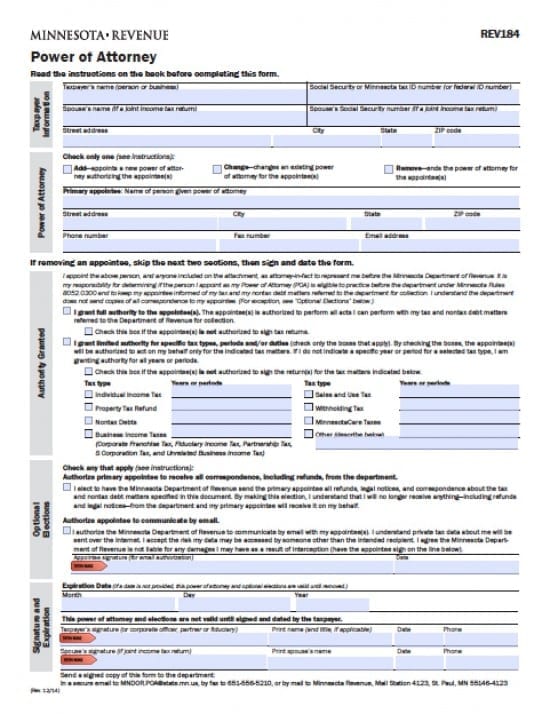

| Minnesota Tax Power of Attorney Form |

The Minnesota tax power of attorney form is a document that will permit a Principal to appoint an individual or business entity as Agent(s) to assist with completion of tax information and/or represent the Principal(s) if required, before any tax agency.

This document will allow the Principals to limit or restrict some powers if the wish. However, the Principal(s) must consider making it possible for the Agent(s) to collect confidential information so that they may properly complete all of the needed tax documents.

This document may be revoked at any time by the Principal(s) and will, unless otherwise stated, shall revoke all previous tax powers documents.

How to Write

- Step 1 – Taxpayer’s Information – Enter:

- Taxpayer’s name (person or business)

- Social Security or Minnesota tax ID number (or federal ID number)

- AND

- Spouse’s name (if a joint income tax return)

- Spouse’s Social Security number (if a joint income tax return) Taxpayer Street address

- City

- State

- Zip code

- Check one of the boxes if applicable

Step 2 – Primary Appointee – Provide the following information:

- Name of person given power of attorney

- Street address

- City

- State

- Zip code

- Phone number

- Fax number

- Email address

If removing an appointee, skip the next two sections, then sign and date the form

Step 3 – Powers to be Granted –

- Check the appropriate box that would apply to the Principal’s wishes

Step 4 – Check the boxes and enter the Years or Periods to be addressed: (If the Agent is not to be authorized to access any of the boxes, check the box stating that they will not be authorized to have powers with the boxes checked)

- Individual Income Tax

- Sales and Use Tax

- Property Tax Refund

- Withholding Tax

- Nontax Debts

- MinnesotaCare Taxes

- Business Income Taxes

- Other (describe)

- (Corporate Franchise Tax, Fiduciary Income Tax, Partnership Tax, S Corporation Tax, and Unrelated Business Income Tax)

Step 5 – Authorize Agent(s) to Receive Correspondence –

- Check the box in this section if the taxpayer(s) would like the Agent(s) to receive correspondence (including refunds) in their stead

- If the taxpayer(s) decide to allow the Agent(s) to receive correspondence and refunds, check the box and then the Agent must provide signature

- Date the signature in mm/dd/yyyy format

Step 6 – Expiration Date – Enter:

- The expiration date of the document in mm/dd/yyyy format

Step 7 – Signatures – (Signatures must be submitted for the document to be valid)

- Taxpayer’s signature (or corporate officer, partner or fiduciary)

- Print name (and title, if applicable)

- Date in mm/dd/yyyy format

- Phone

- AND

- Spouse’s signature (if any and if joint income tax return)

- Print spouse’s name

- Date in mm/dd/yyyy format

- Phone