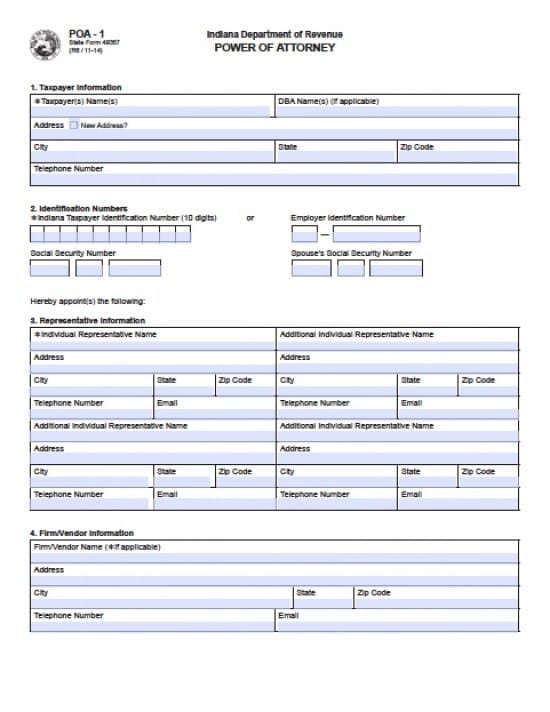

| Indiana Tax Power of Attorney Form |

The Indiana tax power of attorney form is a legal document that provides notarized permission for an attorney, CPA or individual of the Principal’s selection, to complete tax information and/or represent the Principal before tax agencies. This document will require that all fields be completed. This document may be revoked at the discretion of the Principal.

How to Write

Step 1 – Taxpayer(s) Information – Complete the following:

- Taxpayer(s) Name(s)

- Doing Business As (DBA) Name(s) (if applicable)

- Address ( is this a new address?)

- City

- State

- Zip Code

- Telephone Number

Step 2 – Identification Numbers – Enter:

- Enter the Indiana Taxpayer ID Number (10 digits long)into the boxes

- Social Security Number

- OR

- Employer Identification Number

- Spouses Social Security Number

Step 3 – Appointment of Agent – Provide the following:

- Individual Representative Name

- Address

- City

- State

- Zip Code

- Telephone Number

- Email Address

- AND

- Additional Individual Representative’s Name

- Address

- City

- State

- Zip Code

- Telephone Number

- Email Address

The Principal may name up to three Agents to serve consecutively if needed

Step 4 – Firm/Vendor Information – Enter:

- Firm/Vendor Name (if applicable)

- Address

- City

- State

- Zip Code

- Telephone Number

- Email Address

If the representative(s) are with a firm, provide the following:

- Representative(s) Names

- Telephone Number(s) (respective)

- Email Addresses (respective)

Step 5 – General Authorization –

- Read the paragraph

- If the Principal agrees, check the box preceding the statement

Step 6 – Tax Type(s)

This is not applicable if the box is checked in question 5)

- Enter the type of tax into the lines provided

- Enter the years or periods (check the appropriate box)

- The Principal must read and agree to the acknowledgement statements

Step 7 – Authorizing Signature –

- Principal’s Signature

- Printed Name

- Telephone Number

- Date of signature

- Title

- Email Address

Look over the completed form to ensure all fields are completed. Failure to complete all of the fields will result in the form being returned to the sender