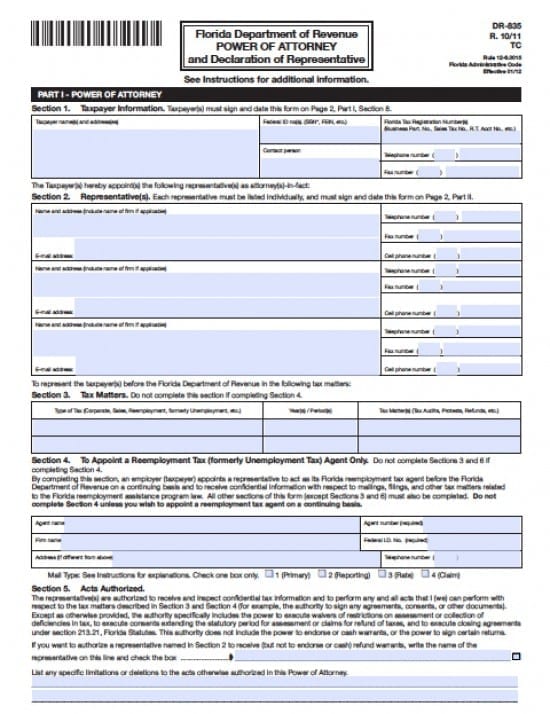

| Florida Tax Power of Attorney Form |

The Florida tax power of attorney form is a document that will legally allow a resident in the state of Florida to employ a CPA, accountant, a tax attorney or another person to acquire information and work on a Principal’s tax case or, if needed, represent them before the Florida Department of Revenue. Unlike other power of attorney documents, in the state of Florida, this particular document will not require witness or notarization. Should a Principal work with any firm or individual that specializes in tax situations, this will most likely be one of the forms you will be required to sign in order to use their services. Be certain to check your tax information prior to signature as many firms will not take responsibility for miscalculations or mistakes, you will be held responsible. Check to see if the person or firm offers any protection with regard to liability if mistakes are made and you are contacted by the Department of Revenue. If so, acquire this protection in writing. (See 709.2108 Section(s) 709.02 – 709.2402)

How To Write

Step 1 – Begin by downloading the form provided and completing section 1-taxpayer’s information, as follows:

- Taxpayer name(s) and address(es)

- Federal ID number(s)(SSN, FEIN, etc.)

- Florida Tax Registration Number(s)

- (Business Part. Number(s) (Sales Tax No., R.T. Acct No., etc.)

- Contact person Telephone number

- Fax number

Step 2 – Section 2 – Appointment of Representatives -Each representative must be listed individually. As well, each representative must sign and date this form on Page 2 of Part II – Provide all of the following information with regard to the representatives – There are 3 spaces on this form for up to 3 representatives. All information for all representatives will be identical. If more room is needed, add a sheet and attach to this form:

- Name and address (include name of firm if applicable)

- E-mail address

- Telephone number

- Fax number

- Cell phone number

Step 3 – Section 3 – Tax Matters involving representative(s) – Do not complete this section if completing Section 4 – If Section 3 is being completed, provide the following information:

- Type of Tax (Corporate, Sales, Reemployment, formerly Unemployment)

- Year(s)/Period(s)

- Tax Matter(s) (Tax Audits, Protests, Refunds, or any other Tax Matter)

Step 4 – Section 4 – If you are completing Section 4 – read the paragraph of instructions. Pay particular attention to the final statement, bolded at the end of these instruction “Do not complete Section 4 unless you wish to appoint a reemployment tax agent on a continuing basis.” – If you will be completing this section, provide the information as follows:

- Agent name

- Agent number (required)

- Firm name

- Federal I.D. Number (required)

- Address (if different from the address at the top of the form)

- Telephone number

- Mail Type – See all of the explanations here and choose only one box on the form

- Check one box only

- 1 (Primary)

- “Primary Mail. If you select primary mail, the agent will receive all documents from the Department of Revenue related to this reemployment tax account, and will be authorized to receive confidential information and discuss matters related to the tax and wage report, benefit information, claims, and the employer’s rate.”

- 2 (Reporting)

- “Reporting Mail. If you select reporting mail, the agent will receive the Employer’s Quarterly Report (Form RT-6), certification, and correspondence related to reporting. The agent will be authorized to receive confidential information and discuss the tax and wage report, certification, and correspondence with the Department.”

- 3 (Rate)

- “Rate Mail. If you select rate mail, the agent will receive tax rate notices and correspondence related to the rate and will be authorized to receive confidential information and discuss the employer’s rate notices and rate with the Department.”

- 4 (Claim)

- “Claims Mail. If you select claims mail, the agent will receive the notice of benefits paid, and will be authorized to receive confidential information and discuss matters related to benefits.”

- *Note: Duplicate copies of certain computer-generated notices and other written communications cannot be issued due to current system constraints and therefore, these communications will be sent only to the representative”

Step 5 – Section 5 – Acts Authorized – In this section you will list any language you would like to delete or limitations you wish to impose. Read the paragraph carefully and follow the instruction precisely providing the requested information on the lines provided.

Step 6 – Section 6 – Notices and Communications – If you have completed section 4, do not complete section 6. If you are, in fact. completing section 6. read the request and select from one of two options and check the appropriate box on the form. Your options are as follows:

- a. If you want notices and communications sent to both you and your representative, check this box

- b. If you want notices or communications sent to you and not your representative, check this box

Step 7 – Section 7 – Retention / Nonrevocation of Prior Power(s) – This document will not automatically revoke past powers. If you would like past documents revoked with others, you must check this box and attach a copy of any and all powers of attorneys that you would like to revoke.

Step 8 – Taxpayer Signature(s) – If this is a joint return, both spouses must sign and date this form – Each person signing the form must provide the following on the lines provided on the form:

- Signature

- Date of Signature

- Title (if applicable)

- Print name

Step 9 – Part II Declaration of Representative – This section is to be completed by the representative(s) you have appointed to work with you regarding your tax matters.

- Once completed by the representative(s) ask for copies of the document for your records