF)

16 – Disclosure of Tax Information

In Item 5, select the applicable statement by marking the corresponding check box:

- Mark Item 5a if the Representative should receive copies of the Principal’s Tax Information, Notices, and Communications in the Matters defined

- Select Item 5b if Representative should not receive copies of the Principal’s Tax Information, Notices, and Communications in the Matters defined

17 – Retention/Revocation

If there are previously issued authorizations that should remain in effect after this document’s execution, check the box in Item 6, then attach a copy of those documents to this paperwork

18 – Taxpayer Signatures

Each Taxpayer granting Authorization to the Representative listed in this document must supply the following in Item 7:

- His or her Signature

- The Date of Signature

- Printed Name(s)

- Title (if any)

- PIN